As I read the news in the last week, I was struck by how precarious things are globally across many (many) assets. Japanese Yen, Euro, and Sterling getting slaughtered against the dollar. Europe, Japan, and UK all being forced to raise rates as their economies are slowing. China’s property market looking decidedly sick. Like intestinal flu sick. China’s stock market in a rout. Emerging markets are swooning in the face of a monstrously strong dollar.

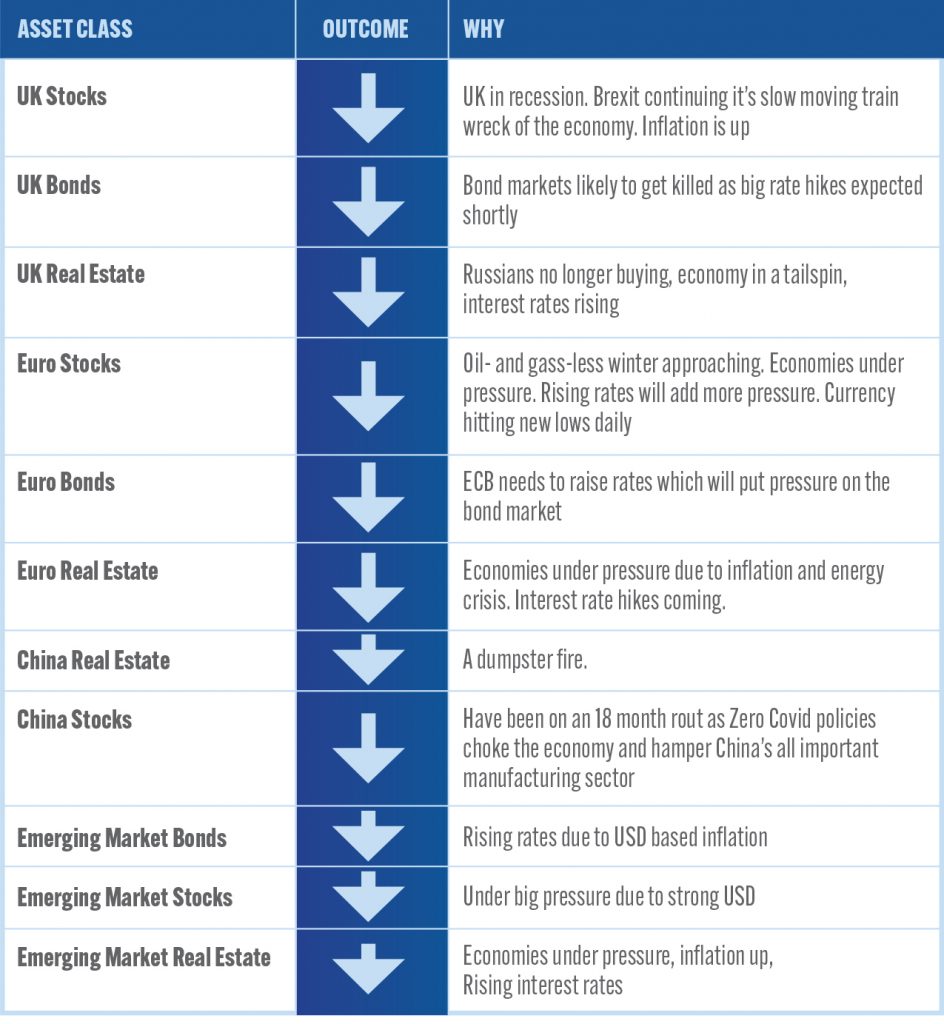

Let’s consider some asset classes and their outlook:

Let’s remember that real estate is the mother-of-all assets, which some people either forget or don’t realize. In 2022, the total market capitalization of the US residential housing market was $43.4 trillion, according to Zillow. This does not include commercial or government owned real estate. The total market cap of the Nasdaq and NYSE combined was $44.1 trillion.

Here is my point. Sometimes we get myopic about real estate, and we only think about the two bedroom in Chelsea (or whatever) that we ourselves are interested in. However, real estate is a fundamental piece of the global asset pie. And New York City is the cherry on that pie. In 2018, Bloomberg estimated that just the land of Manhattan, without any of the buildings on it, and excluding parks, roads and highways was worth $1.74 trillion, more than the GDP of Canada.

With the dollar soaring, it’s true that real estate here looks expensive to foreigners. But what other decent choices do they have? Would you really want to invest in European real estate at the moment? Or European stocks for that matter? Wouldn’t it make sense to have some money out of the liquid but volatile and highly correlated equity markets? With interest rates rising globally, real estate is the asset class of choice.

My sense is that as we accelerate out of the pandemic, NYC real estate will become even more apparent as both a store of value and a great place to live and work. Expect it to outperform other asset classes and global cities in both the short and long term.

Have a great weekend, everyone!

CONTACT US HERE