SUBSCRIBE TO THE INSIDER

SUBSCRIBE TO THE INSIDER

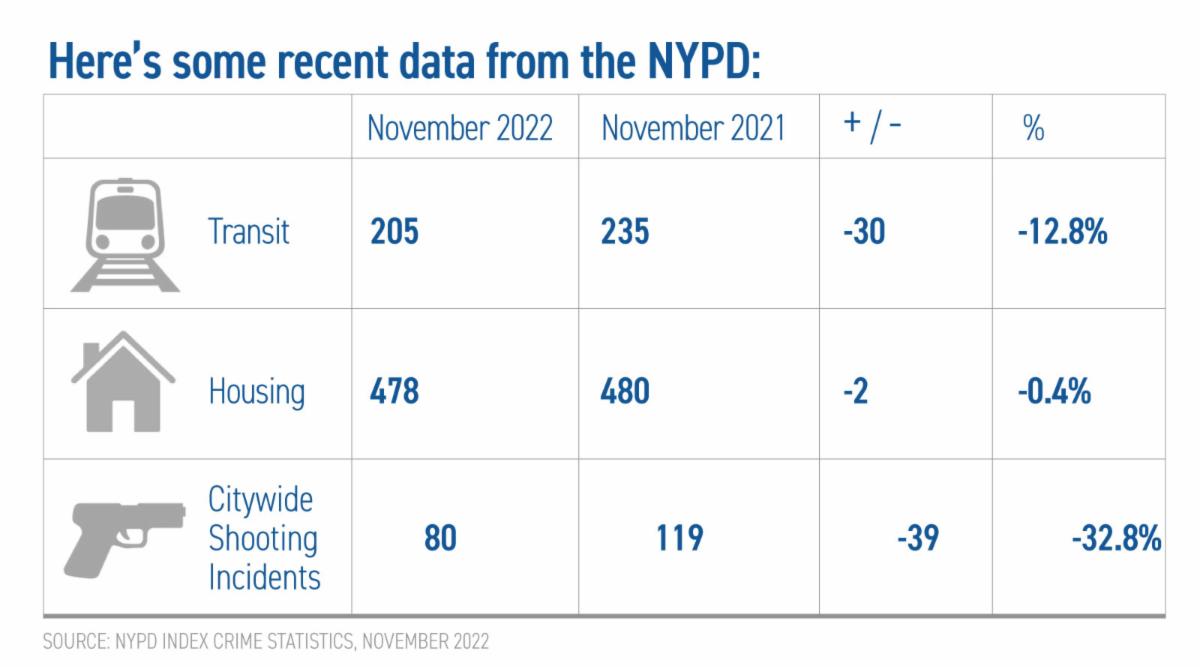

1: New York’s Crime Wave Will Recede, Spurring Confidence in NYC as Investment-Worthy

—NY Times

—NY Times2. Mortgage Rates Will Have Peaked in 2022 and Will Recede in 2023

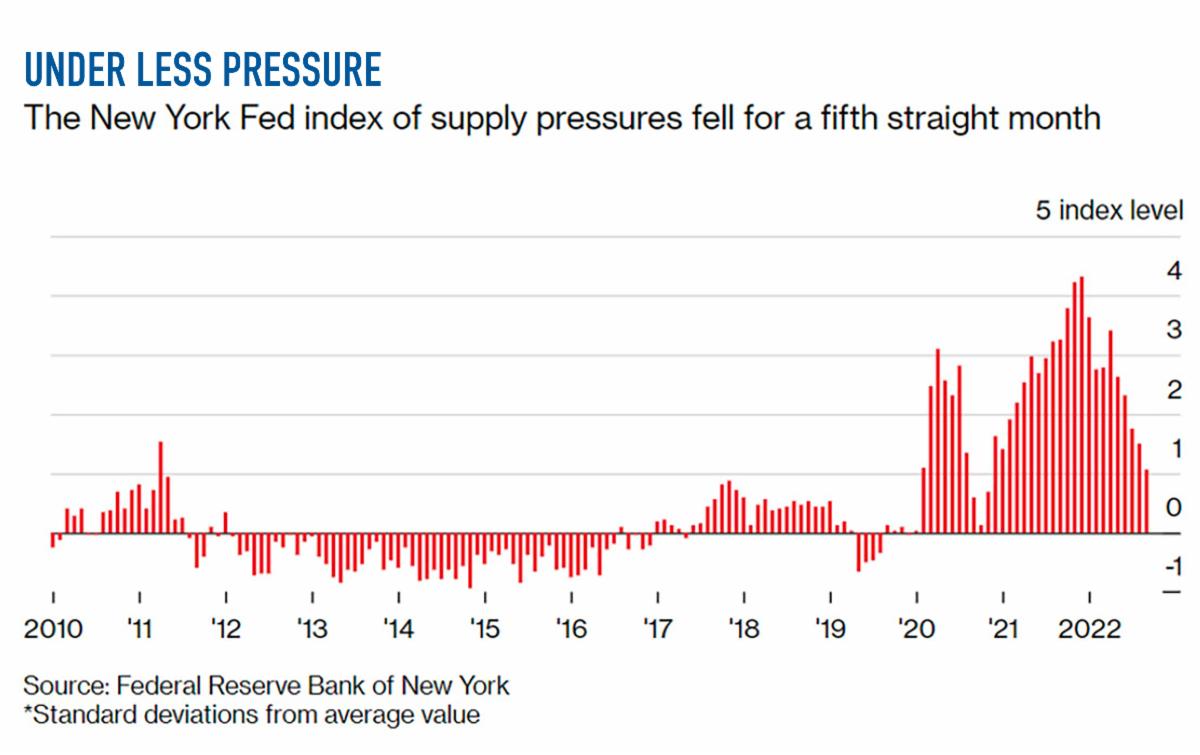

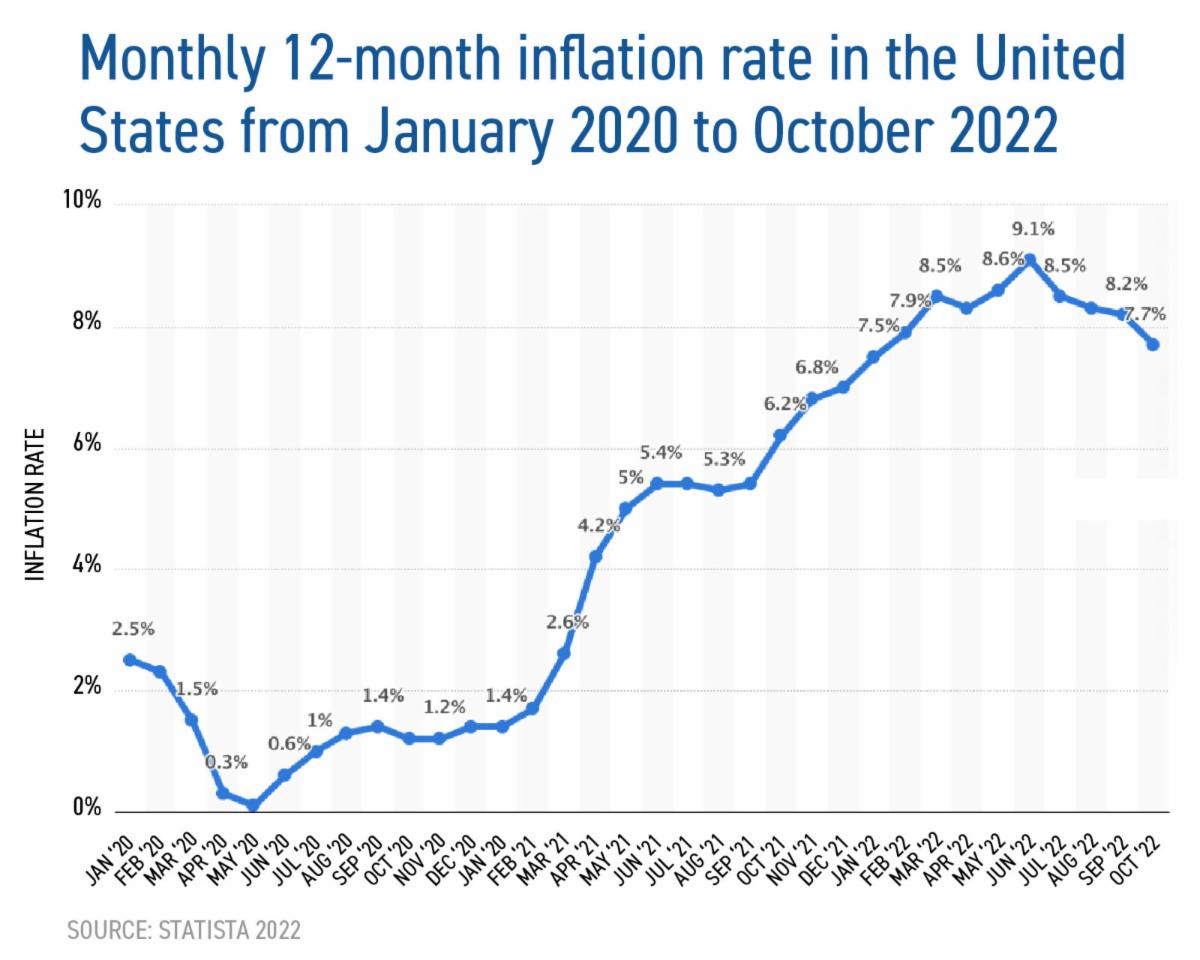

I am totally unsure why I seem to be the only person saying this, but the peak in the 30 mortgage rate already happened in late October/ early November when the rate briefly crossed 7% for conforming mortgages. The Fed’s actions in both the short and long end of the yield curve are having their effects and inflation is cooling. The yield curve inversion means longer term rates are lower than short term rates, and this tends to precede a softening economy. So the Fed will loosen up on the short end of the curve and there you go. How obvious is this?? And yet people are still grousing about rates. That story is behind us and 2023 will see mortgage rates drop further.

I am totally unsure why I seem to be the only person saying this, but the peak in the 30 mortgage rate already happened in late October/ early November when the rate briefly crossed 7% for conforming mortgages. The Fed’s actions in both the short and long end of the yield curve are having their effects and inflation is cooling. The yield curve inversion means longer term rates are lower than short term rates, and this tends to precede a softening economy. So the Fed will loosen up on the short end of the curve and there you go. How obvious is this?? And yet people are still grousing about rates. That story is behind us and 2023 will see mortgage rates drop further.3. There Will Be a New Law Authorizing a 421A-like Tax Break for Developers

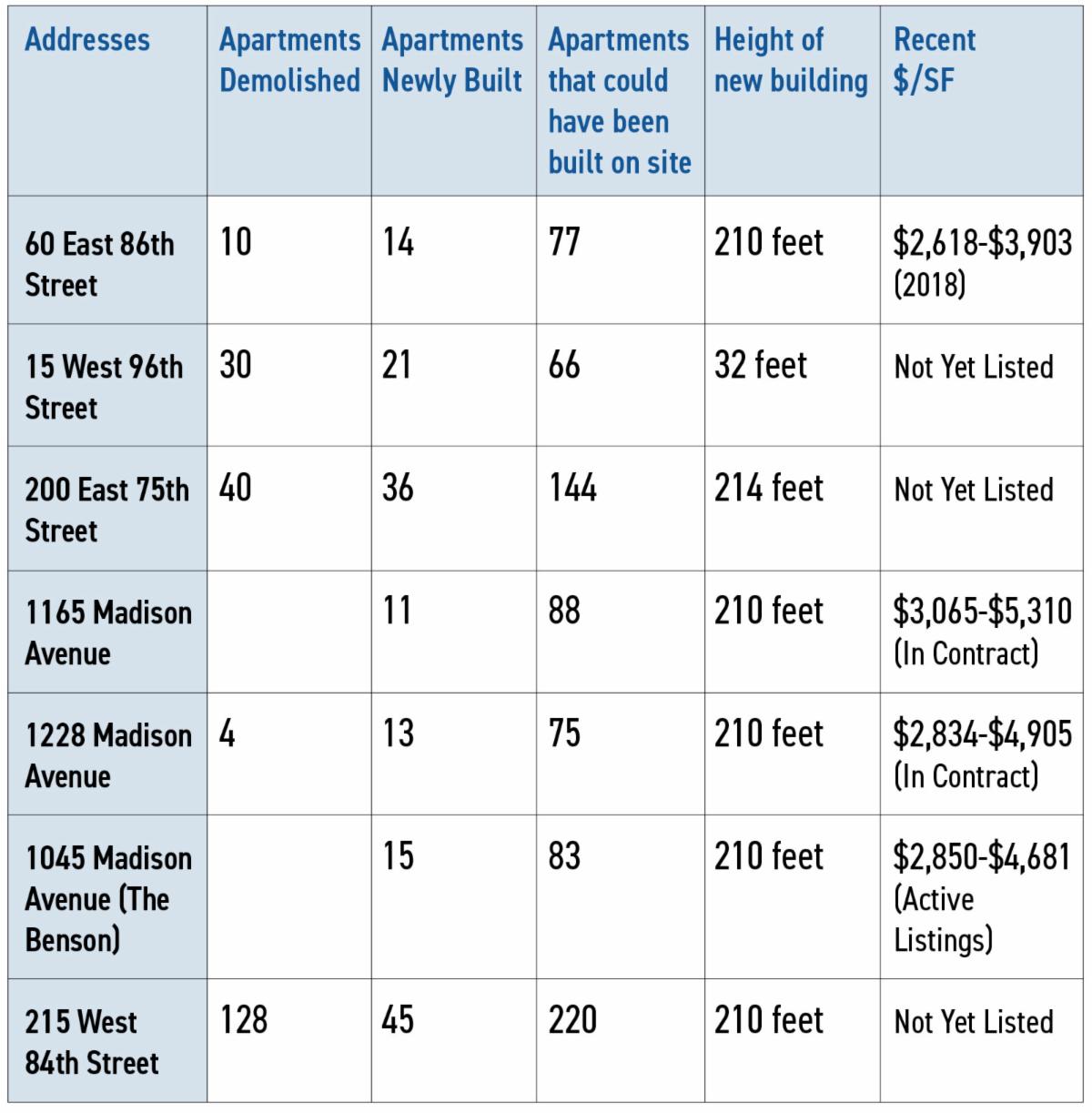

This means the sheer pressure on lawmakers to create more housing will become intolerable. That being said, higher interest rates and the lack of the 421A tax abatement program make most development uneconomic for developers. So there will be a new tax abatement program to spur new housing development in 2023.

4. Commercial to Residential Conversions Will Begin In Earnest

As we wrote in The Insider last week, the work from home movement has hollowed out many office buildings, particularly those that are older and rather tired. With demand for office space at an all time low and demand for housing at a fever pitch, we will start to see conversions of office space to residential apartments in 2023. In fact Silverstein Properties has already raised a $1.5 billion dollar war chest for this effort (and is in the midst of converting another building at 15 Broad already).

—businessinsider.com

—businessinsider.com

Expect this office to residential trend to gain major steam in 2023, revitalizing tired commercial areas for the next several years.

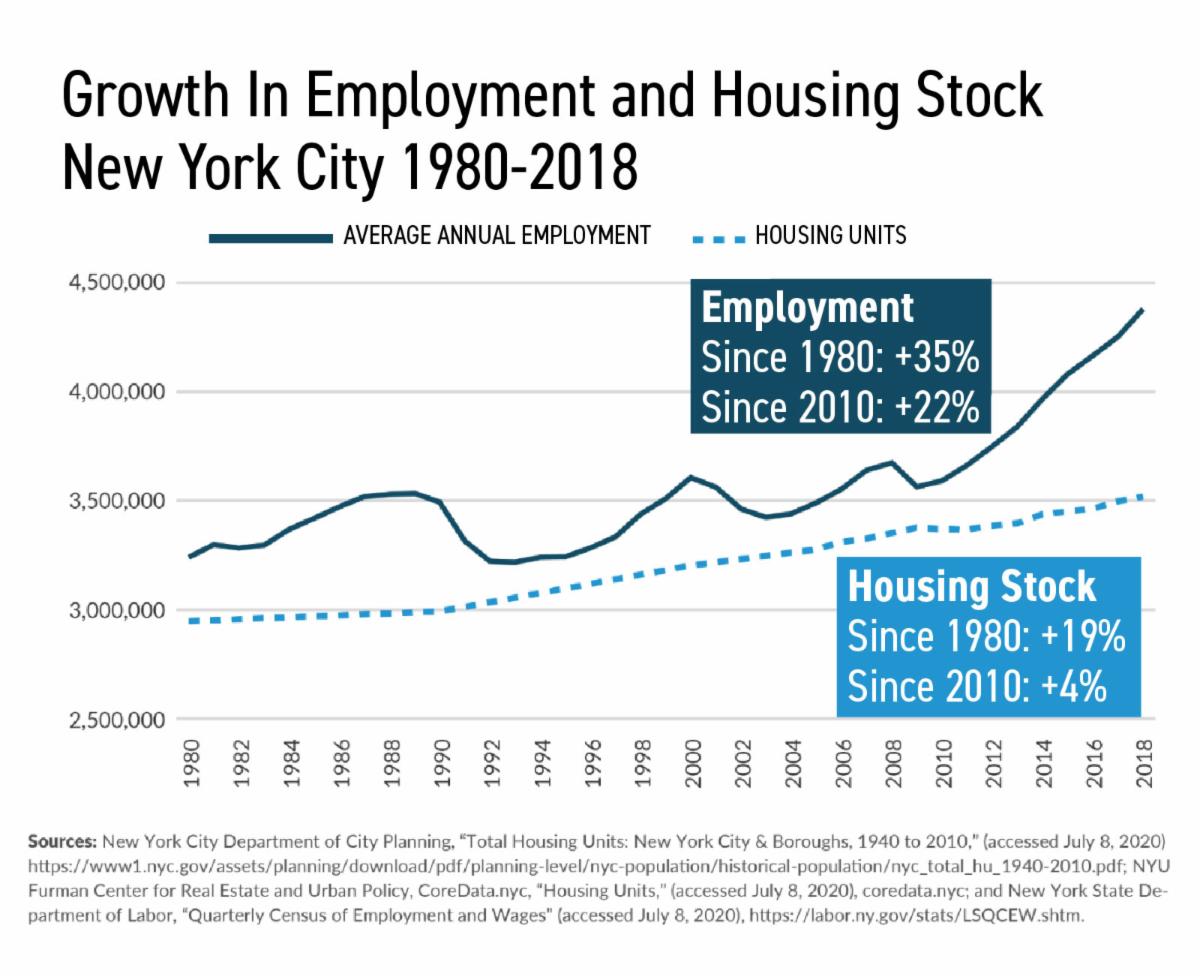

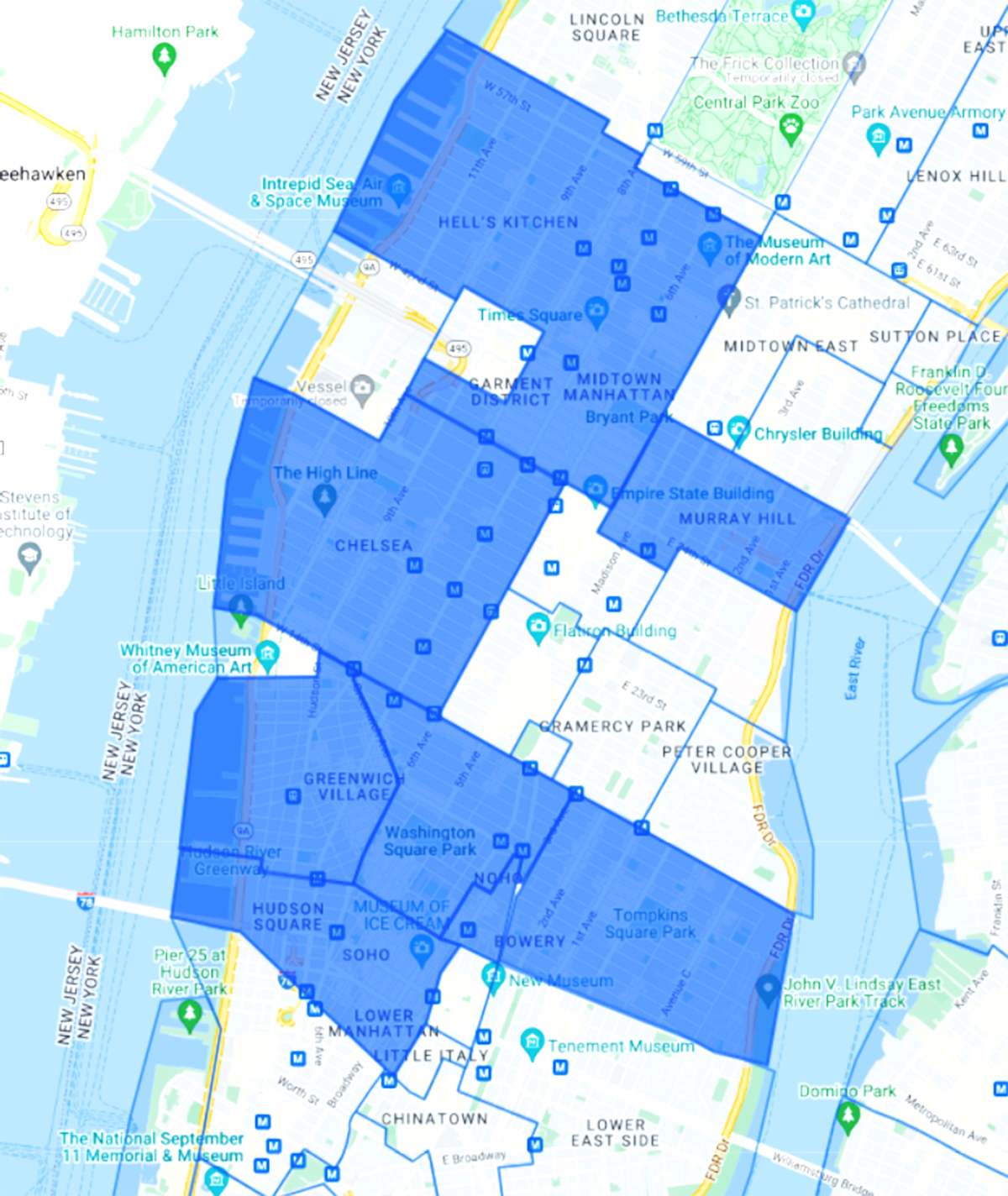

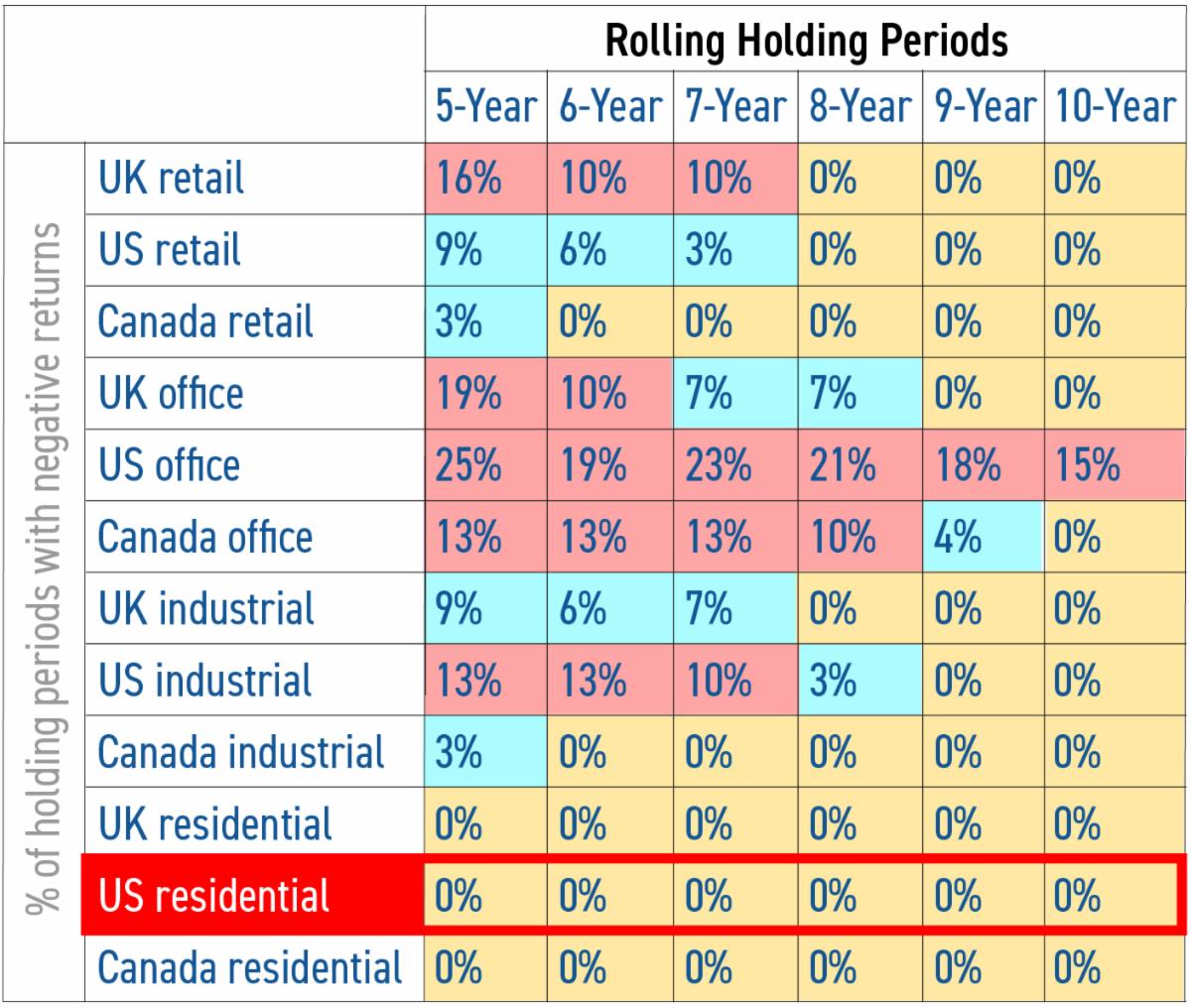

5. There Will Be Major Institutional Interest In Multi Family Properties During a Year-long Flight to Quality

Even before Work From Home and the pandemic, the multifamily asset class was considered a more blue chip asset than office space. Why? Commercial is more volatile. Think about it this way. If you have a class B or C office building that is getting long in the tooth, your anchor tenant could move to, say, Hudson Yards and leave you with a 40% vacancy rate. A few more tenants leave and you have big problems. But in residential, in a town where the vacancy rate is typically in the low single digits, 40% of your tenants just don’t walk out of the door at the same time. That is not a thing. Blue chip means predictable, long term income, which is exactly what you get from residential multifamily properties.

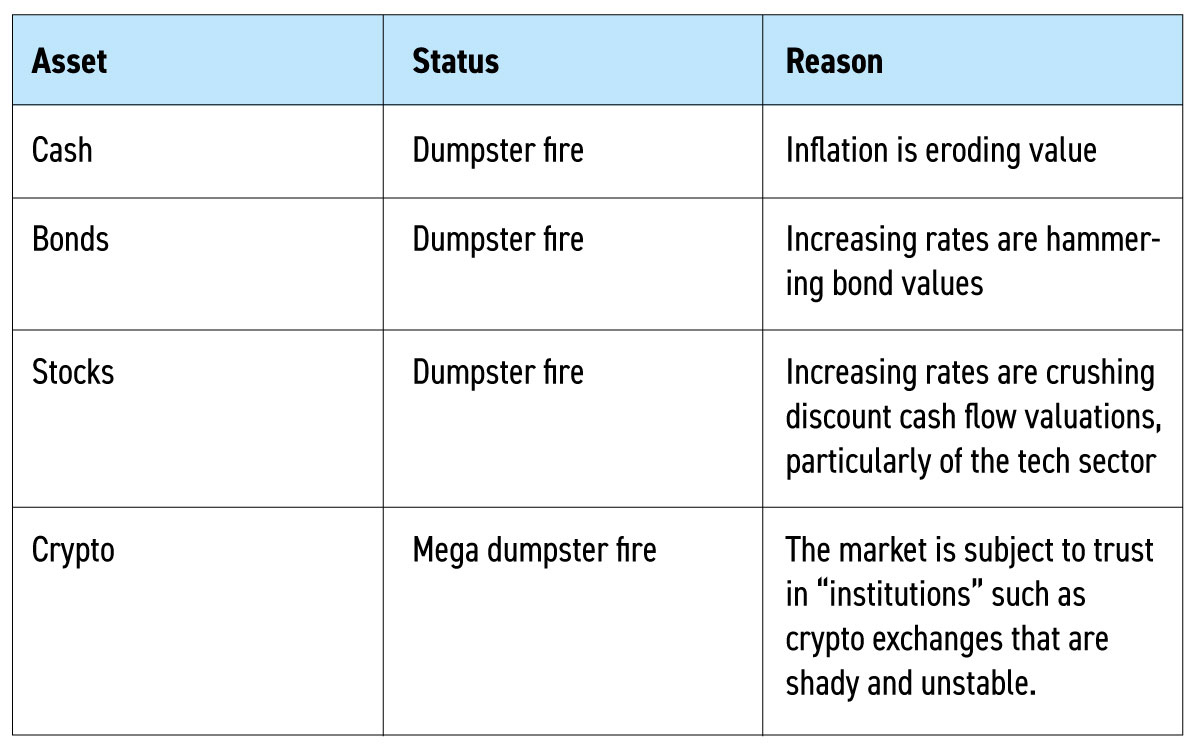

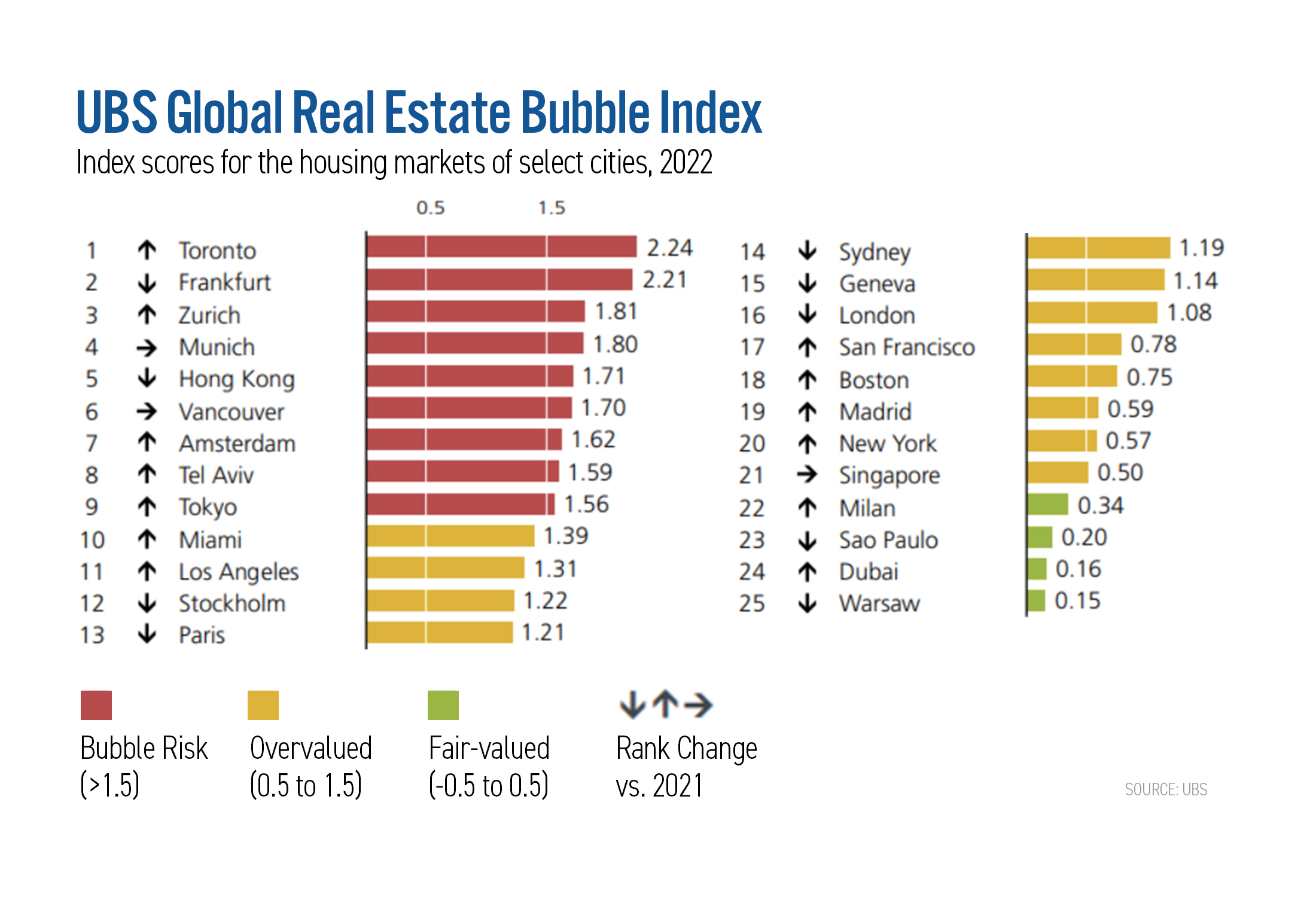

These things are going to push global assets to the bluest chip of all real estate investments (NYC multifamily properties):

- NYC’s distance from Europe’s theater of conflict with Russia

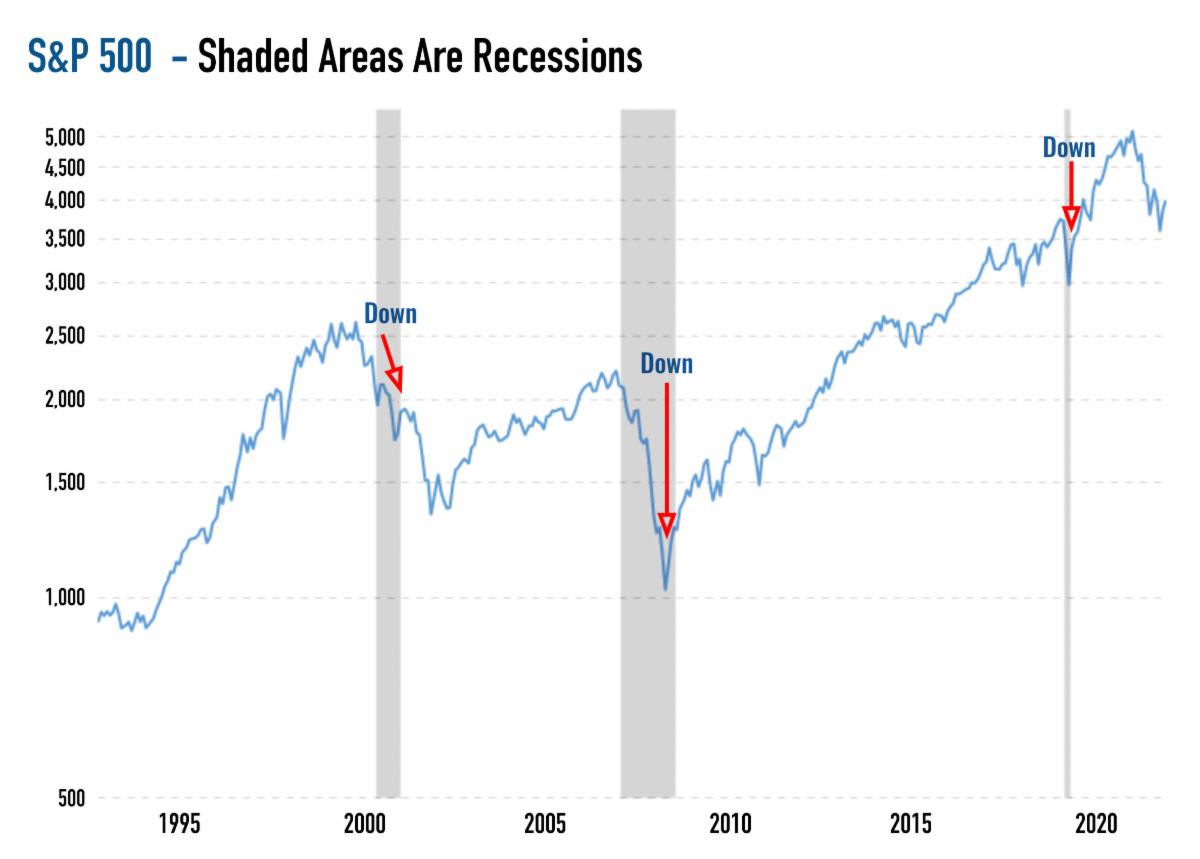

- Equity volatility globally

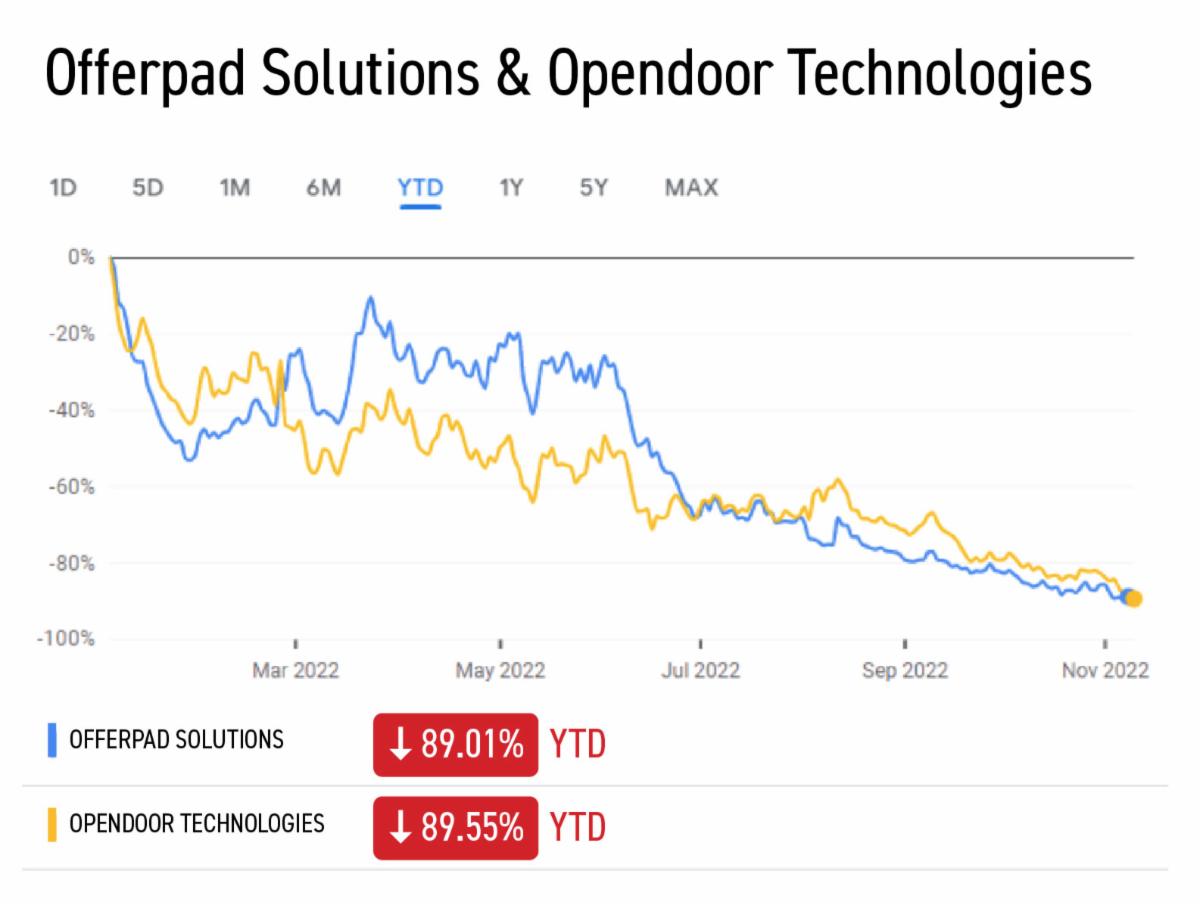

- China’s Covid mess (not to mention their own property mess)

- The crypto dumpster fire

Insider Conclusions

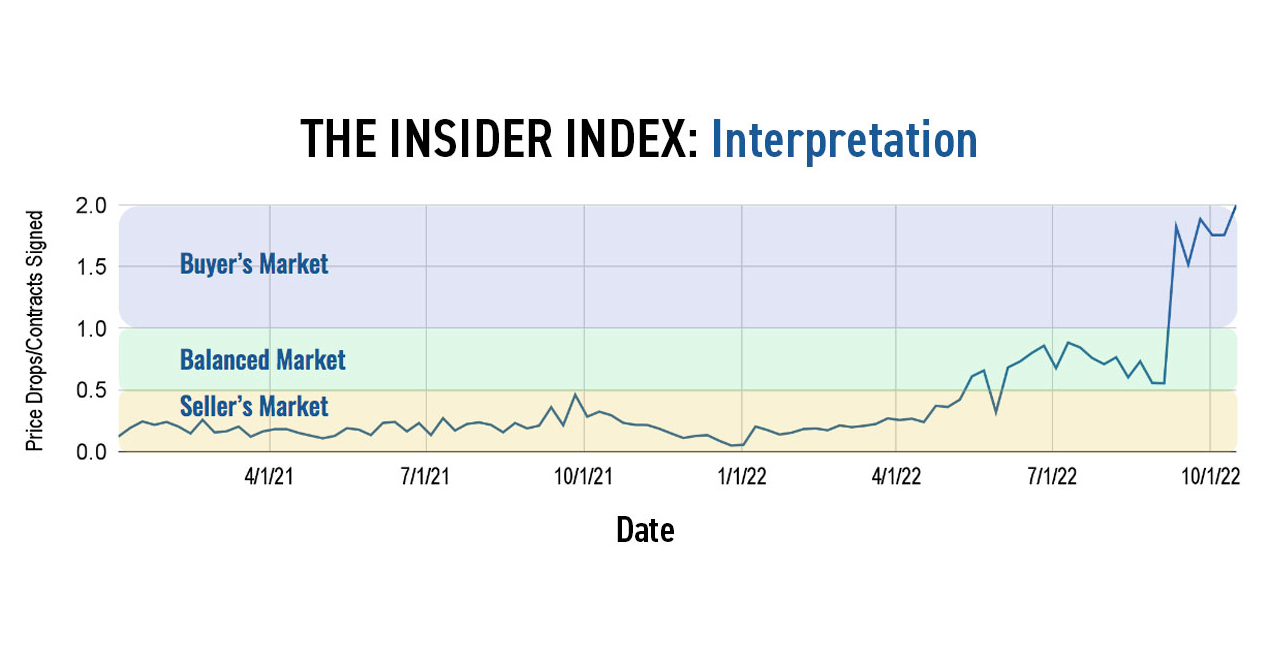

I know this flies in the face of almost everyone’s predictions that 2023 will be characterized by lower sales volumes and lower prices, but I think we’ll pull out of buyer market territory and be back in a seller’s market by fall.

The thing that kills transaction unit counts is uncertainty. And as it becomes clear that (1) crime is being brought to heel (2) interest rates have peaked (3) revitalization is happening in NYC and (4) NYC is a stable asset, confidence will drive asset purchases. With few new developments coming online there is no supply-side overhang to worry about. 2023 will be a solid year for real estate, with rising prices and healthy transaction volumes.

Have a great weekend, everyone!

SUBSCRIBE TO THE INSIDER

ARTICLES

|

|

This means China is stuck with their zero-Covid policy unless and until they produce a vaccine that is as effective as Moderna’s or Pfizer’s, since they refuse to use non-Chinese vaccines (at least thus far). They have been playing for time and hoping their next generation vaccines would roll out before the damage caused by zero-Covid became intolerable. Well, that gambit appears to have failed.

This means China is stuck with their zero-Covid policy unless and until they produce a vaccine that is as effective as Moderna’s or Pfizer’s, since they refuse to use non-Chinese vaccines (at least thus far). They have been playing for time and hoping their next generation vaccines would roll out before the damage caused by zero-Covid became intolerable. Well, that gambit appears to have failed.

WATCH NOW

WATCH NOW

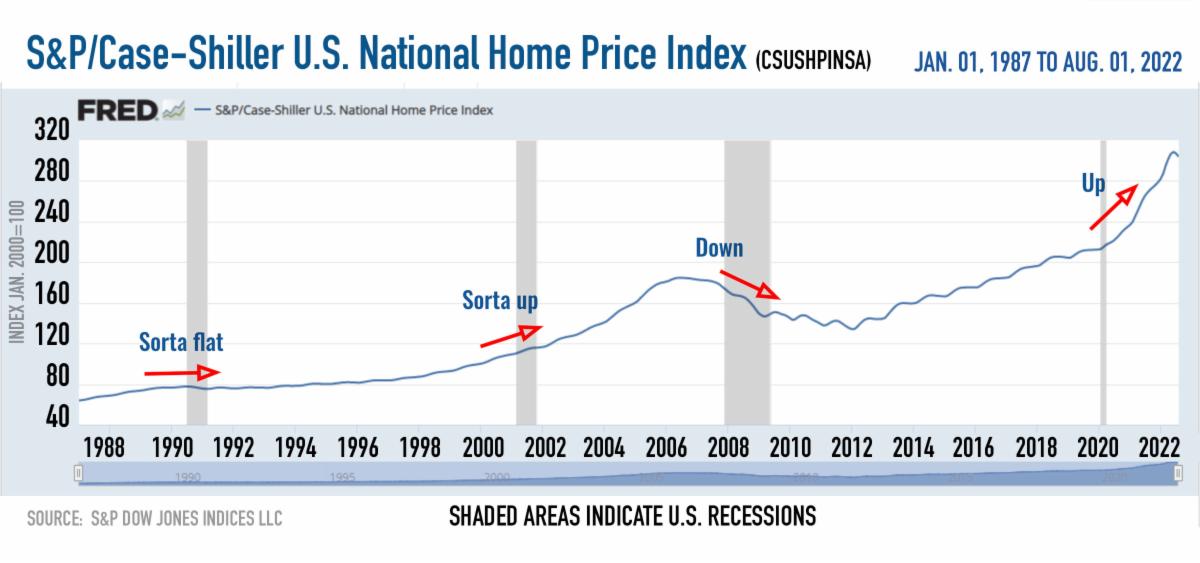

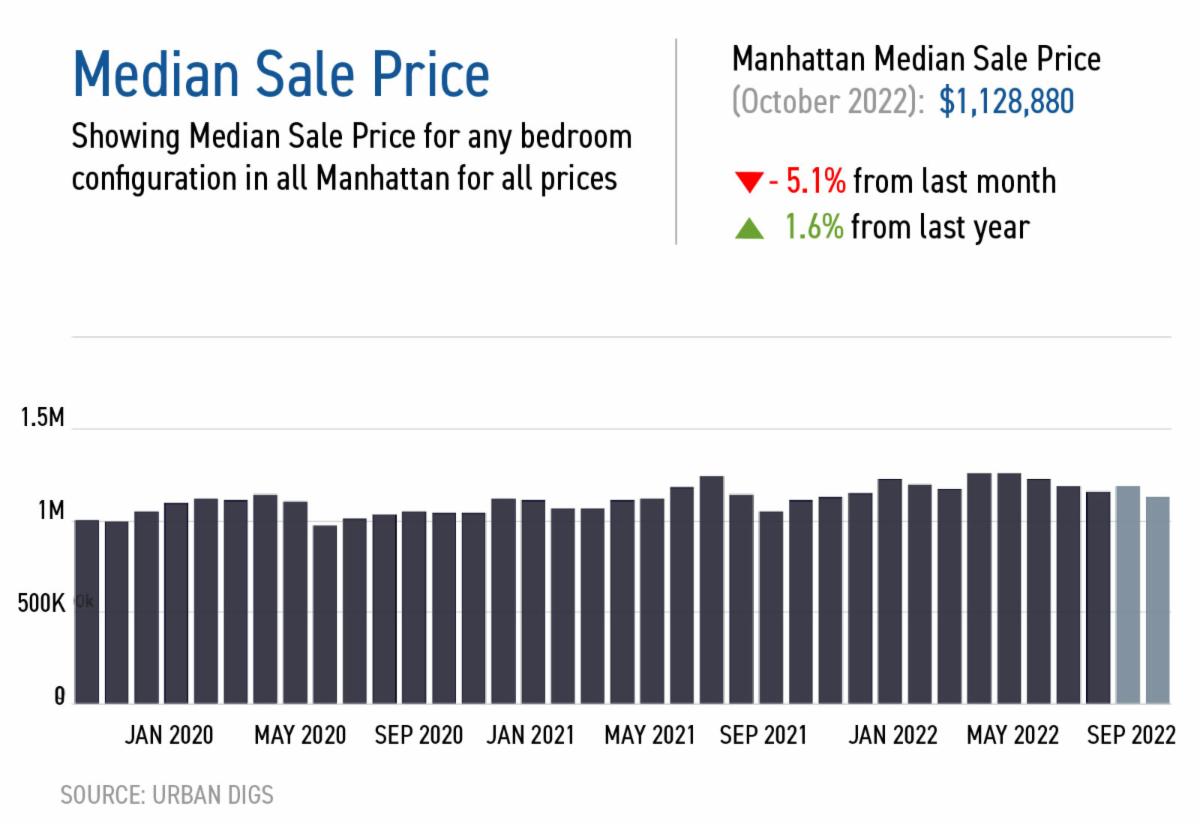

This graph shows the (national) S&P Case-Shiller US National Home Price Index from about 1987 to present. The gray areas are recessions. As you can see, home prices were flat, up or down during recessions during the last 45 years. Let’s be clear: I am NOT saying that prices won’t come down in real estate in NYC. What I AM saying is that making your decision predicated on the (seemingly consensus) idea that a recession is impending and that this means prices are coming down is not useful (and not based in actual reality).

This graph shows the (national) S&P Case-Shiller US National Home Price Index from about 1987 to present. The gray areas are recessions. As you can see, home prices were flat, up or down during recessions during the last 45 years. Let’s be clear: I am NOT saying that prices won’t come down in real estate in NYC. What I AM saying is that making your decision predicated on the (seemingly consensus) idea that a recession is impending and that this means prices are coming down is not useful (and not based in actual reality).

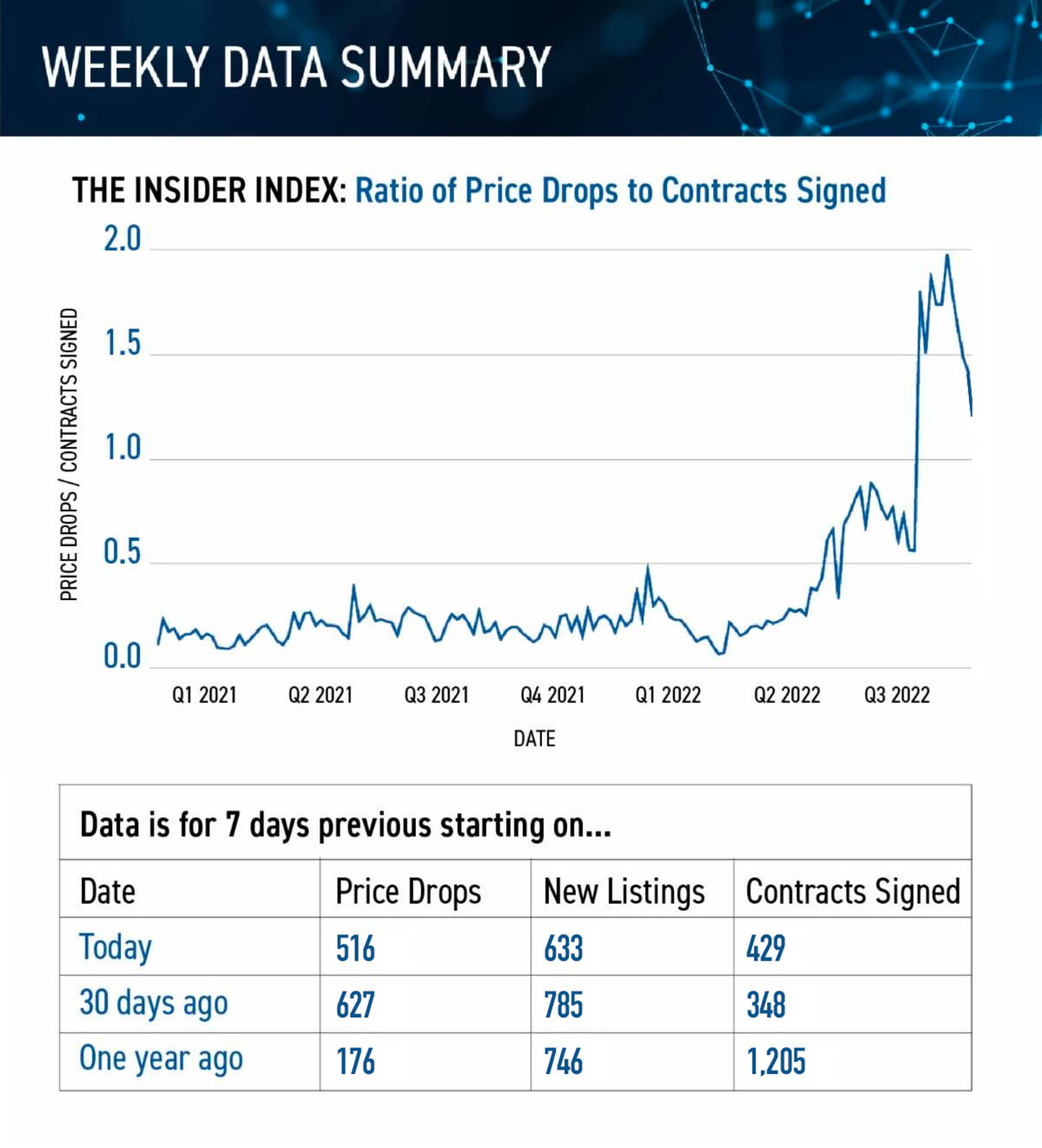

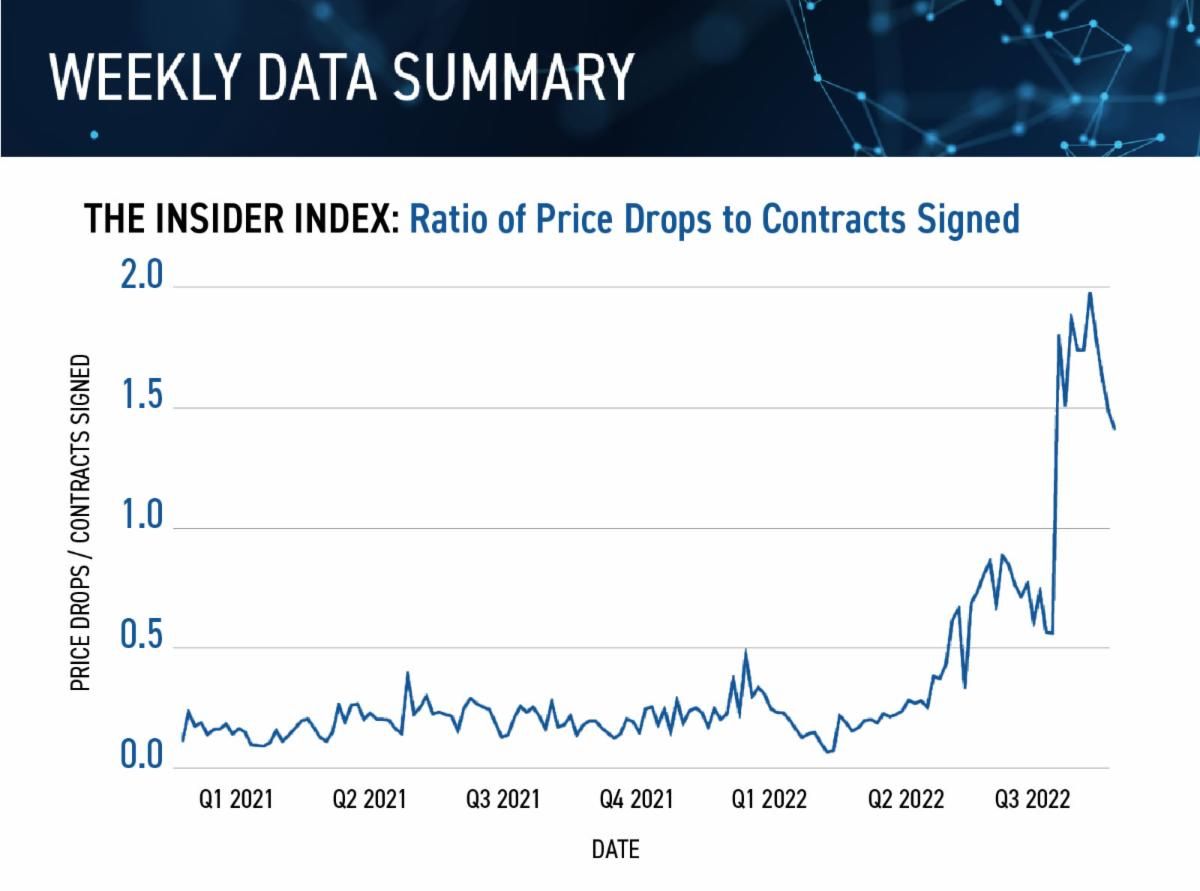

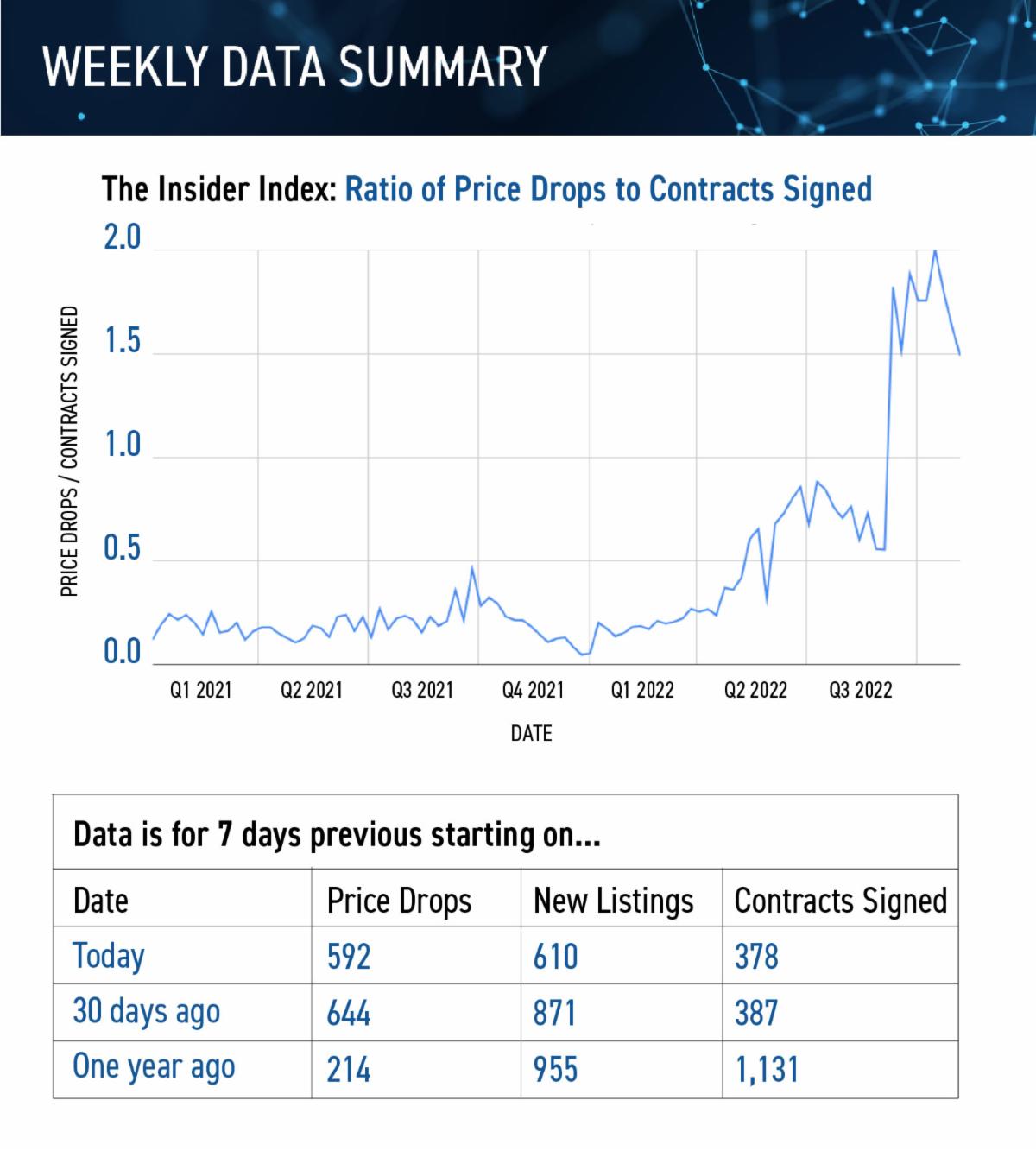

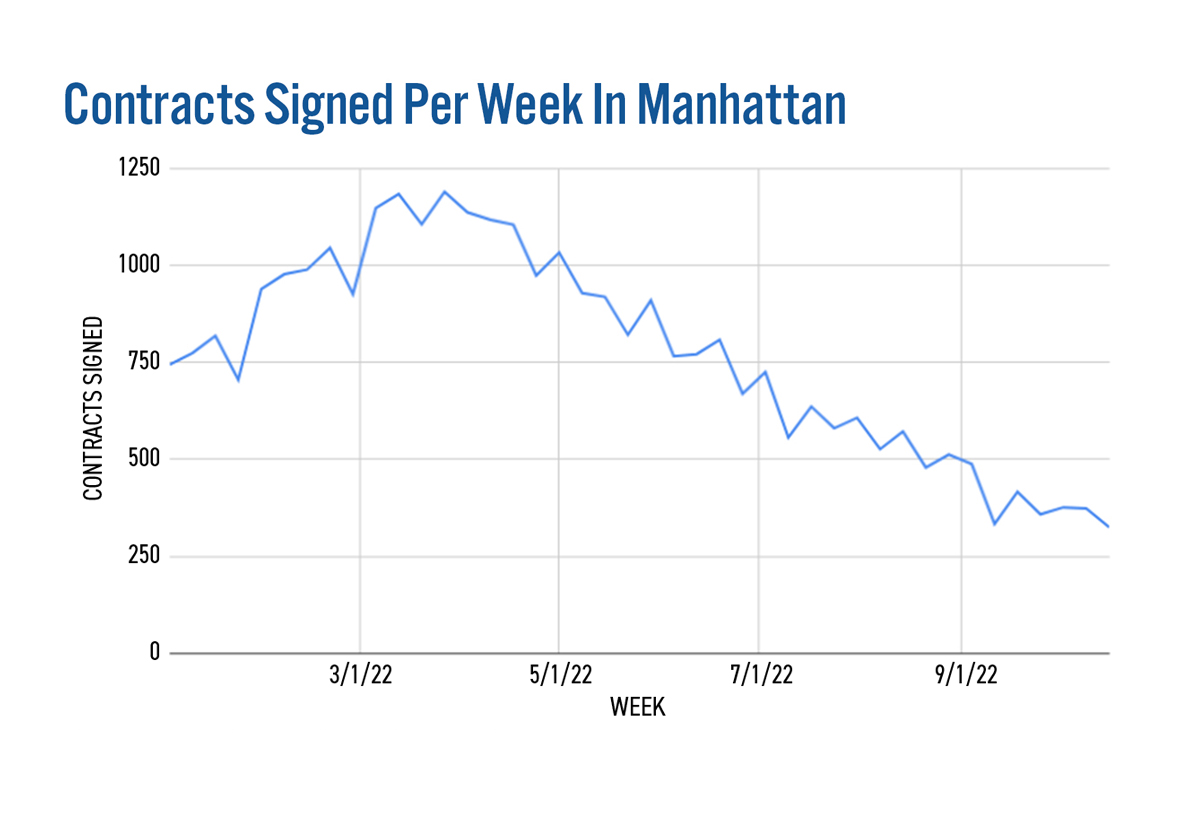

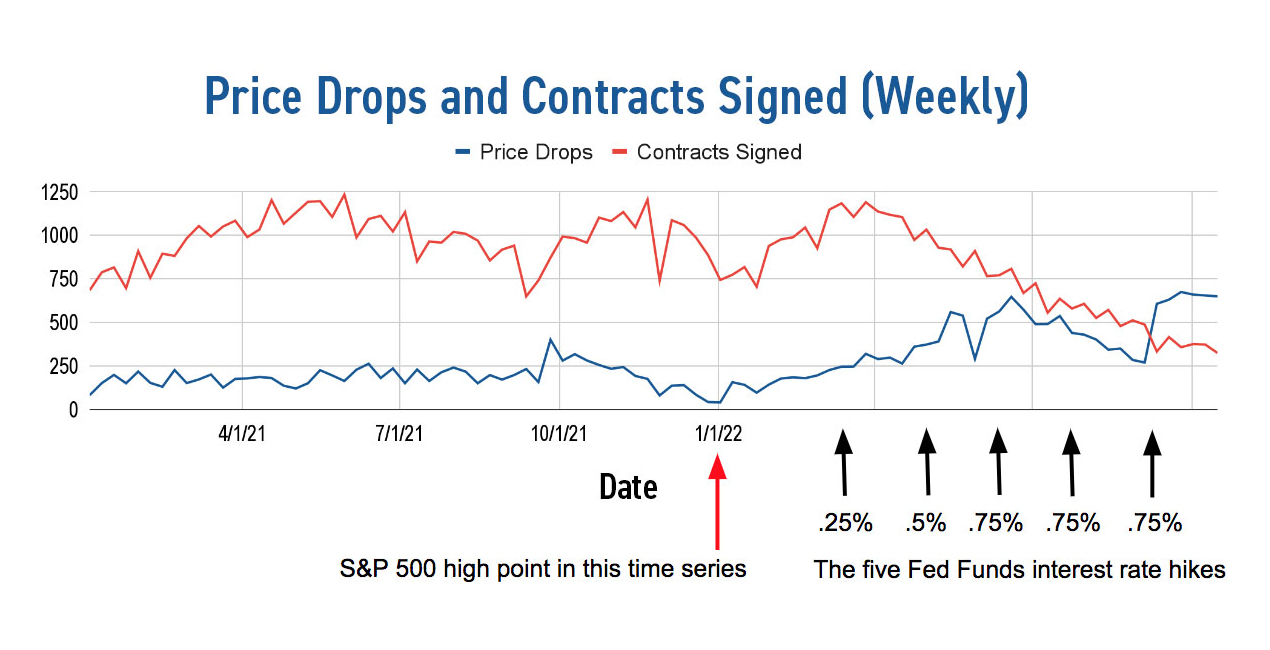

In this format…

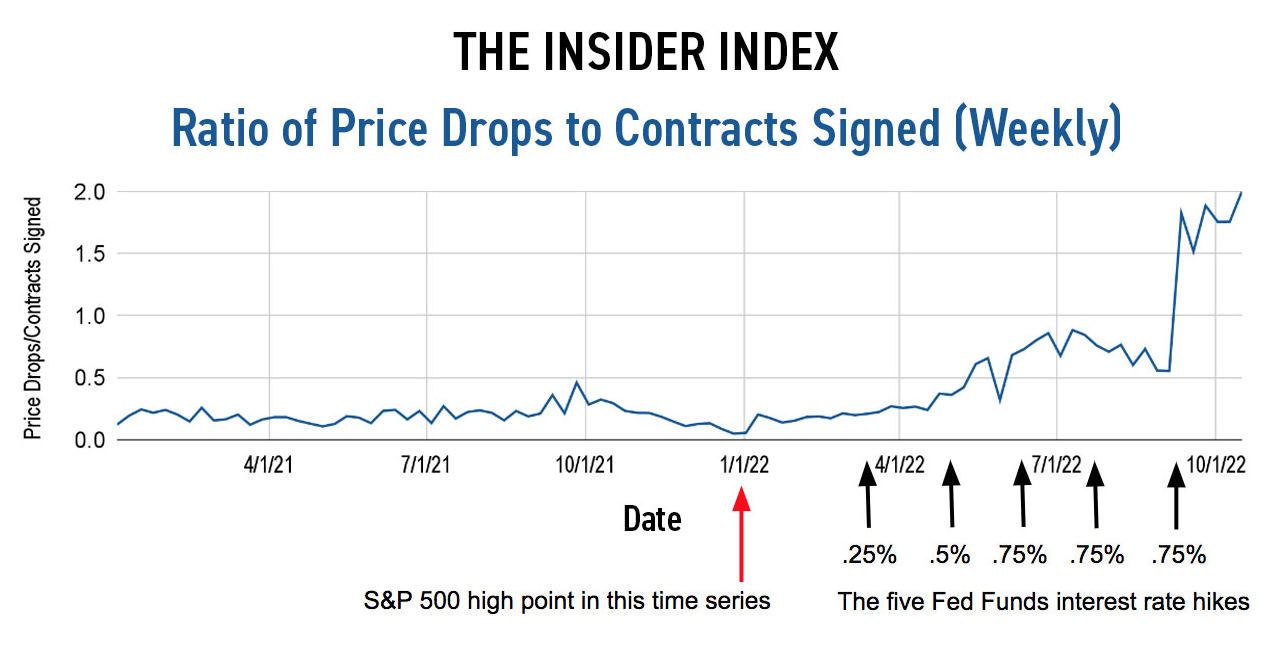

In this format… In a seller’s market, there are at least 4 signed contracts for every price drop.

In a seller’s market, there are at least 4 signed contracts for every price drop.