Click to watch the recap of today’s Insider with Josh Rubin and Mark Chin

Let’s get this out in the open: yesterday (Thursday 10th November) the financial markets posted some remarkable results:

- Dow up 1,200 points (+3.7%)

- S&P 500 up 207 points (+5.5%)

- Nasdaq up 760 points (+7.4%)

- The yield on the 10 Treasury dropped 31.3 basis points (biggest one day drop since 2009)

- 30 year jumbo fixed rate mortgages dropped from 6 ⅜ to 6.0%

Stocks are going to rock when the market perceives the Fed’s war on inflation is coming to an end, and yesterday’s action is a harbinger of things to come.

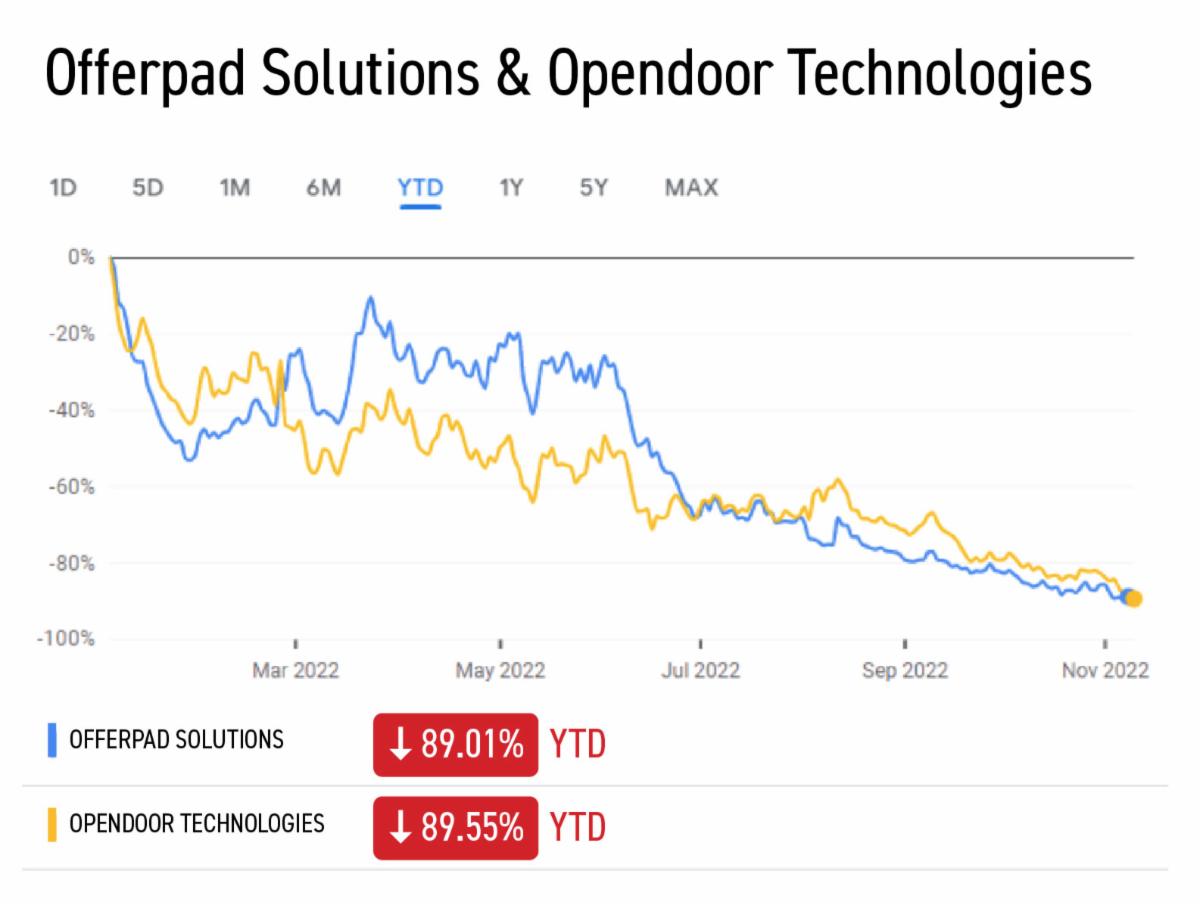

As I pointed out in the Insider last week, because of the frictional costs of buying and selling real estate, it’s appropriate to think about it in the medium to long term. In fact, most of the companies that were in the i-buyer space (that is, companies that offered to buy your home for cash immediately with the plan of sprucing them up and flipping them) are either licking their (rather deep) wounds or are out of the space entirely.

Licking wounds:

- Opendoor (no choice but to tough it out; it’s their entire business model)

—TheRealDeal

- Offerpad (no choice but to tough it out; it’s their entire business model)

—Inman

Source: NY Times

Out of i-buying entirely:

- Keller Williams

- Redfin

- Zillow

Here’s the takeaway: short term trading real estate sorta works when the market is rocketing upwards. When the market is going down while financing costs are going up it is a guaranteed way to lose a shocking amount of capital quickly. So stop thinking about real estate in the short term already.

Let’s consider some of the larger demographic, structural, and financial forces at work.

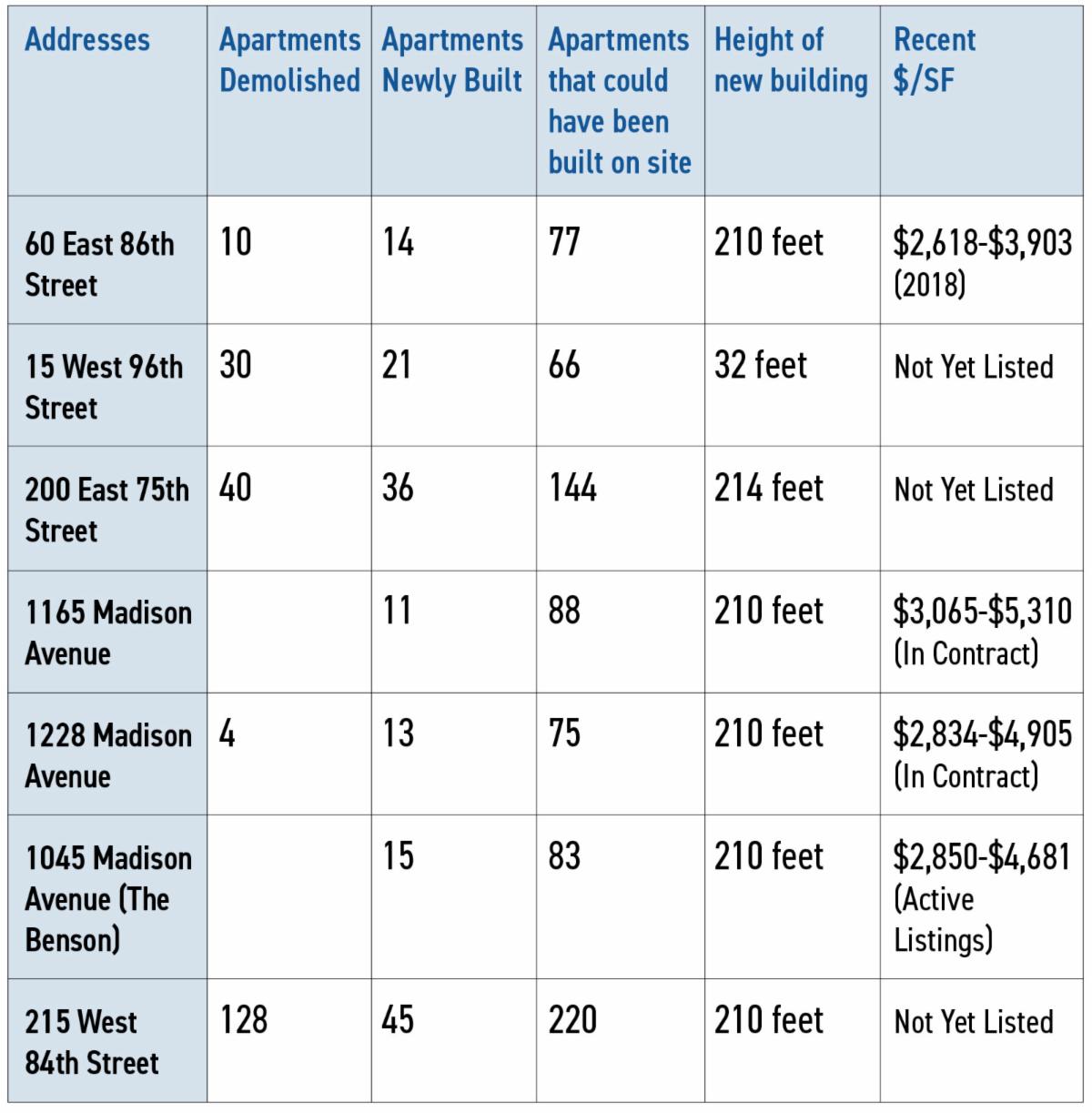

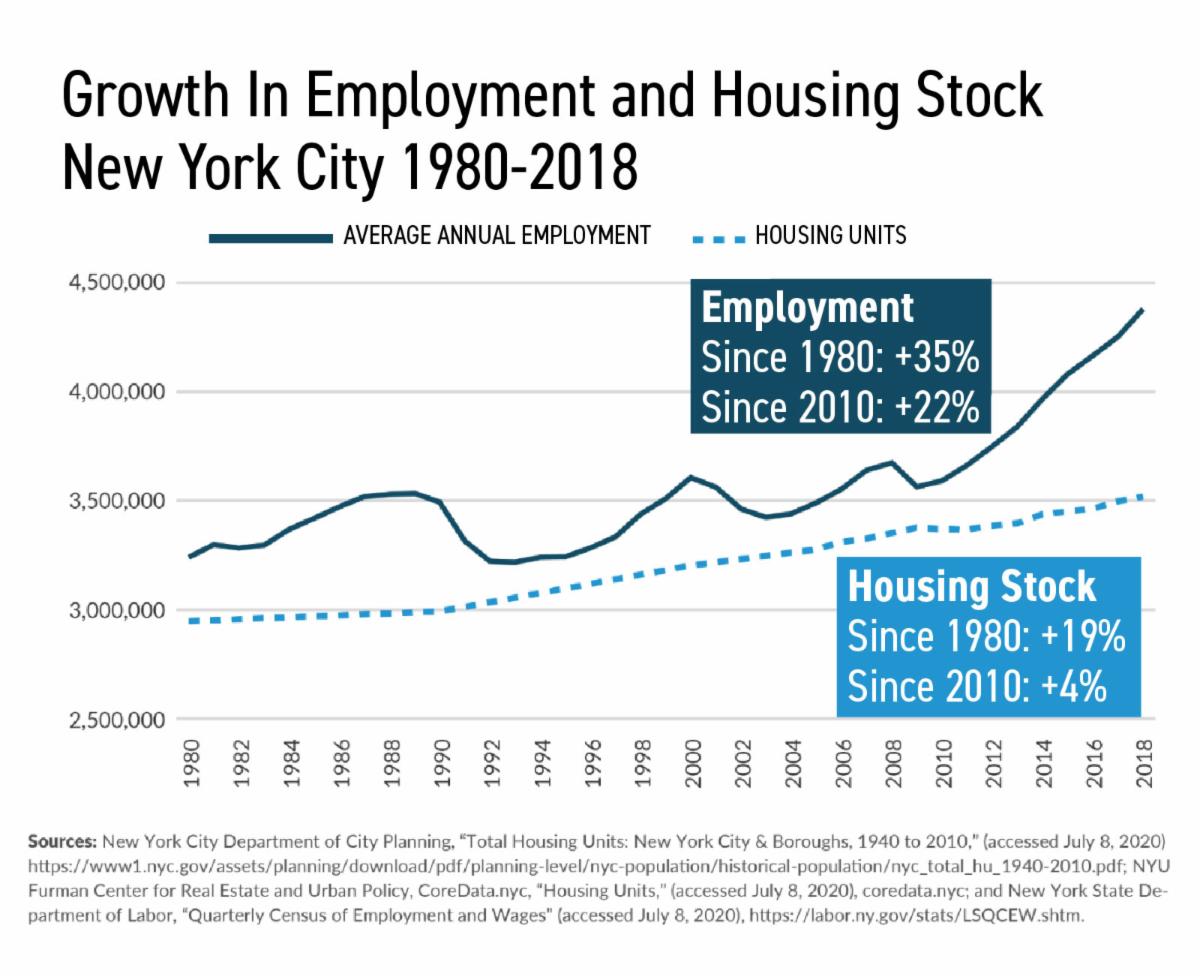

- NYC is not building enough apartments. It doesn’t take a genius to figure out that with rents breaking all-time highs this year, there is a scarcity of apartments in the city.

- Construction finance has gotten a lot more expensive as interest rates have risen.

- The 421-A tax incentive program expired in June of 2022. Over the last decade this program helped finance 117,000 apartments. Without this tax break, building rental buildings is not economic.

- This is pushing developers to building condos, which have a slight edge over rentals without the 421-A tax break

- However, in order to protect margins, developers have to build luxury properties, often building far fewer but larger units than they could as-of-right.

Note: most of the buildings that were torn down were walkups, most of what replaced them were 200+ foot towers with very large apartments.

Note: most of the buildings that were torn down were walkups, most of what replaced them were 200+ foot towers with very large apartments.

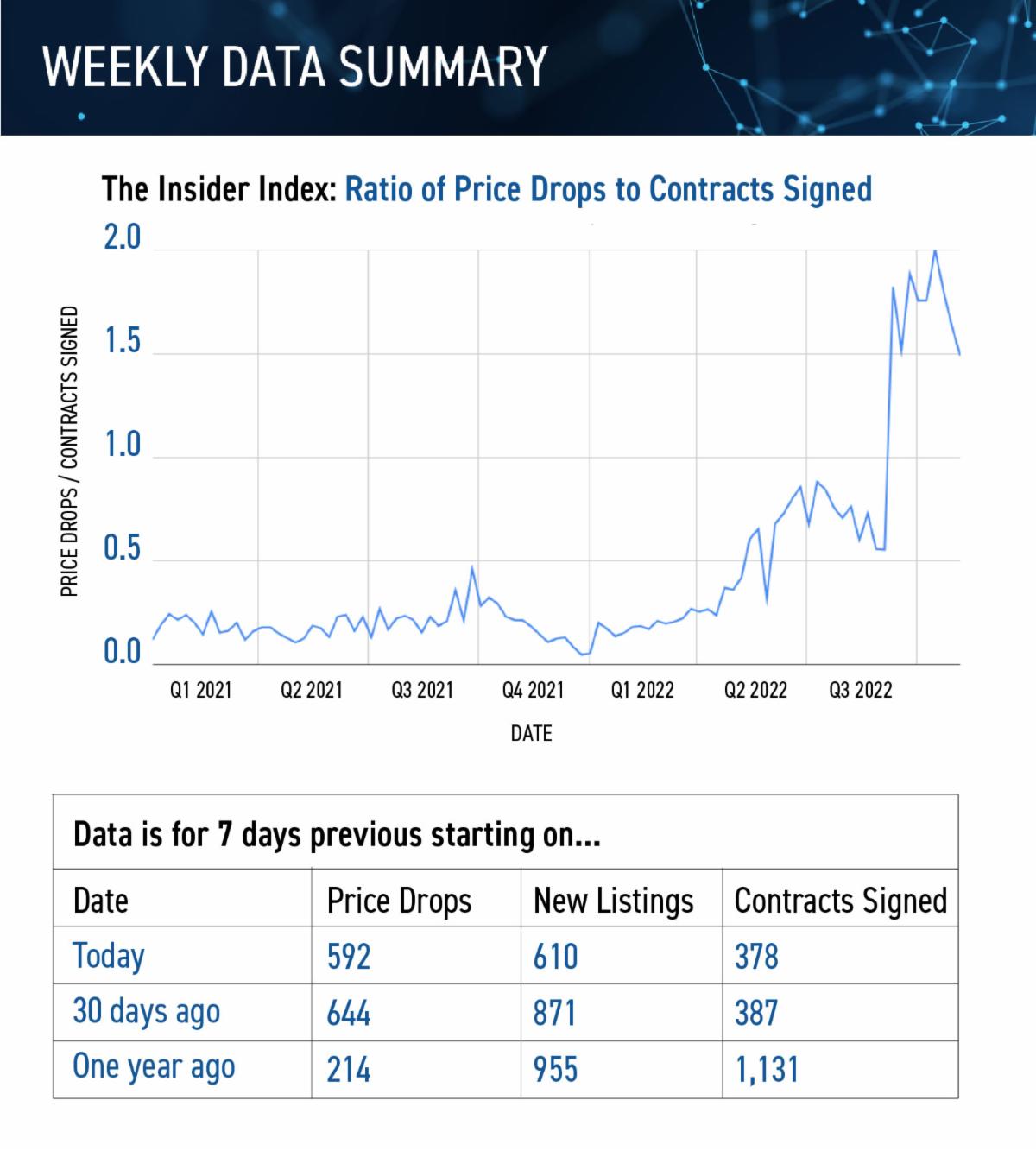

Housing is outstripping jobs rather spectacularly

(these data look at pre-Covid trends because post Covid data is super noisy). According to the Citizen’s Budget Commission, a research and advocacy group, “Between 2010 and 2018 New York City’s job base increased 22 percent, while its housing stock increased only 4 percent, resulting in the addition of only 0.19 housing units for every new job created this decade.”

The real estate industry in NYC is breathing a sigh of relief that Kathy Hochul was re-elected, having invested heavily in her campaign. There are two reasons for this: her commitment to the MTA and congestion pricing (which we covered here), and her plans to revive a 421-a tax abatement look alike.

evisited in 2023Earlier in 2022, Hochul proposed a new tax abatement called 485-w, which deepened the affordability requirements and percentage unit requirements to qualify. Opponents lambasted the measure as not doing enough and the proposal was ultimately pulled from the budget. Expect this concept to be revisited in 2023, as developers look for returns on their investment in Hochul’s re-election.

The old adage is “when the tide goes out, all the ships go down” and that is largely true. That being said, in New York City, the ebb tide is limited by a structural lack of supply that cannot be solved in the short term. Look for NYC to continue to outperform other large metro areas for the foreseeable future.

Have a great weekend, everyone!