We’re suckers for Bond Street

Condo

1,100 SF private outdoor terrace

10.5” Ceilings

2 beds, 2 full baths

Airy and light

Amazing energy

$4,550,000

Call 212.321.7111 for an Insider showing!

LISTING COURTESY OF BROWN HARRIS STEVENS

Average rental prices in Manhattan just broke $5,000 – an all time record.

—NY Post

Elliman reports the average days on market are down and average and median prices are up:

—Douglas Elliman

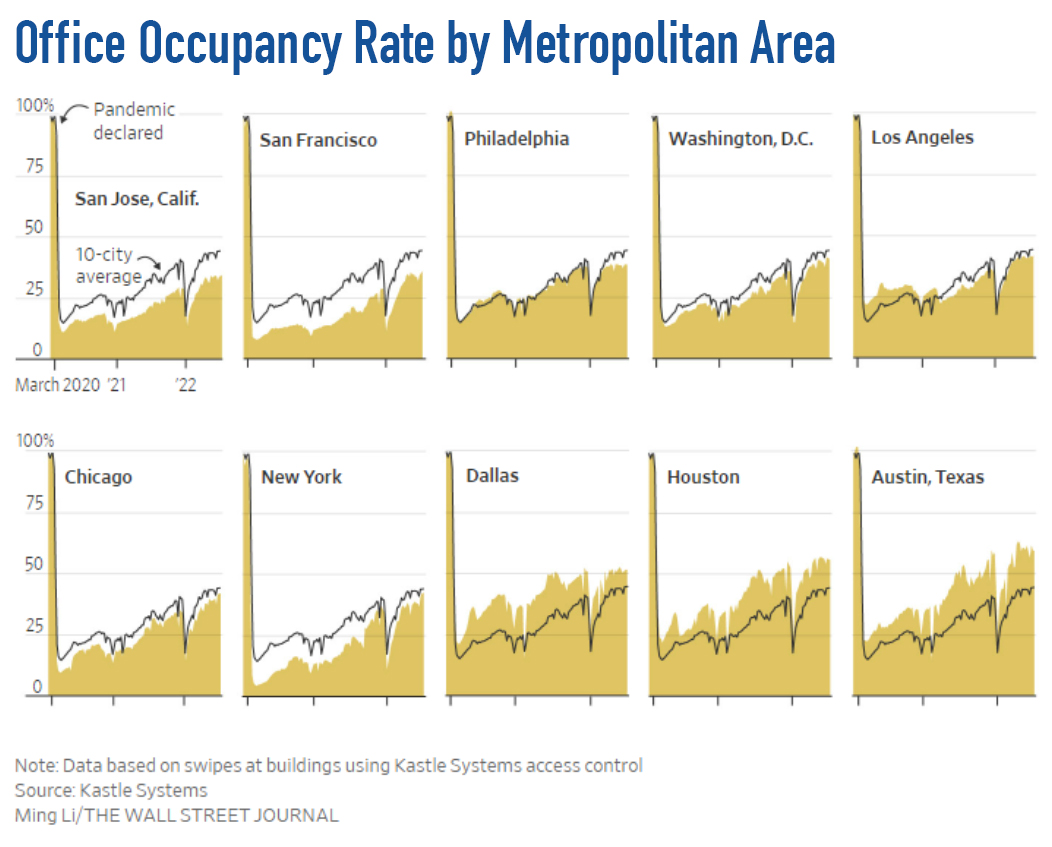

And yet NYC office towers are still only at 40% capacity. What is going on?

- Leading up to 2008, credit was lax and lots of people who were marginal buyers got loans. Not now. The credit box is a lot tighter, so those excluded from the mortgage market are renting.

- Affordability has taken ~50% hit since the beginning of the year with rising interest rates. Anyone on the affordability margin has been kept in the rental market.

- With rents rising and rental concessions disappearing, many renters are opting to stay where they are as the switching costs are at a high point.

So that’s what’s happening right now. What about in the medium term future?

Unfortunately, a developer tax exemption, widely used to finance rental units just expired:

—Commercial Observer

And it won’t even be considered for renewal for six months. The point of 421-A was to incentivize developers to build affordable housing, which they did. Roughly 70% of new multifamily construction in recent years utilized it. The problem was that construction, being expensive, is biased to the expensive side of the market. Add in the incentives for low-income housing and you have the middle without any new supply. Read: $3,500 one bedrooms. Which has been supply constraining (for years) the sort of affordable rentals that young professionals need when starting their careers and middle class renters need generally.

In short, we see no relief for renters on the supply side in the near term foreseeable future. There might be demand side relief in the form of a recession, if that happens.

Have a great weekend, everyone!