The Insider: Let’s Zoom Out for the Big Picture

Posted on August 26, 2022

And so on. So let’s zoom out and look at what’s really going on.

We need to look at (only) four things. employment, credit conditions, foreclosure activity, and supply. We’ll take them one at a time.

One: Employment

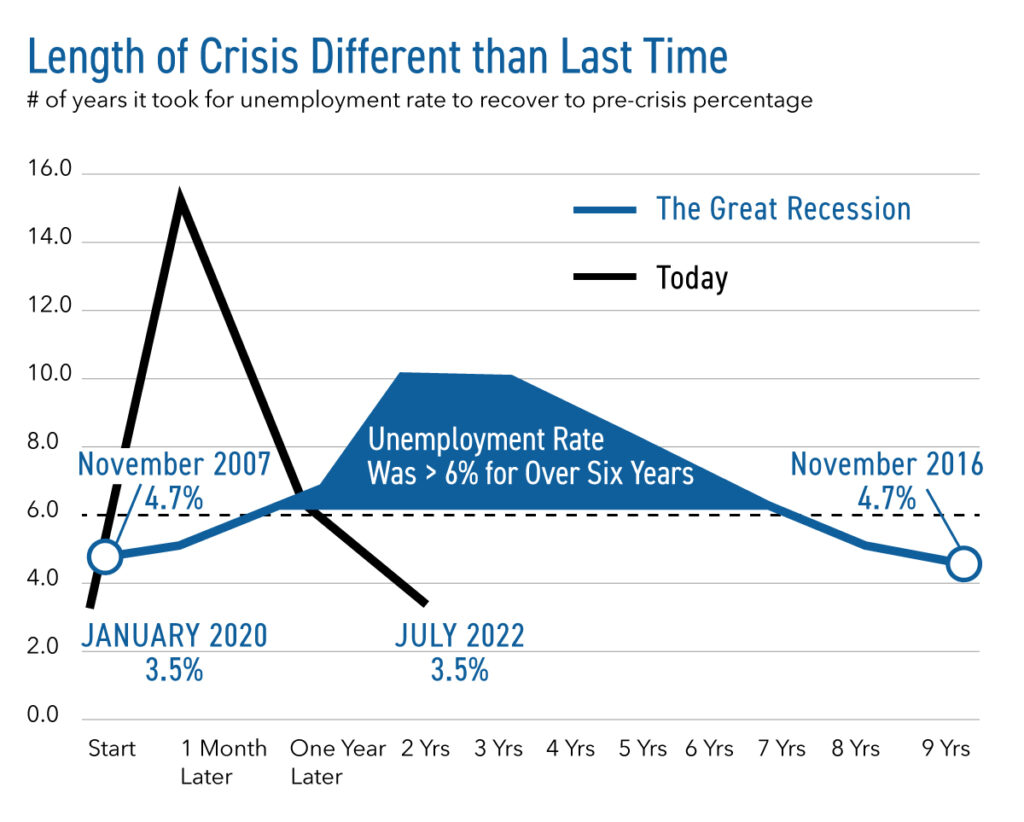

It took 2.5 years to recover from the Covid-19 employment shock. We are, in fact, back where we started before Covid right now (nationally).

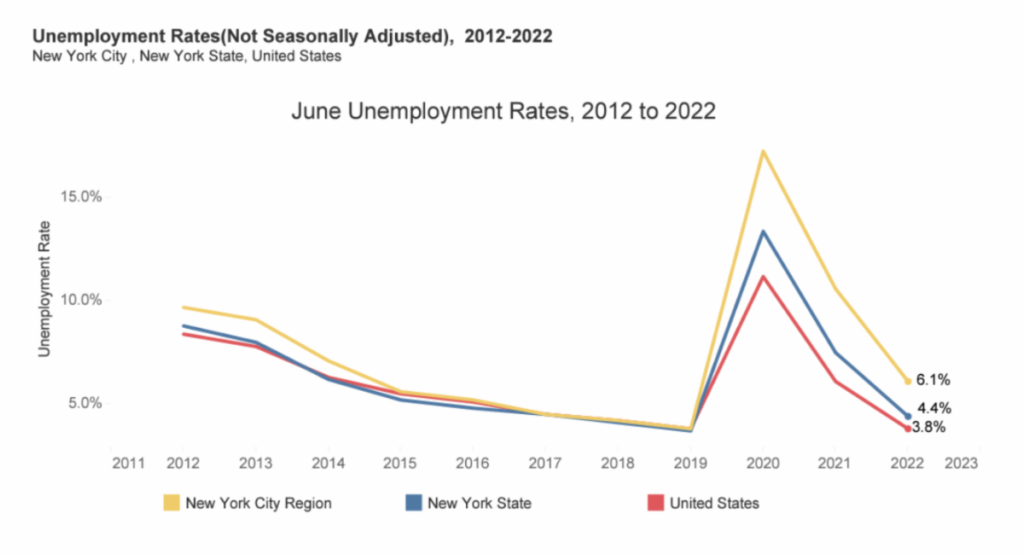

Here in NYC, we are not quite back to where we were pre-Covid. But still, the recovery is striking.

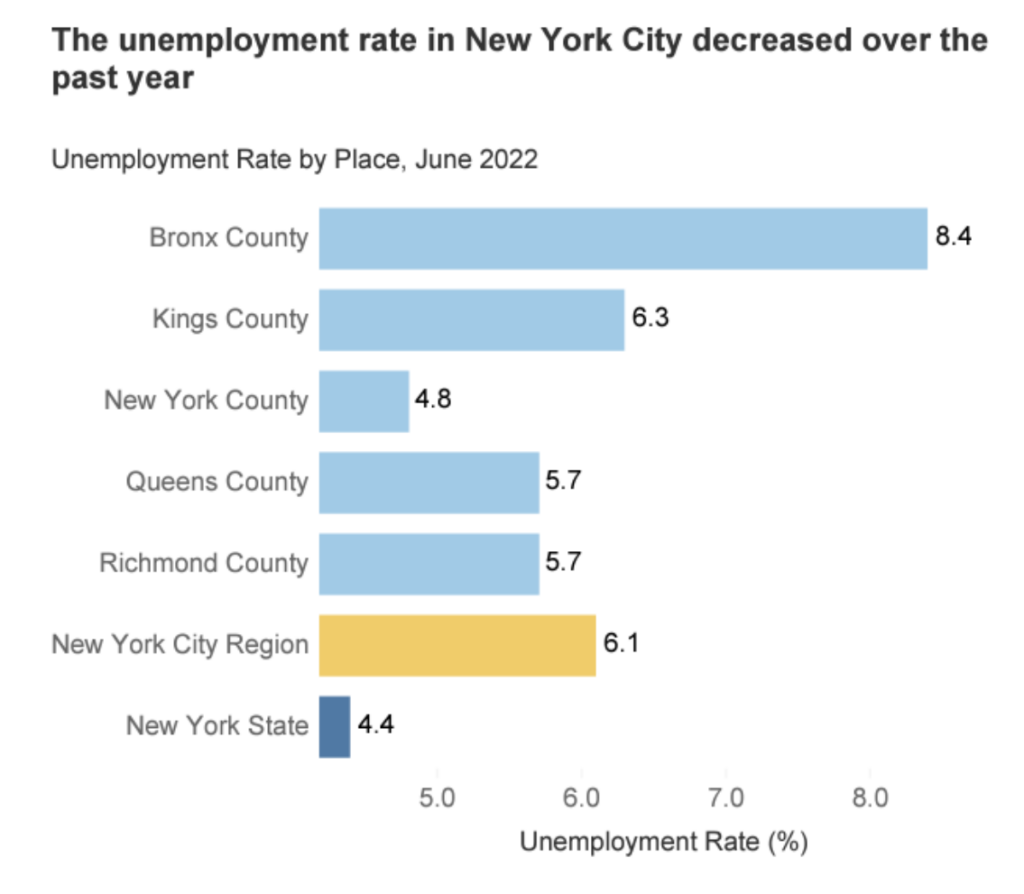

This is a blended rate however. The unemployment rate in Manhattan is a lot better:

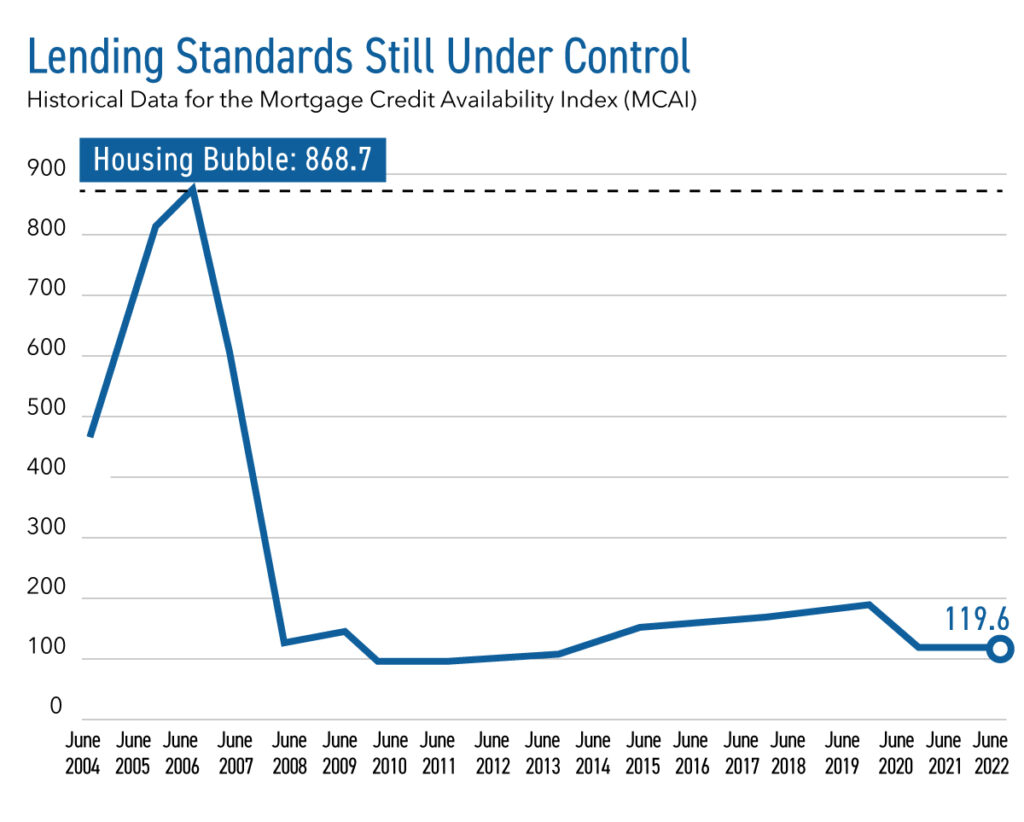

Two: Credit Conditions

As you can see from the graph above, credit conditions are still pretty tight, and NOTHING like they were during the housing bubble of the mid-aughts.

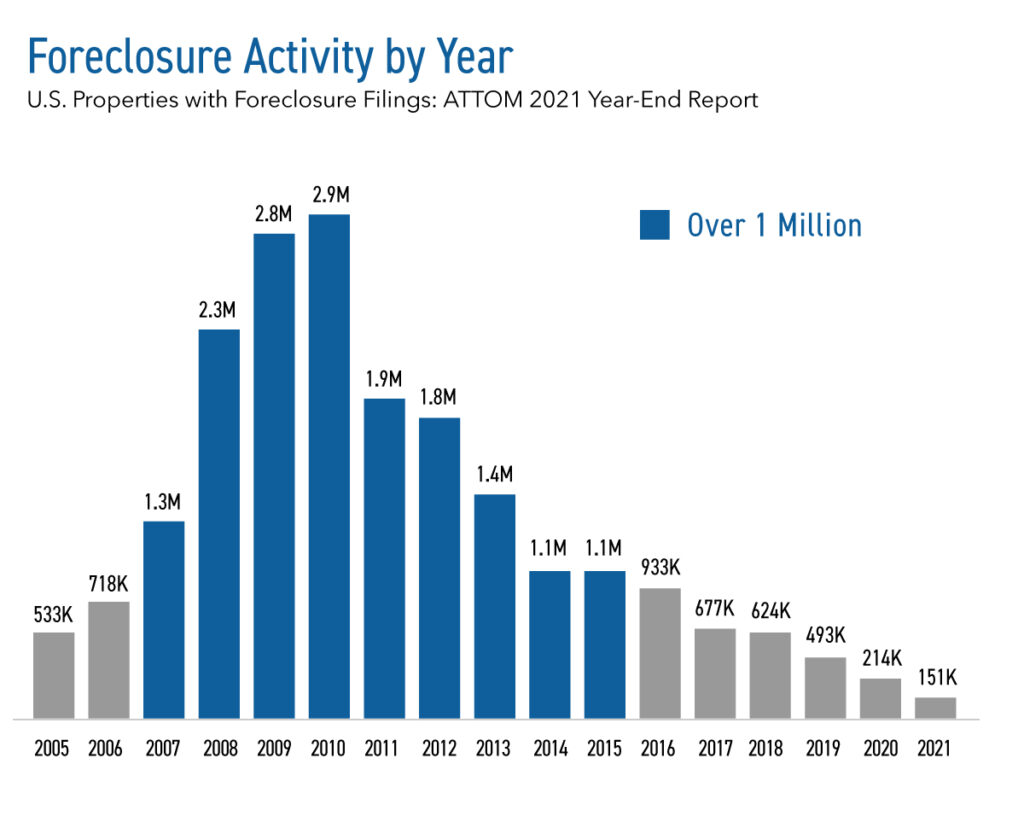

Three: Foreclosure Activity

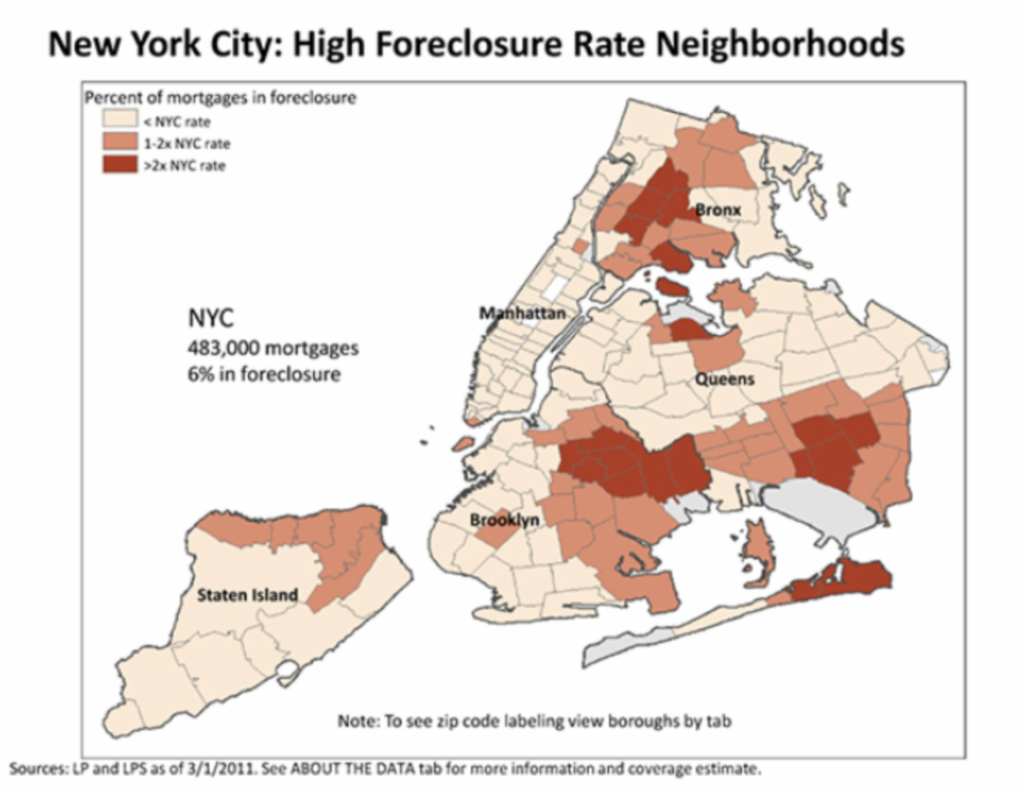

Foreclosure activity nationwide is lower than it has been since 2005. In New York City, the distribution of foreclosures looks like this:

Manhattan continues to see very little foreclosure activity, whereas the outer boroughs are disproportionately hit.

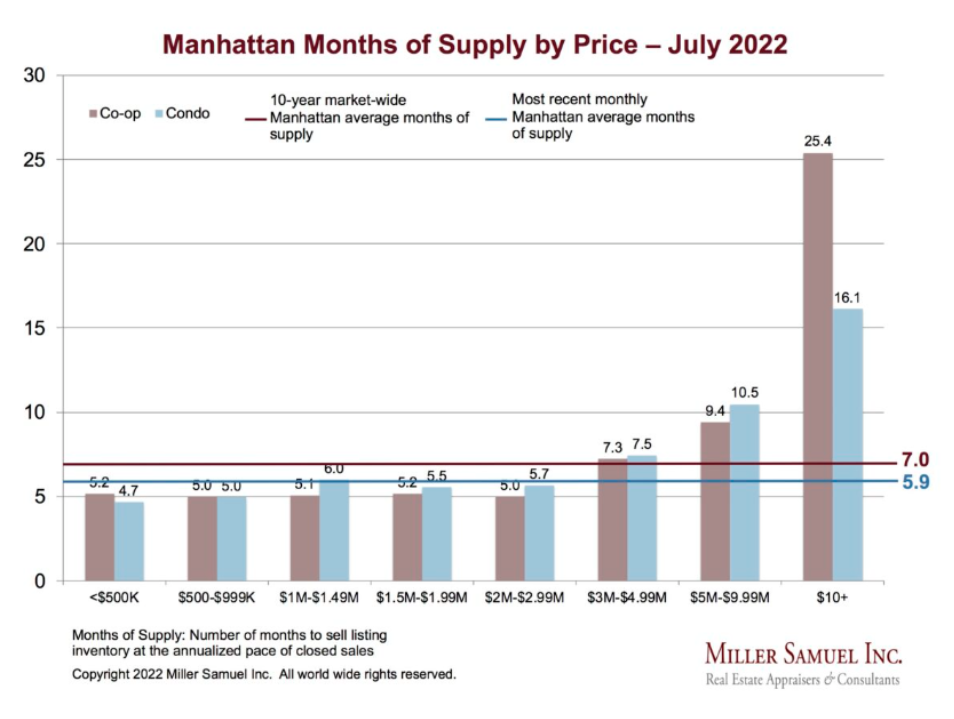

Four: Supply

Folks, we are below the 10 year average supply market wide. Significantly, in the new development segment, in Manhattan, supply has fallen below 6,000 units for the first time since 2018. Furthermore, that supply constriction is not going away any time soon.

Conclusion:

The US is fine from a lending standards standpoint. Better than fine, in fact. Employment is tight, and in Manhattan it is strong. Foreclosures are a non-issue nationally and a rounding-error matter in Manhattan. Finally supply is tight! And in the crucial new development segment, the years-long supply overhang is finally gone.

The same factors are not as rosy in non-prime NYC as the outer boroughs (besides prime Brooklyn and Queens) are suffering unemployment and foreclosure stress. But in our core markets, everything is just fine.

Have a great weekend, everyone!