In this “good news is bad news, bad news is bad news” kind of market, it is easy to get overwhelmed with doom scrolling. The Fed tightened another 75 basis points this week and the S&P immediately sold off. The GDP numbers are strong? The S&P sells off. The job market is stronger than expected? The S&P sells off.

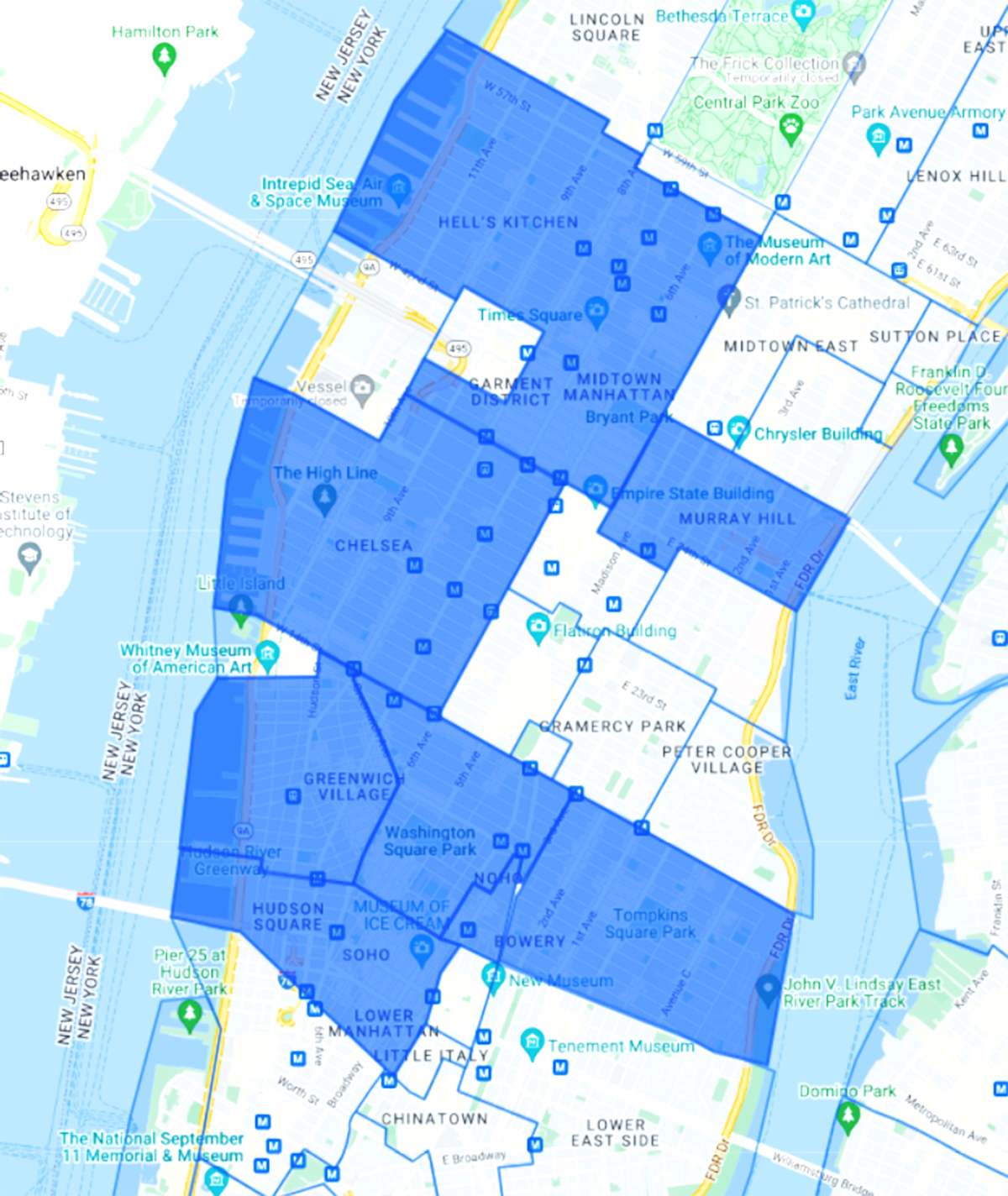

So why is the City awash in bidding wars right now? Here at the Rubin Team, we carry significant inventory (usually 30-50 listings at any given time) and have a lot of buyers we’re working with. So we see a fairly good slice of the market, at least in Manhattan. And in the last week, the most notable thing we’ve seen is that 80% of Rubin Team agents have been involved with at least one competitive bidding situation in the last 7 days. Roughly 25% of the time when we’ve been representing buyers, we’ve seen best-and-finals. One of our listings just accepted an offer ~22% above the asking price.

Douglas Elliman internal data suggest that city-wide bidding wars account for 7% of current deals, as compared to a long-term average of 5% (Rubin Team data is heavily skewed to Manhattan south of 96th Street).

So what is going on?

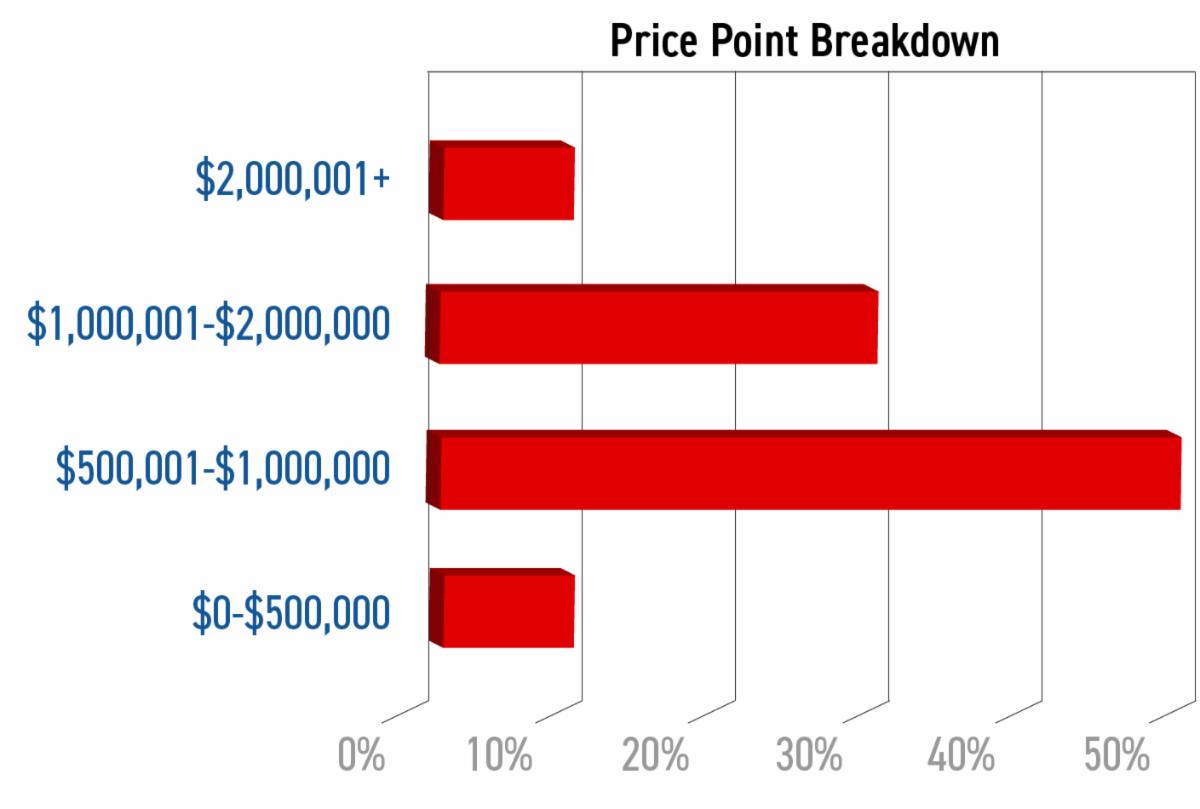

- The sub 2 million dollar price point is dominated by white collar workers, and clearly these people are feeling confident (unless they work at Twitter). This suggests strength in NYC employment.

- Let’s not forget how much cash is always sitting on the sidelines here. By way of perspective, there are nearly 350,000 millionaires that live in New York City, and there are about 12,000-14,000 residential real estate transactions a year in Manhattan.

- As we wrote last week in the Insider, contracts signed per week have been decreasing since about March, and are now about 20% below their multi-year averages.

- In order for that to be true AND bidding wars to be happening, there can only be one conclusion: sellers have capitulated by dropping prices enough that buyers are finding selective value, even with interest rates up and the S&P 500 down.

Imagine what the market would look like if the S&P were a thousand points higher and interest rates were dropping.

Let’s talk about Inflation for a sec:

The traditional viewpoint is that real estate is a hedge for inflation. The theory is that “inflation” is the increase in price of goods and services. Real estate is the mother of all goods, so it should inflate as well.

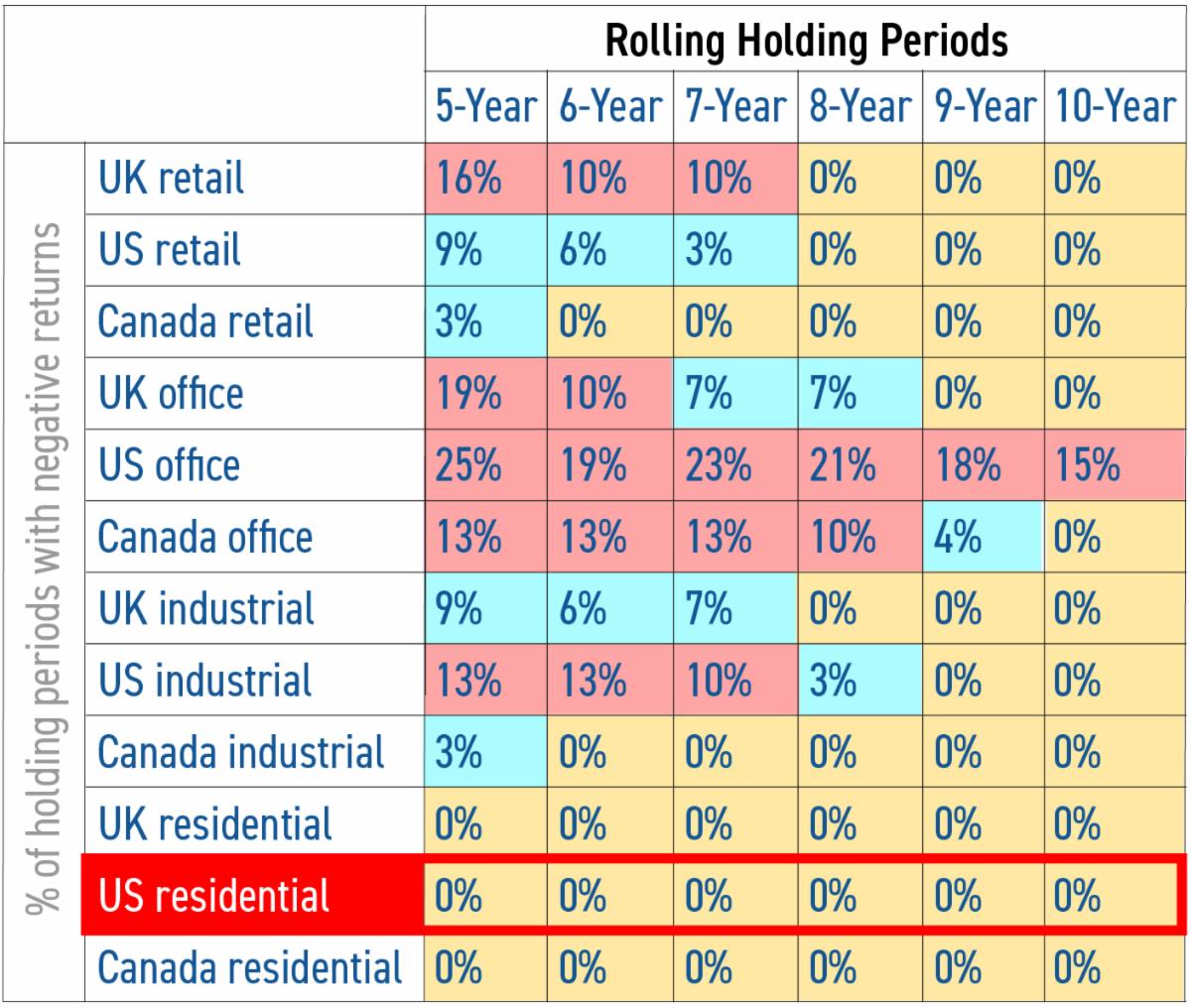

Avison Young just published a study of this in the US, Canada, and the UK covering all real estate asset classes. I will spare you the details of all the correlation percentages and the lengthy analysis. Here’s the punchline: only residential real estate provides real (i.e. inflation adjusted) positive returns over every time horizon from 5 to 10 years, though the results in shorter time periods is more murky.

Conclusion:

This brings me to close on an ongoing theme of the Insider. I think that because New York is first and foremost the center of finance for the world (post-Brexit), people think about real estate in the same breath as stocks and bond funds and derivatives and such. But real estate is fundamentally not such a liquid asset and is a long term investment.

![]() To highlight this point, imagine if you had a 10% frictional cost in buying and selling Tesla (or any) stock, as you do in real estate. You would surely be inclined to think about it as a long term investment rather than day trading it.

To highlight this point, imagine if you had a 10% frictional cost in buying and selling Tesla (or any) stock, as you do in real estate. You would surely be inclined to think about it as a long term investment rather than day trading it.

Therefore, the obsession with timing the real estate market is inappropriate and often leads to the wrong decision, when seen in the rearview mirror.

I remember taking clients out who were looking to invest in 2009 and 2010, who were obsessed with getting top condo product for under $1,000/sf. They couldn’t understand why the only thing I was showing them was seriously compromised in some way… like ground floor, or every window looking at a wall, or whatever. They ended up deciding to “wait for the bottom” of the market, and of course ended up missing out on a nearly decade run in prices.

Real estate returns need to be thought of in half-decade increments, not 6 month increments.

Have a great weekend, everyone!