13 foot ceilings and 4,200 Sq Ft.

Industrial feel

Completely renovated

Central air

Gorgeous surfaces throughout:

brick, walnut, marble, steel, glass

Beamed ceilings

Vented exhaust in kitchen

$6,950,000

Call 212.321.7111 for an Insider showing!

BOOK A PRIVATE TOUR

LISTING COURTESY OF BROWN HARRIS STEVENS

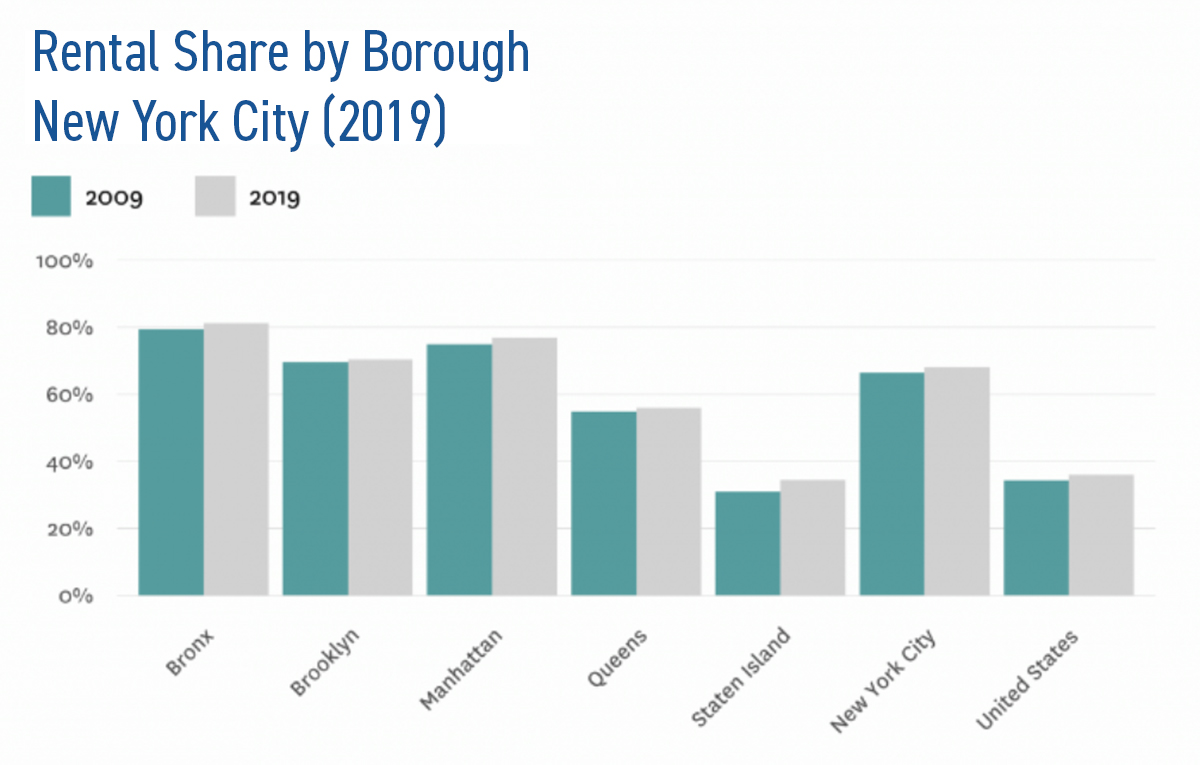

Buyers and sellers of apartments and townhouses here can forget that New York City is a city of renters. 70 percent of our housing stock is rental apartments. As you can see from the chart below, this contrasts heavily with the rest of the country, which has the opposite ratio – about 30 percent of the housing stock is rental.

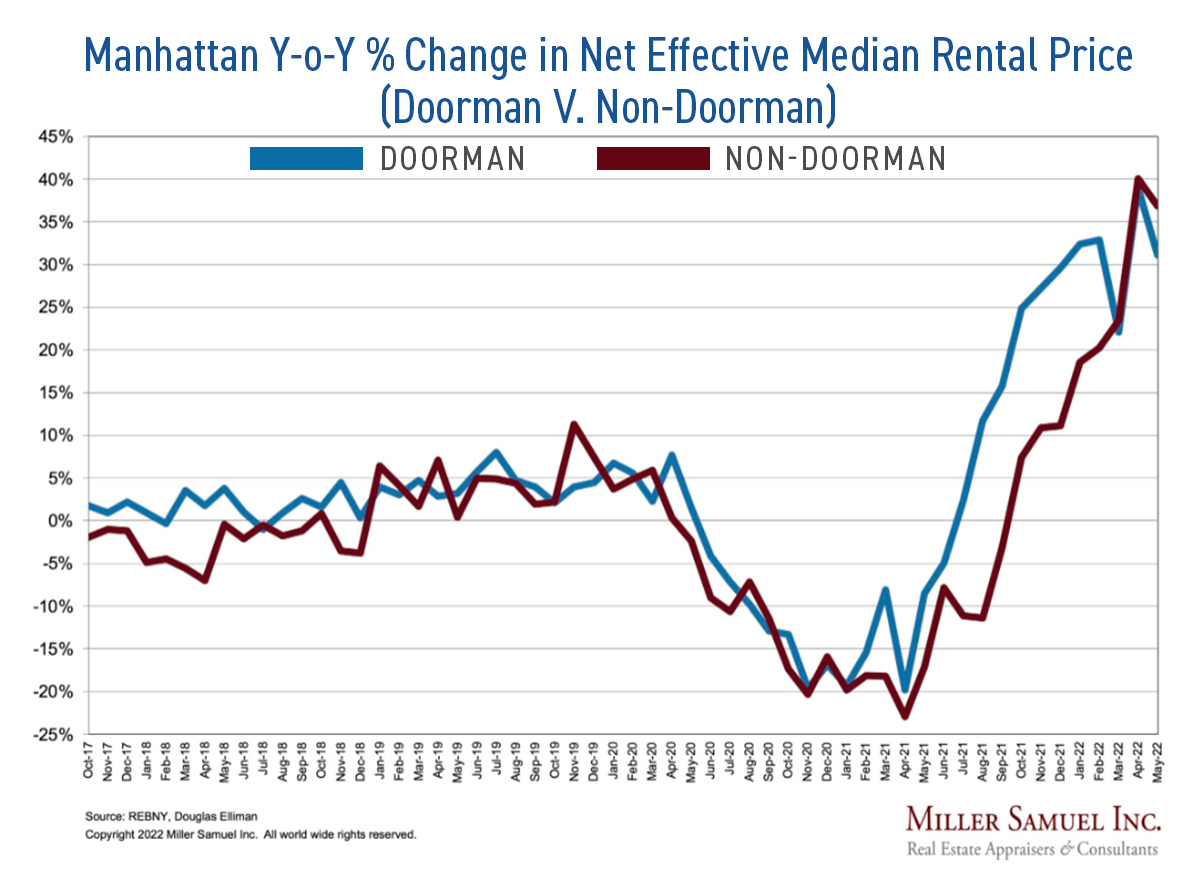

This means that the lower end of the market will continue to be stronger than the high end. We have in fact seen the high end start to stumble a little. As this week’s Olshan Report says:

“Twelve contracts were signed last week in Manhattan at $4 million and above, 13 fewer than the previous week. It was the worst week in the luxury market since the week of December 28, 2020, when 10 contracts were signed. This anemic performance coincided with the S&P 500 Index dropping 5.8%, its worst week since March 2020. The S&P has fallen 11 of the last 12 weeks.”