CLICK HERE FOR MORE INFO

Call 212.321.7111 for an Insider showing!

LISTING COURTESY OF BROWN HARRIS STEVENS

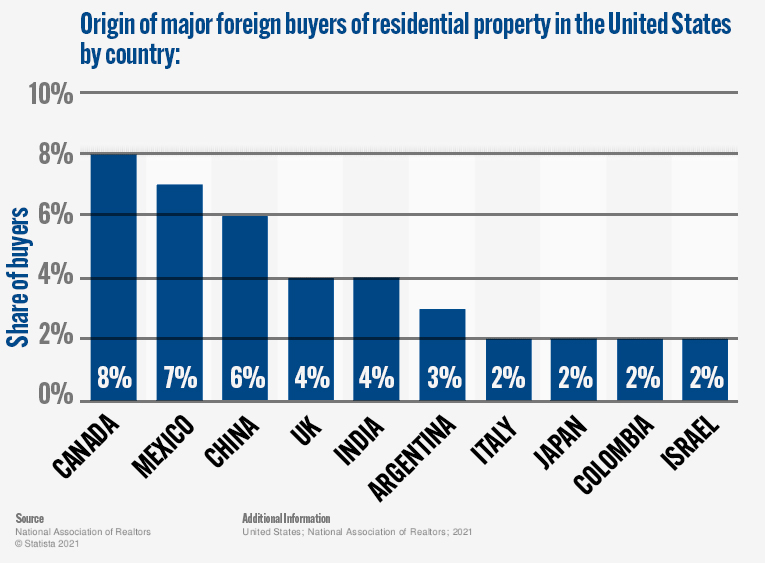

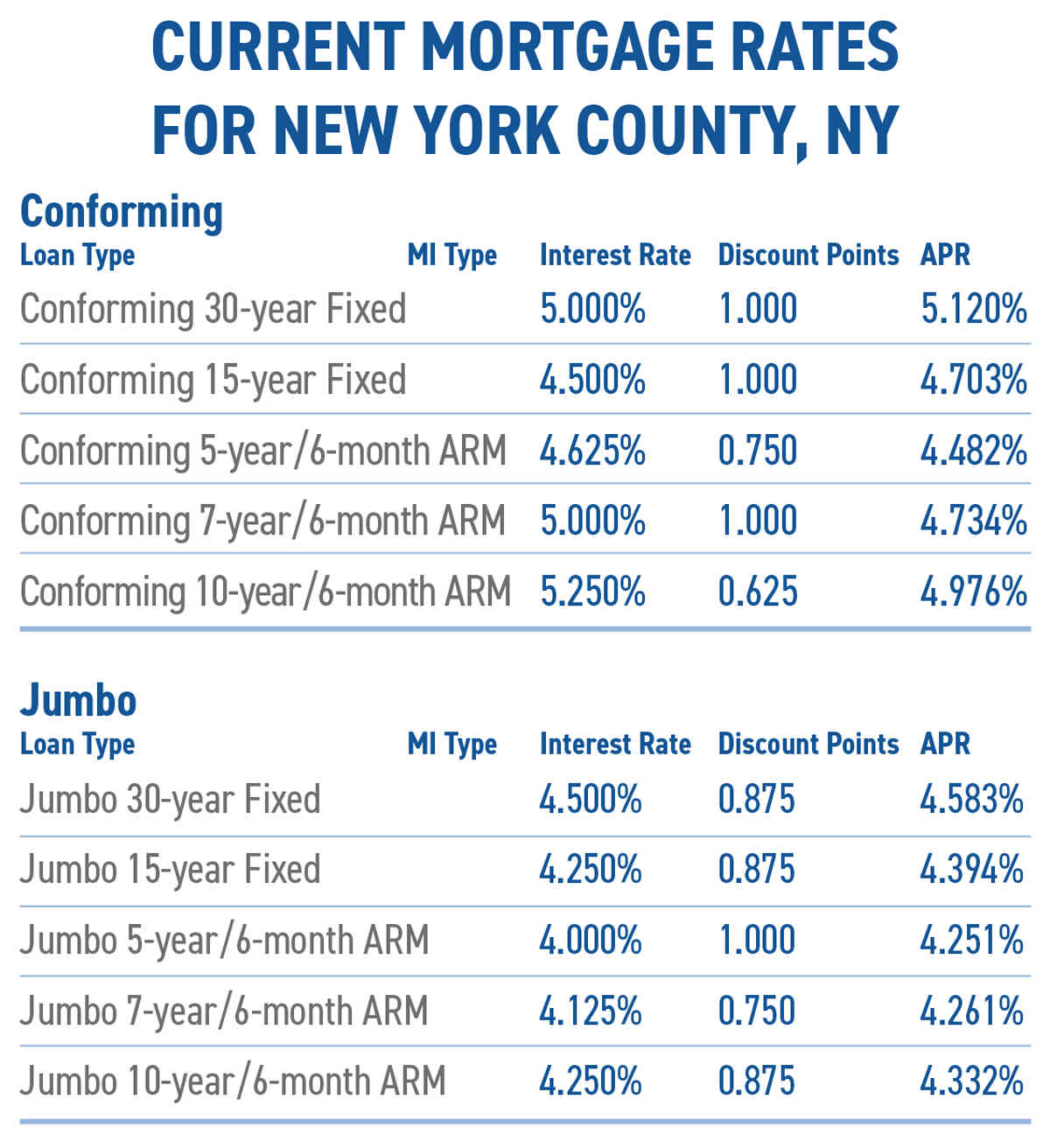

- USD/CAD +3.15%

- USD/MXN +2.19%

- USD/CNY +4.59%

What Does This Mean For NYC Real Estate?

Call 212.321.7111 for an Insider showing!

LISTING COURTESY OF BLU REAL ESTATE

|

|

Gregory A. Socha

|

|

Private Mortgage Banker

NMLSR ID 62414

Wells Fargo Home Mortgage

150 East 42nd Street 32nd Floor | New York, NY 10017

MAC J0161-313

Tel 212-214-7762 | Cell 917-327-5492 | Fax 866-369-2219

|

“We believe the fundamental risk-reward for equities will be improving as we enter the second half of the year, with growth-policy tradeoff likely to turn, from both sides,”

—Bloomberg

—CBS News

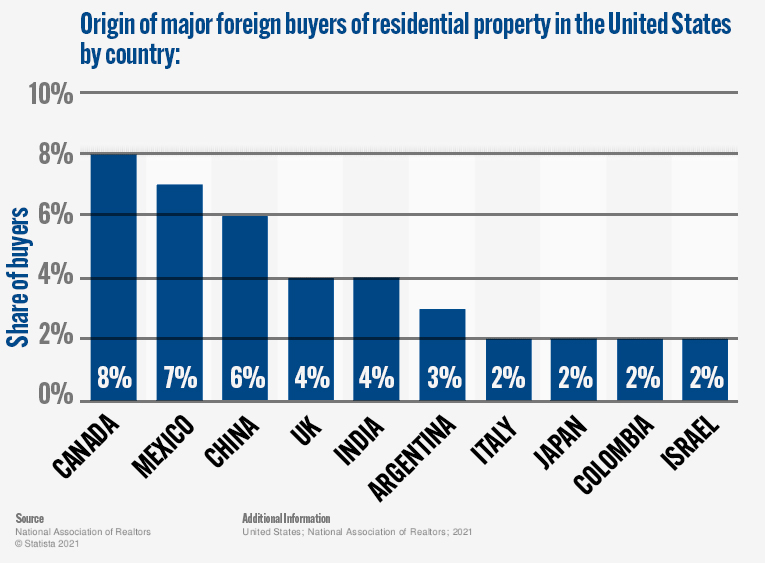

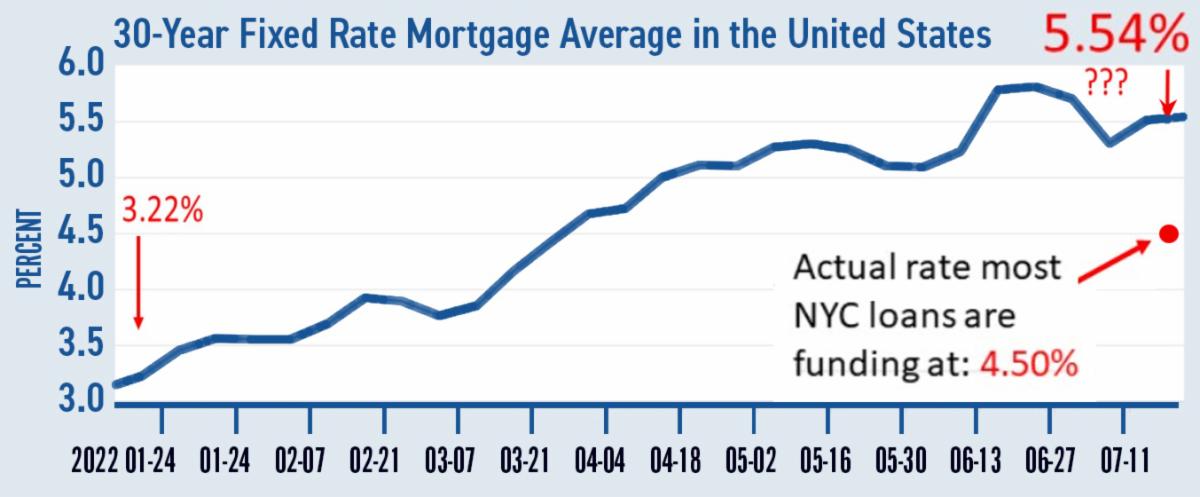

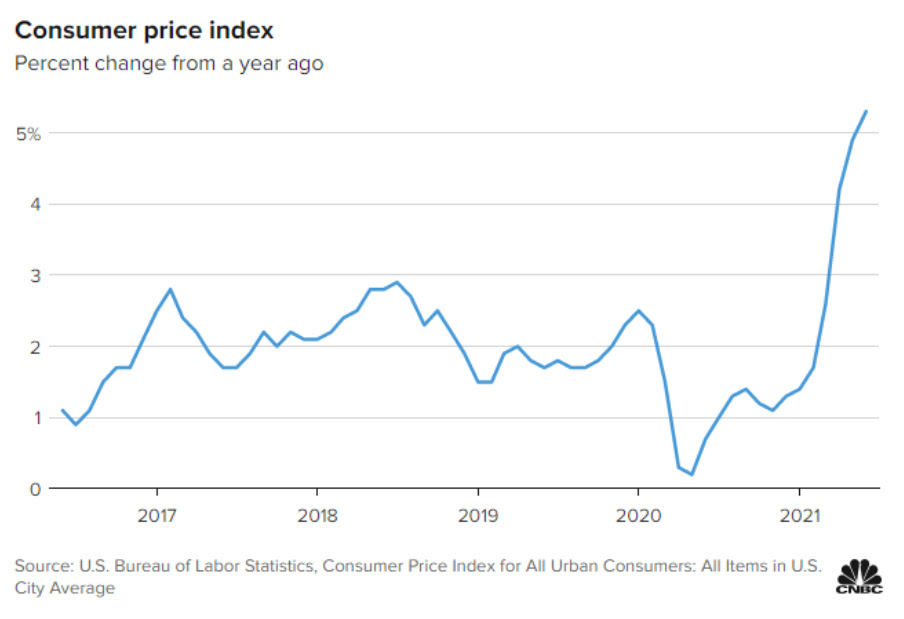

With prices at the pump and in stores coming down, as well as cooling national housing data, it’s likely there will be only one or two more interest rate hikes before the trend reverses.

—Bloomberg

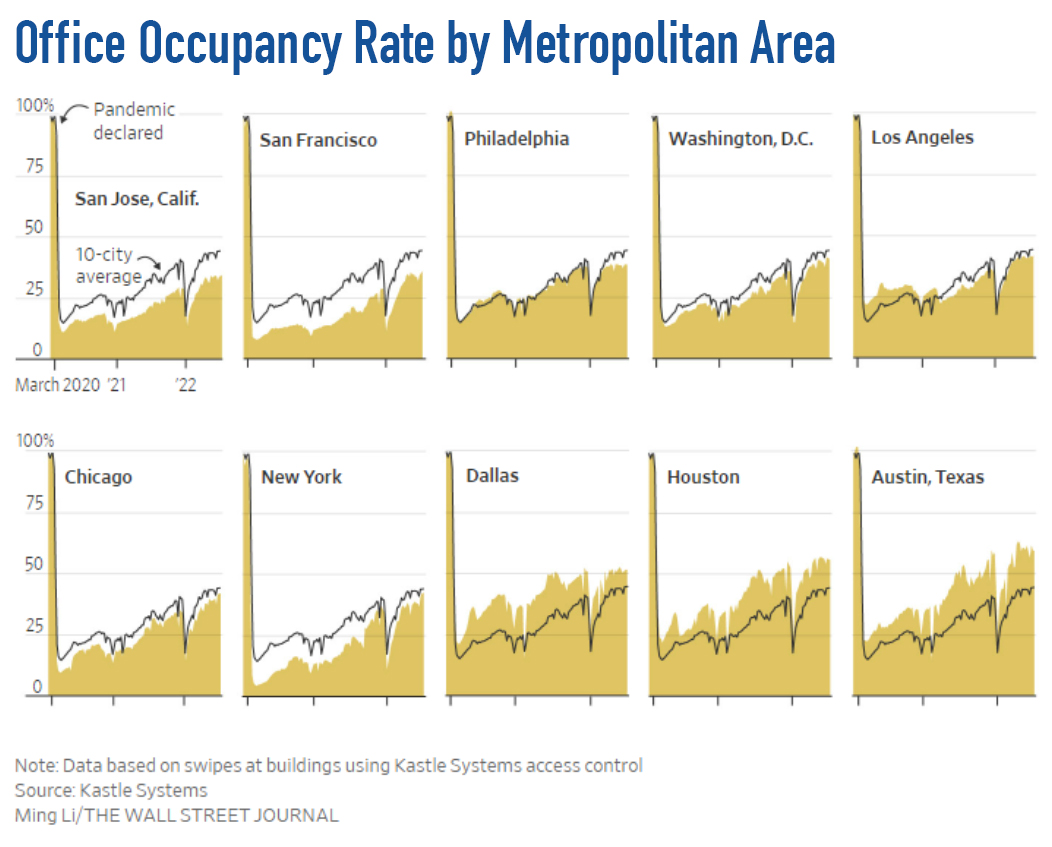

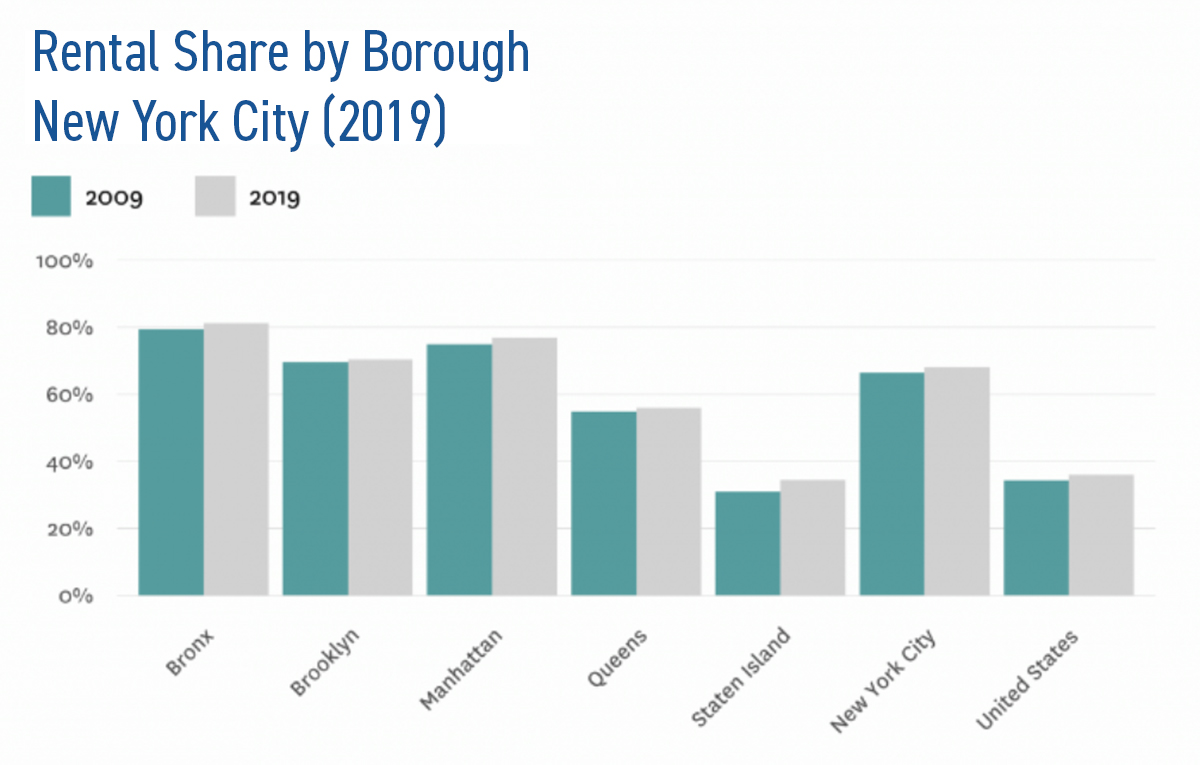

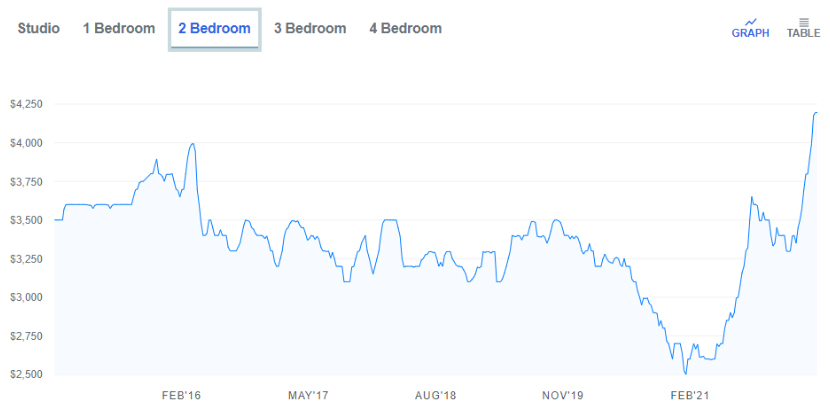

Buyers and sellers of apartments and townhouses here can forget that New York City is a city of renters. 70 percent of our housing stock is rental apartments. As you can see from the chart below, this contrasts heavily with the rest of the country, which has the opposite ratio – about 30 percent of the housing stock is rental.

This means that the lower end of the market will continue to be stronger than the high end. We have in fact seen the high end start to stumble a little. As this week’s Olshan Report says:

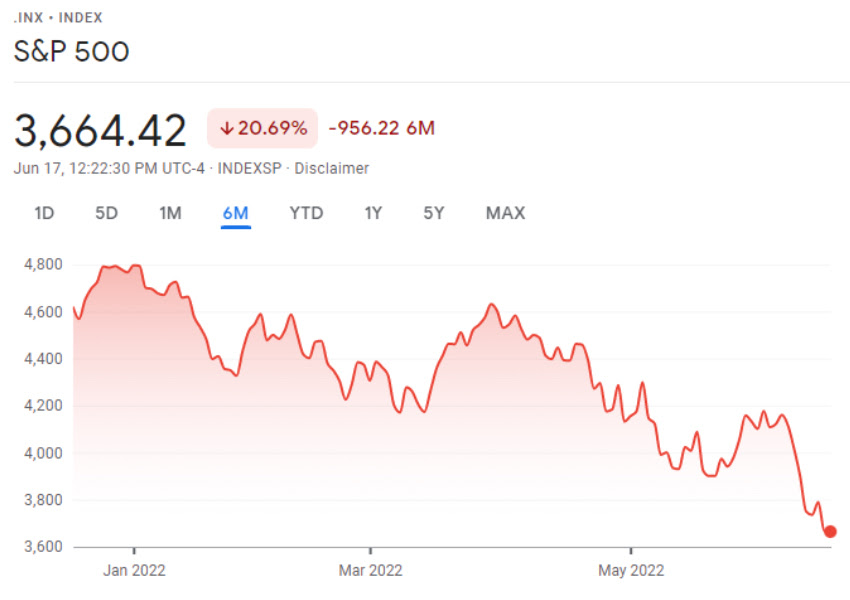

“Twelve contracts were signed last week in Manhattan at $4 million and above, 13 fewer than the previous week. It was the worst week in the luxury market since the week of December 28, 2020, when 10 contracts were signed. This anemic performance coincided with the S&P 500 Index dropping 5.8%, its worst week since March 2020. The S&P has fallen 11 of the last 12 weeks.”

Call 212.321.7111 for an Insider showing!

LISTING COURTESY OF LESLIE J. GARFIELD

LISTING COURTESY OF CORCORON

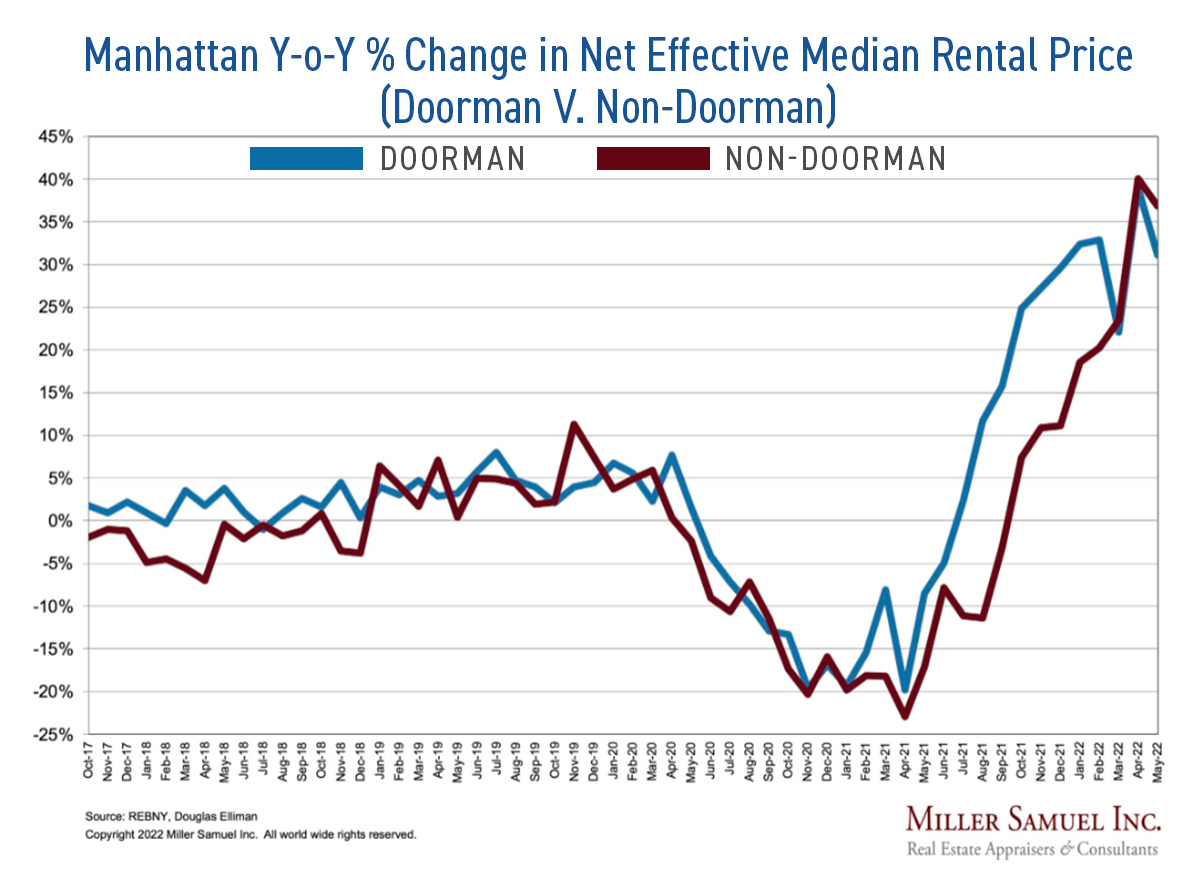

In the last 3rd quarter 2021 data dump, Miller Samuel reported that compared with 3rd quarter 2019, average prices in Manhattan are up 14.7%, unit count is up 76.6%, and sales volume in dollars is up over 100%. In other words, whatever Covid discount there was has evaporated, and the market has, by certain measures, never been stronger.

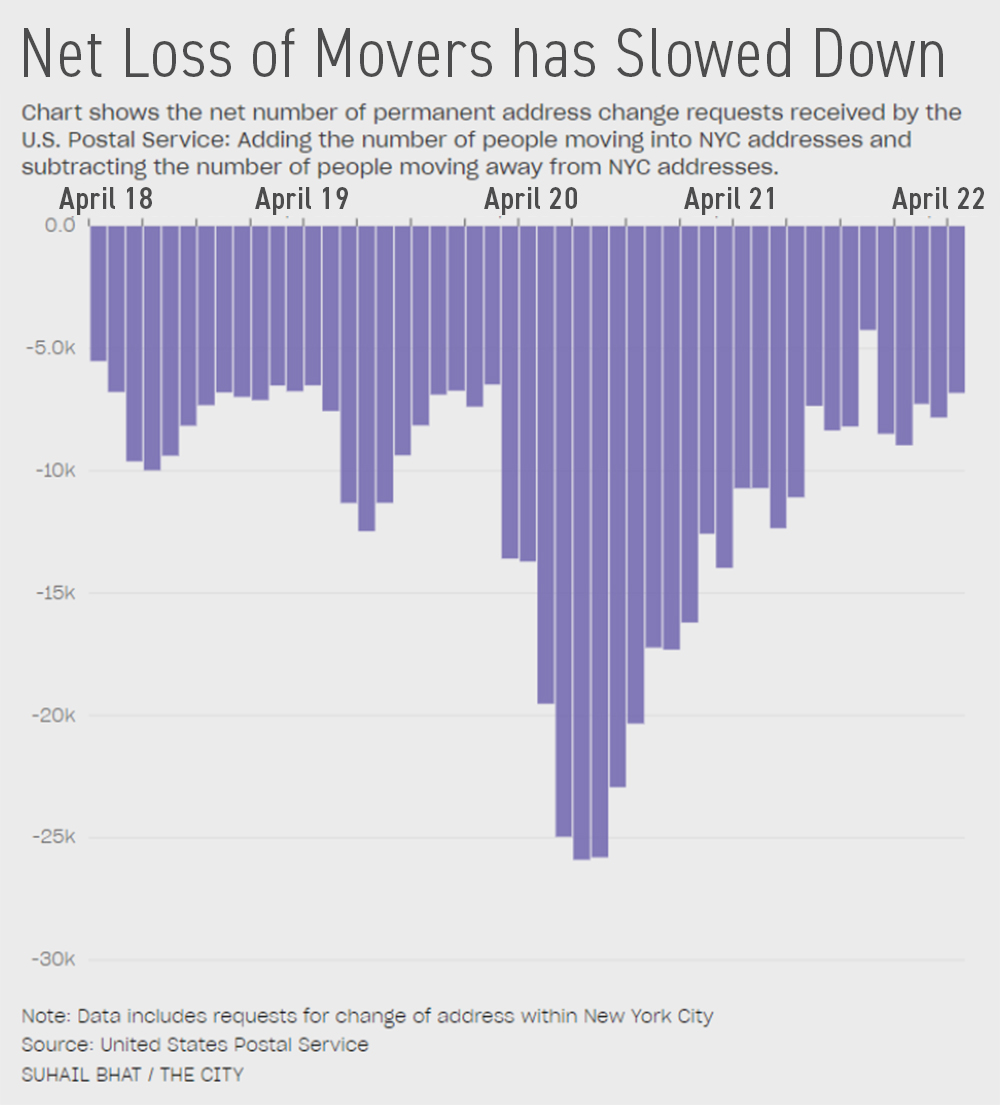

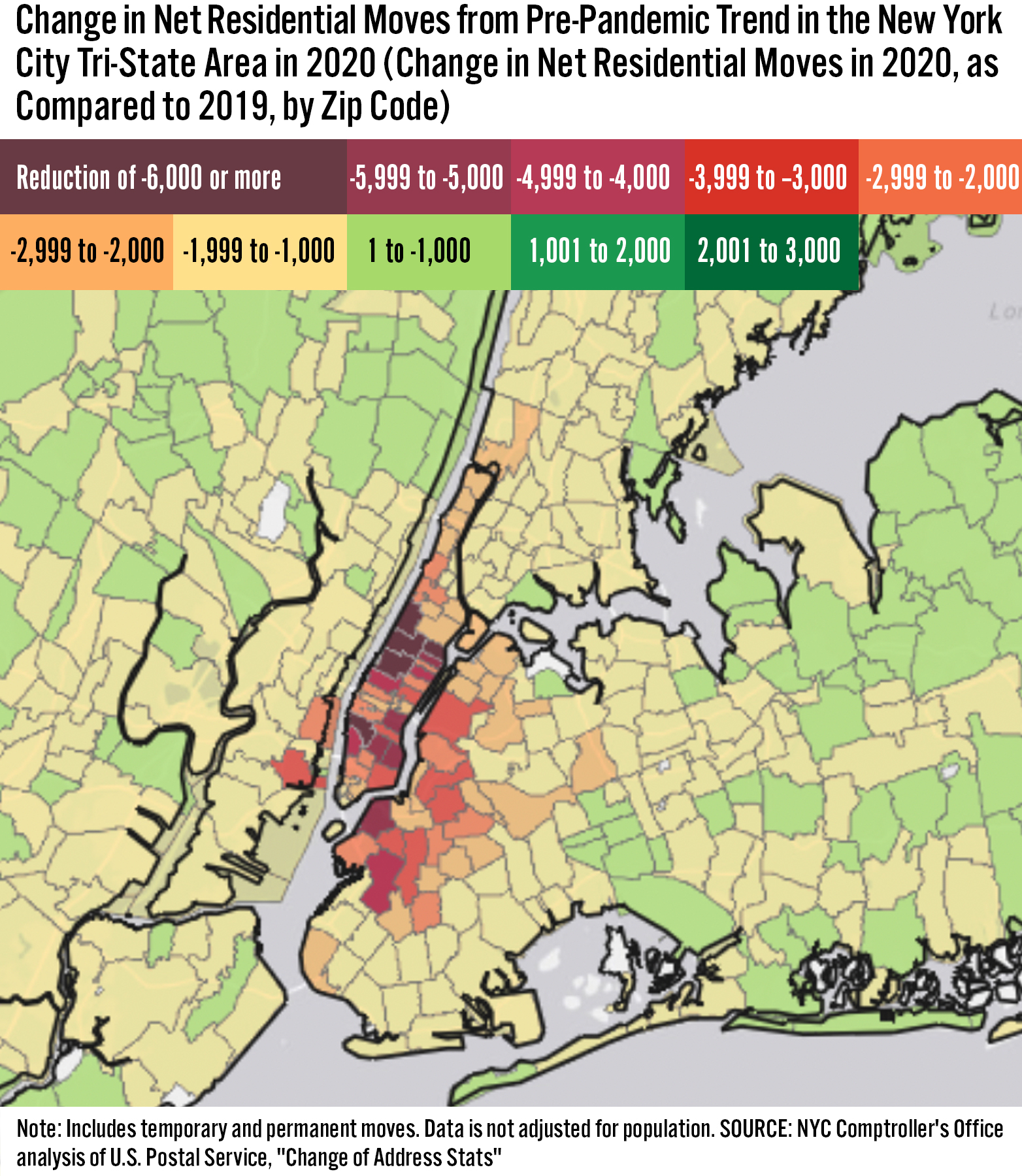

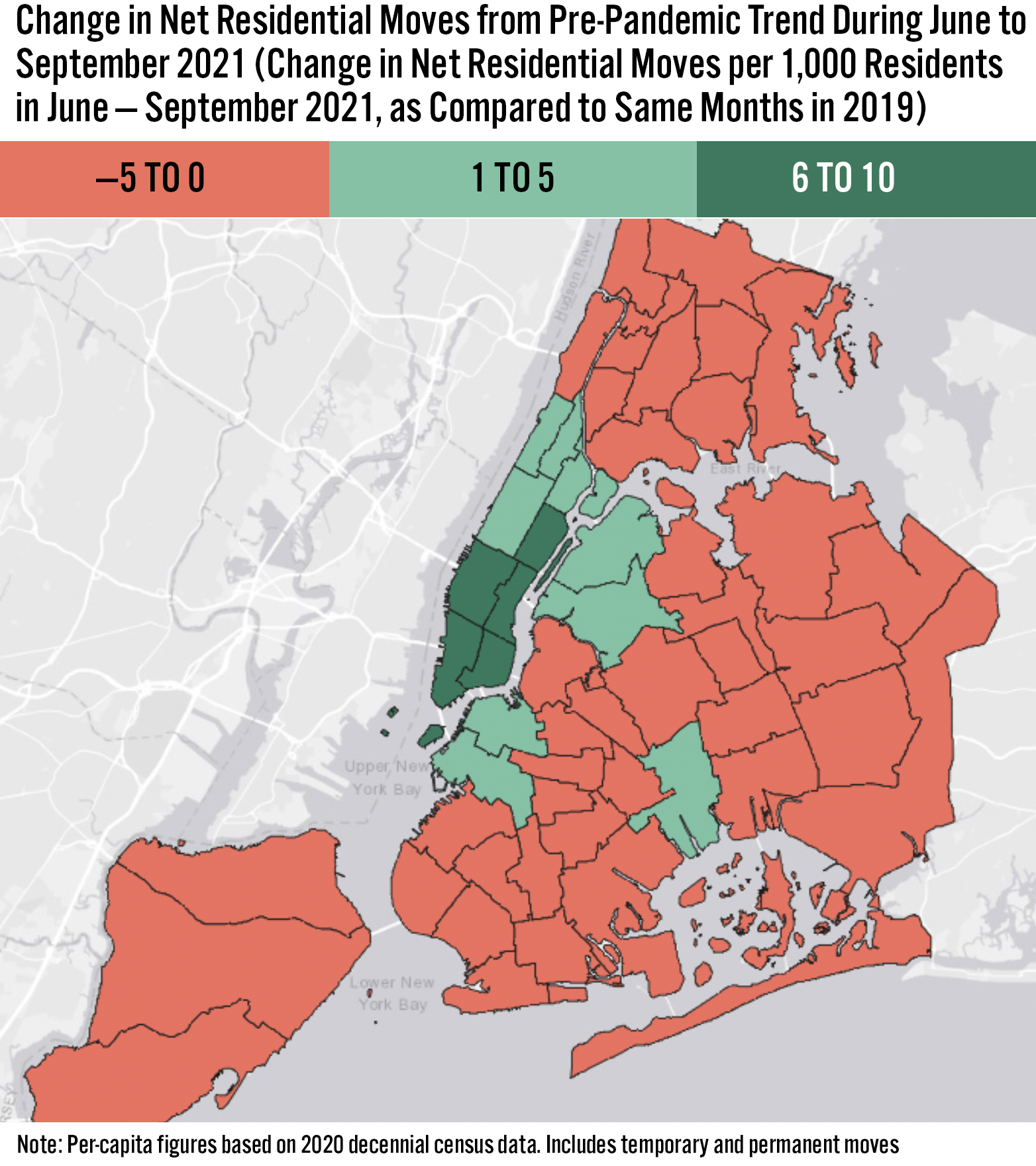

Two pictures show what’s happening, both published in a paper entitled “The Pandemic’s impact on NYC Migration Patterns” by the Scott Stringer (NYC’s Comptroller).

This shows the net moves out of Manhattan and prime Brooklyn in 2020 vs 2019.

The next graphic shows the reverse subsequently happening: net moves back to the city in a window between June and September in 2021.

Of course we are not out of the pandemic, and the virus has a habit of making fools out of prognosticators. That being said, one thing is clear: employment is strong for white collar workers, and these are the people that buy homes. Having spent a year away from the city, many are returning because of comforting vaccine mandates, high vaccination rates, and jobs that are no longer work from home every day.

We expect this trend to continue into 2022, with high stock prices, relatively low inflation and the attractiveness of NYC as a place to live and work driving demand.