WATCH NOW

WATCH NOW

SUBSCRIBE TO THE INSIDER

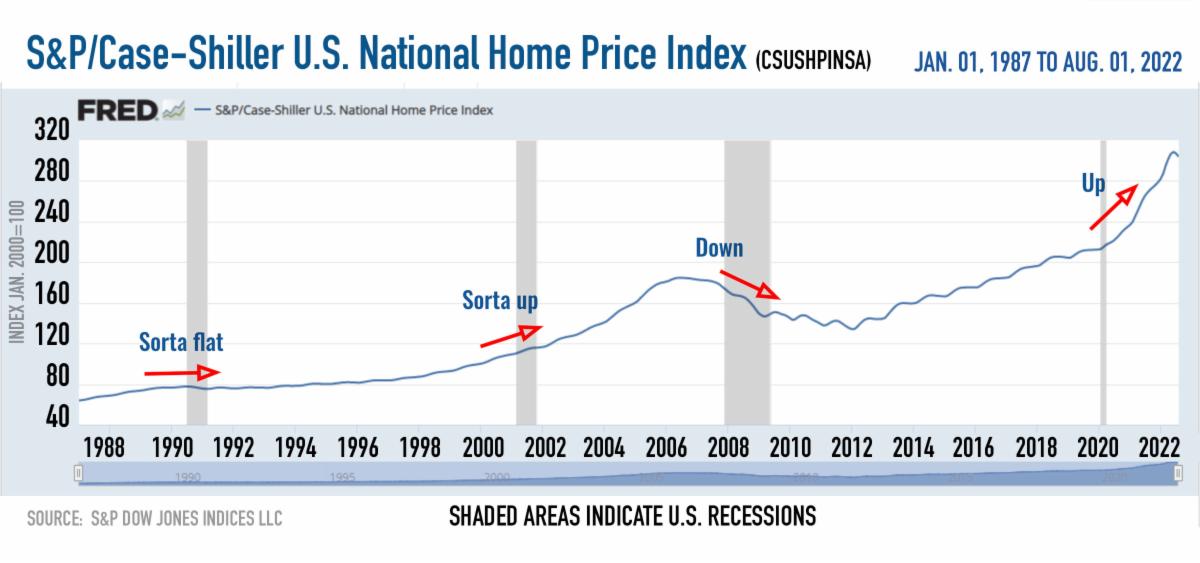

In the last few weeks, I’ve heard a lot of people fretting about an impending recession, and using this as a rationale for not purchasing real estate. Well, here’s a news flash: there is not a strong correlation between recessions and real estate prices, positive or negative. Yeah, you read that right.

Let’s take a look:

This graph shows the (national) S&P Case-Shiller US National Home Price Index from about 1987 to present. The gray areas are recessions. As you can see, home prices were flat, up or down during recessions during the last 45 years. Let’s be clear: I am NOT saying that prices won’t come down in real estate in NYC. What I AM saying is that making your decision predicated on the (seemingly consensus) idea that a recession is impending and that this means prices are coming down is not useful (and not based in actual reality).

This graph shows the (national) S&P Case-Shiller US National Home Price Index from about 1987 to present. The gray areas are recessions. As you can see, home prices were flat, up or down during recessions during the last 45 years. Let’s be clear: I am NOT saying that prices won’t come down in real estate in NYC. What I AM saying is that making your decision predicated on the (seemingly consensus) idea that a recession is impending and that this means prices are coming down is not useful (and not based in actual reality).

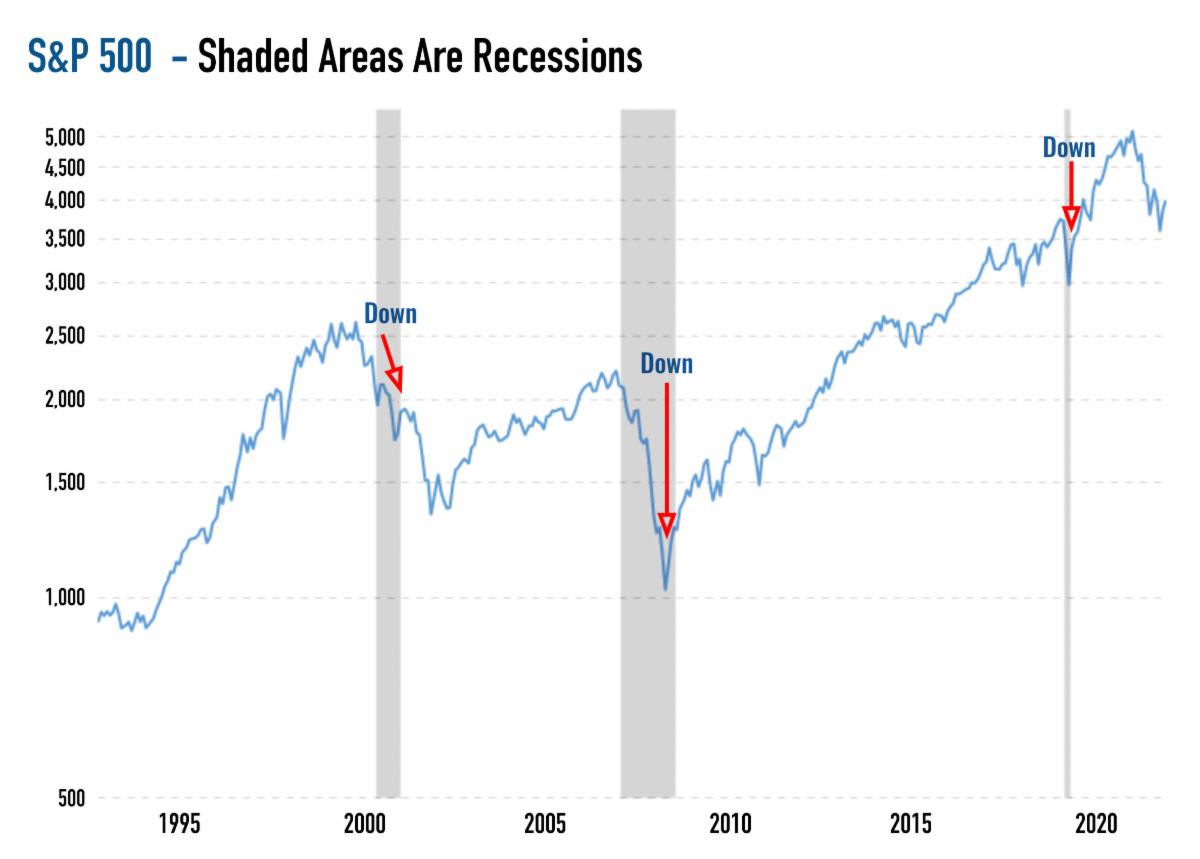

How about stocks? Well that’s a different story:

Here’s one conclusion: in the face of an (apparent) impending recession, it is probably better to be in real estate than in stocks.

Here’s another way to think about it. As we’ve written about in the Insider in the past, NYC real estate buyers are on average very different from the rest of the country. When your average home price is, say, $400,000, you save $40k, and get a loan for the rest. In New York City because of our price points, jumbo loan requirements, and the financial requirements of coops, a lot more cash is required. So people sell stocks and buy real estate. About half of them buy their properties for cash. So for NYC property buyers, the purchase decision is more about asset allocation than affordability.

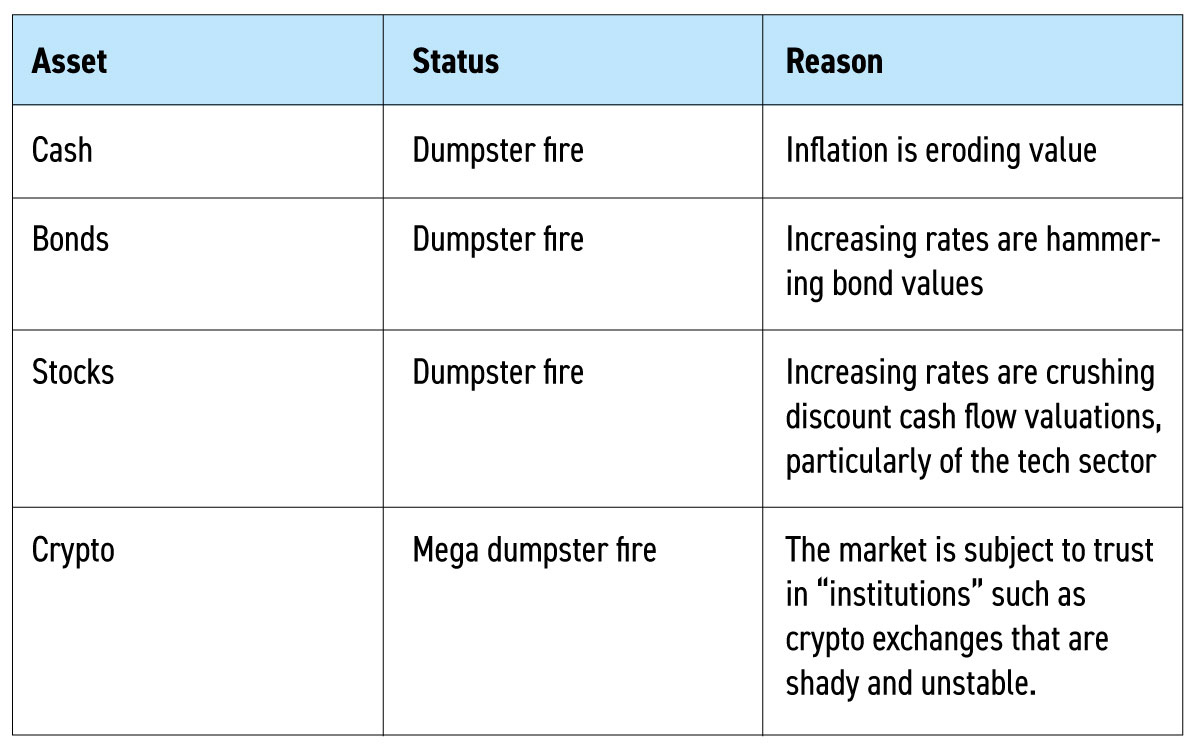

Let’s review asset classes:

Here’s what we know about real estate. Over the long term, it preserves its value. The Furman Center published the most comprehensive longitudinal study of real estate that I’m aware of, spanning 1974 to 2006. Their conclusion is just as relevant today as it was then:

- Reassuringly, despite past price volatility, the overall health of the City’s real estate market remained strong over the past three decades, with the losses from the downturns representing only a fraction of gains from the upturns. Source: Trends in New York City Housing Price Appreciatio

With all of this in mind, consider allocating more assets to real estate as it’s likely to outperform stocks in a recession.

Have a great Thanksgiving weekend, everyone!