The Insider: Let’s Talk About Cars

Posted on October 14, 2021As I have been writing about in the Insider, if there is a trigger that shakes the financial system it will be unlikely to originate in the housing market, unlike in 2008. In the last week, I have been considering whether the trigger could come from the auto financing sector. Why?

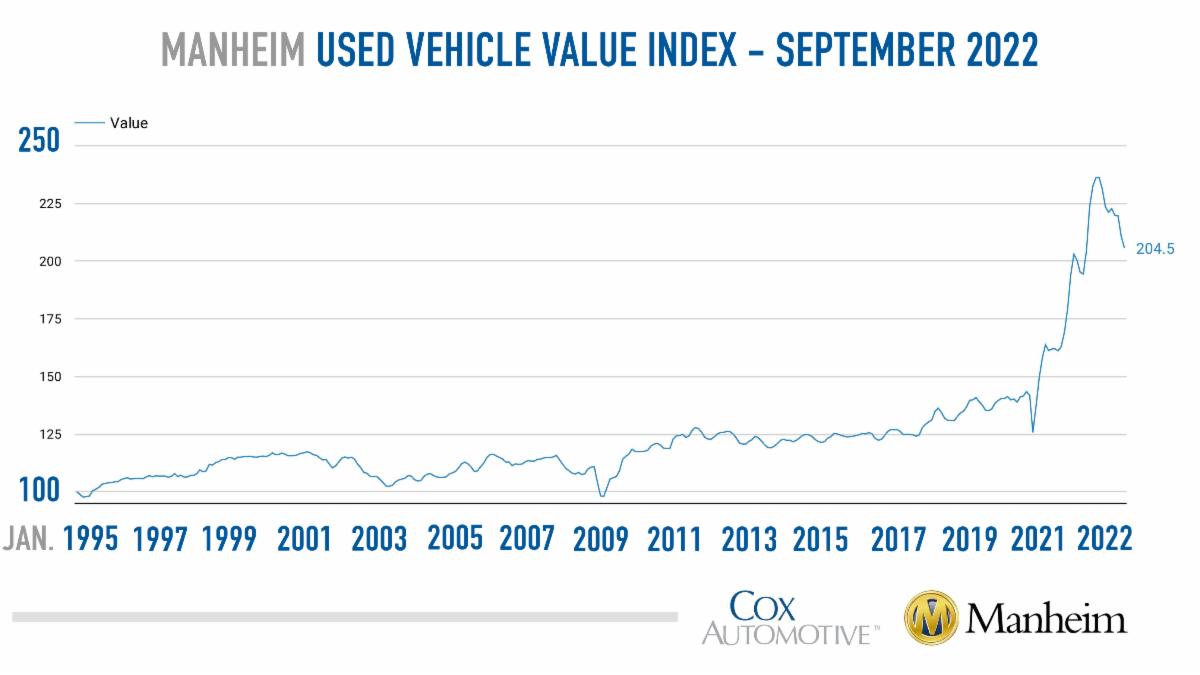

- There is a price bubble in used cars – which seems to be collapsing

And it makes sense that the bubble would be collapsing. The cause was a supply chain meltdown, making new cars scarce and driving buyers into the used car market. But…

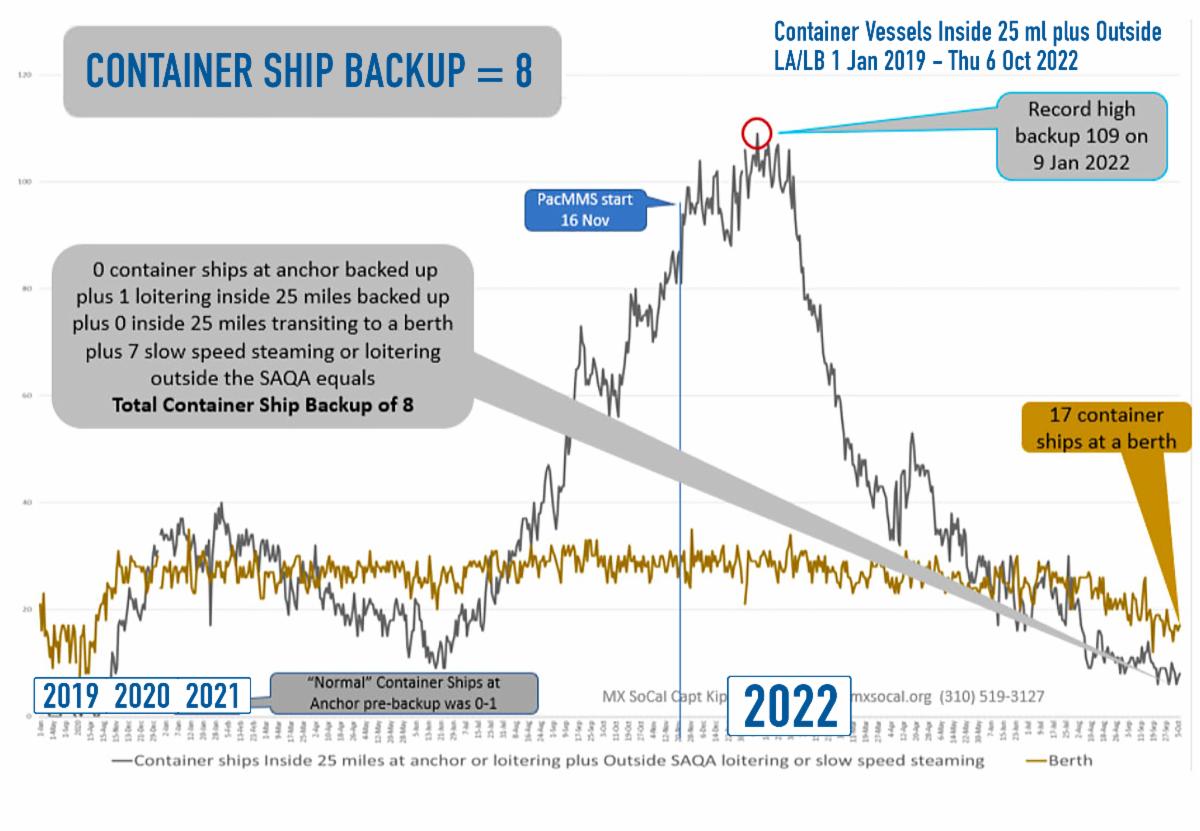

- The Supply Chain Is Normalizing

The following graph shows the backlog of ships waiting to drop cargo in the Los Angeles Harbor.

Source: Marine Exchange of Southern California & Vessel Traffic Service Los Angeles/Long Beach

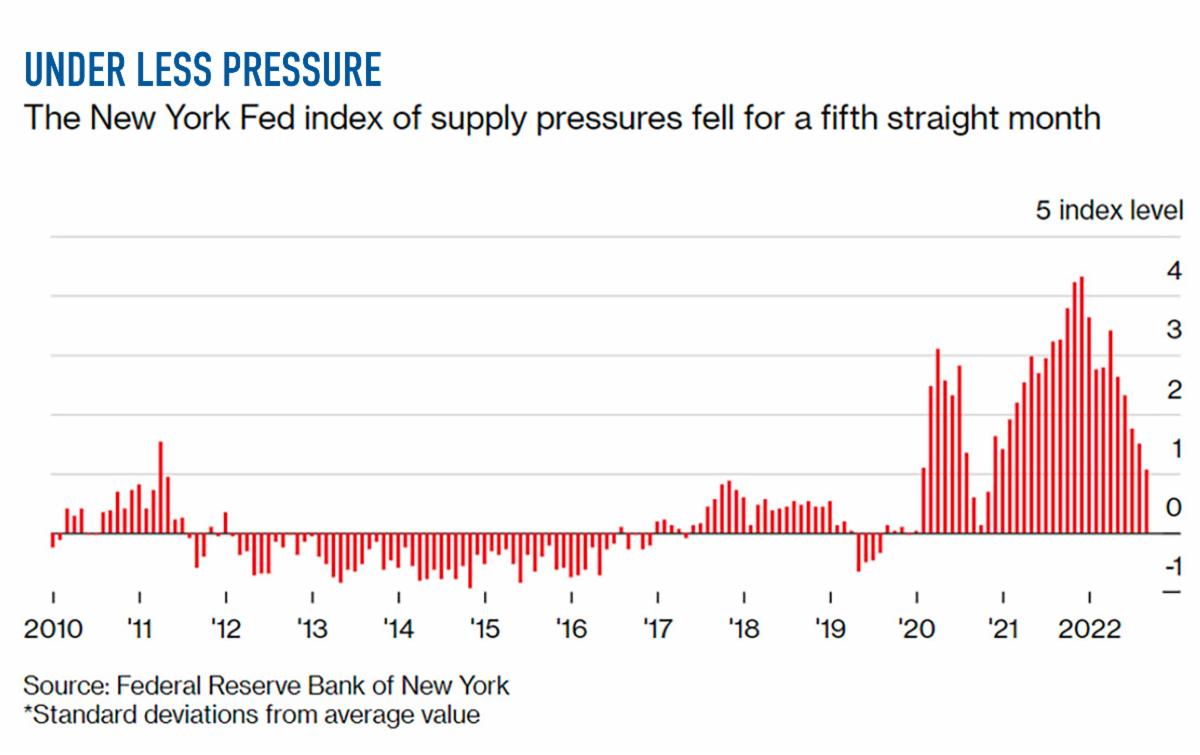

And here is a graph of an index of supply pressures maintained by the New York Federal Reserve:

With the supply chain normalizing, the new car market will spring to life and used cars will lose their luster. To add to that dumpster fire, buyer sentiment is swinging towards electric vehicles so older gasoline combustion engine vehicles are doubly under pressure.

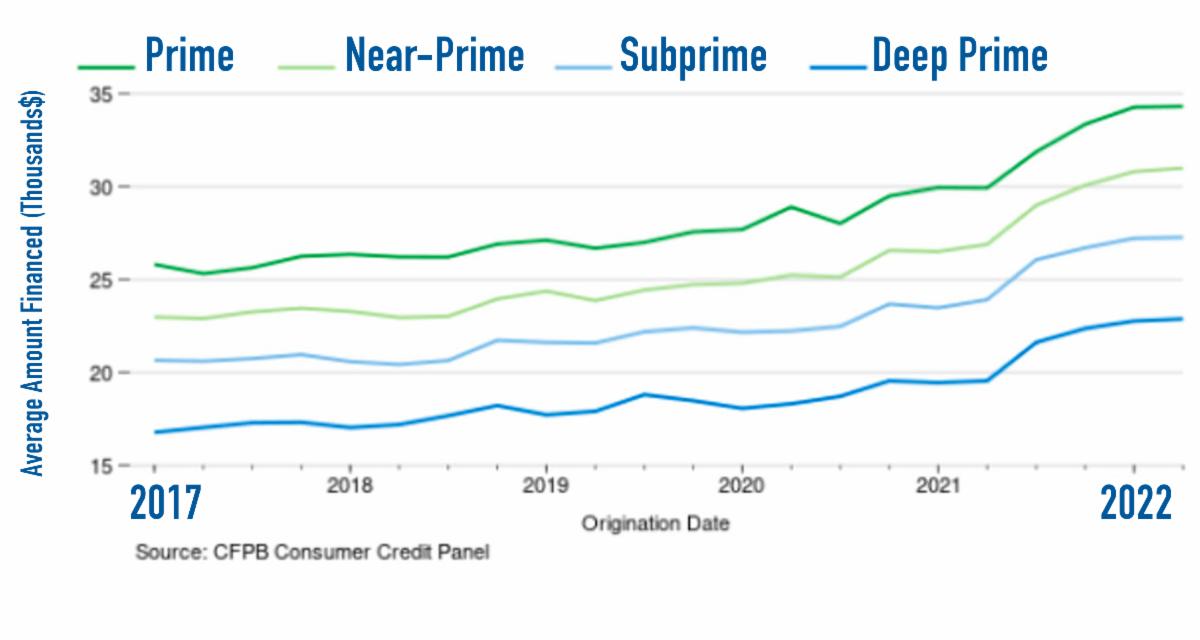

Everyone knows that in 2008, the credit box for mortgages was loose. I’m pretty sure my dog could have gotten a (no-doc) loan but times have changed and mortgages are still relatively hard to get with bad credit. However, the same is not true of the auto loan market, where a large proportion of the 1.5 TRILLION of loans outstanding are sub-prime. And the loan amounts are going up, as you can see below.

You can see serious growth in subprime and “deep subprime” loans. Why are lenders making these loans? Because (1) the borrowers are paying 9%-20% (you read that right) and (2) the market is not nearly as regulated as the mortgage market. In a world that has been yield constrained for years, subprime loans have been a bright spot for yield hungry investors.

In other words, all the factors that led to the Great Recession are happening again, just in the auto loan market. Yes, this market is smaller ($1.5 trillion as compared to the ~$10 trillion mortgage market). Yes, LTVs are lower in car loans. Yes, the loan sizes are smaller. That being said, as the market slides into a recession, and with inflation persisting, subprime borrowers will be pushed to the brink. As they start to default on their loans the pain will be passed to the investors in this market. This could push a large financial institution into bankruptcy (here’s looking at you, Ally Financial). And that starts to sound very familiar.

Have a great weekend, everyone!

—Mark