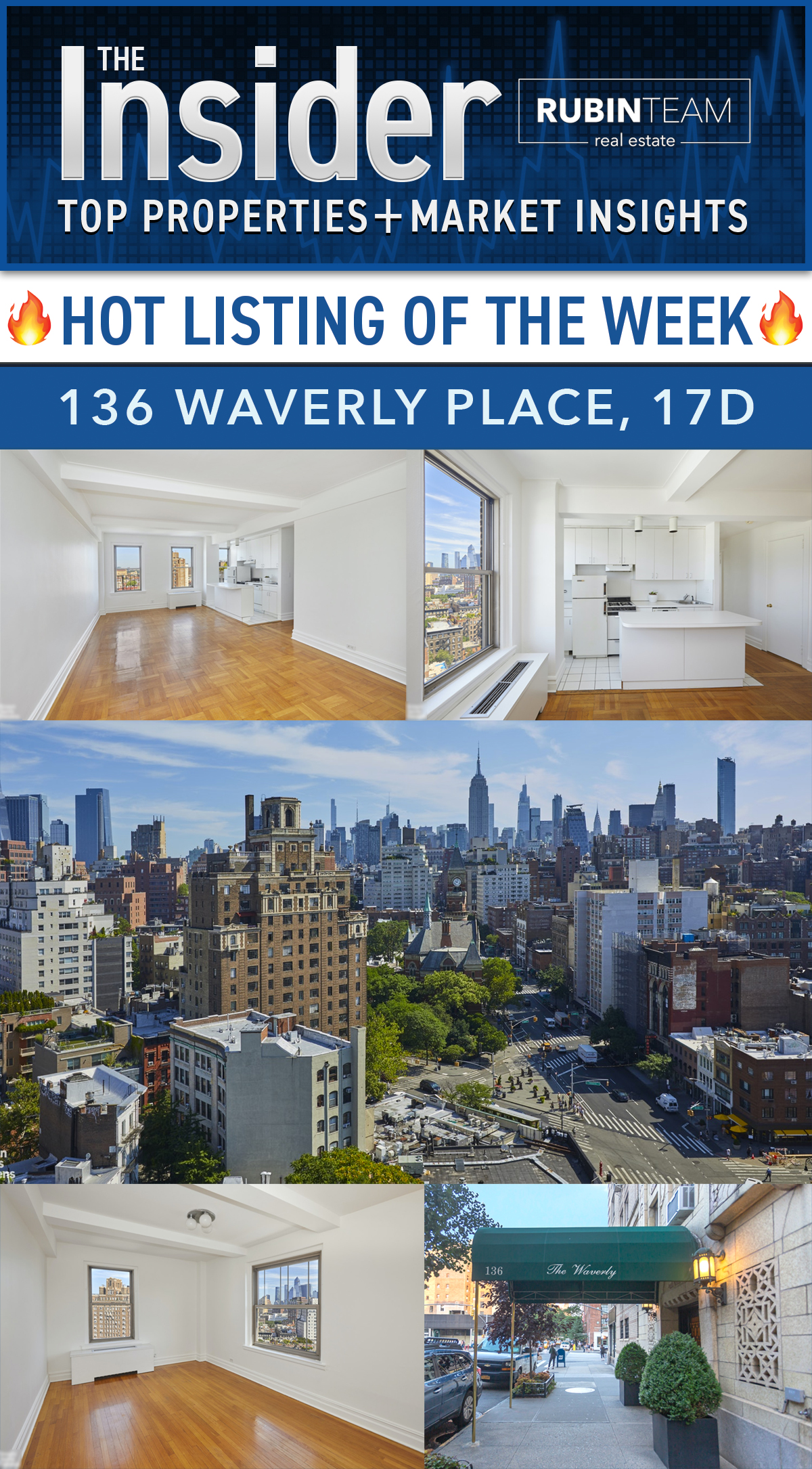

Views for miles (no exaggeration!) from the 17th floor

Prewar

We’re suckers for fixer-uppers in great buildings

Corner unit

Greenwich Village

Doorman/elevator/bike room/pets allowed

(check, check, check, check!)

Opportunity to create an ivory-tower masterpiece

$1,345,000

1 Bed, 1 Bath, 1,000 Amazing views!

CLICK HERE FOR MORE INFO

Call 212.321.7111 for an Insider showing!

LISTING COURTESY OF BROWN HARRIS STEVENS

Today’s Insider is dedicated to the topic of the (recently) mighty US dollar. We’ve been hearing travel is cheap in Europe, but that’s not all. Let’s take a look:

The Euro is essentially at parity with the dollar, the first time in twenty years. And it’s down almost 15% against the dollar in the last year thanks to Russia’s invasion of the Ukraine.

The “Great” British pound is down over 13% in the last year.

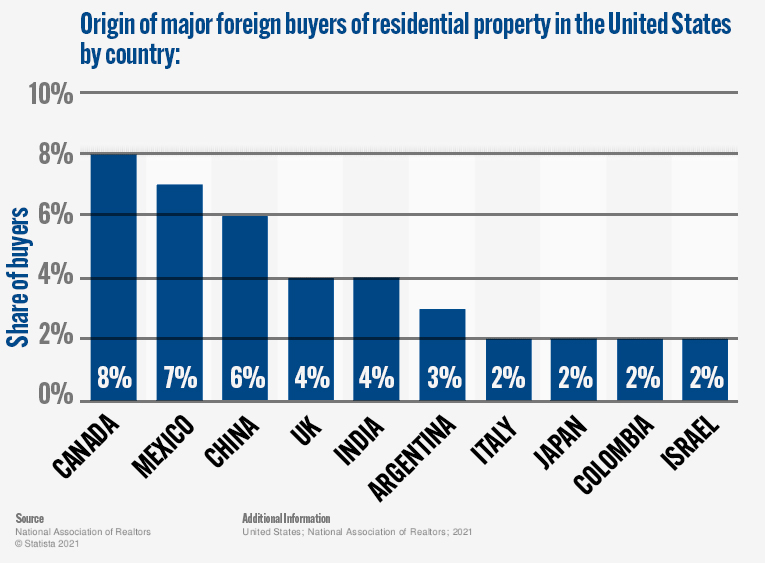

All of this might seem like bad news when it comes to foreign investment in NYC real estate. However! According to Statista, the largest buyers of our city’s real estate are Canada, Mexico, and China (in that order)…

… and the dollar has been relatively stable against those currencies (the following are one year percent changes):

- USD/CAD +3.15%

- USD/MXN +2.19%

- USD/CNY +4.59%

Sure, on the margin we might see less buying from the UK, but their share was only 4% of residential purchases anyway. With the Fed expected to do another 75 basis point move in the Fed Funds rate followed by perhaps a few more 25 basis point raises, the dollar looks to continue in its strength. This may actually induce greater buying from Canada, Mexico, and China in the short term.

What Does This Mean For NYC Real Estate?

What the dollar does versus other currencies for those people that earn their money in dollars and invest here is not really relevant. The best strategy for those people right now is to buy a rental property and take advantage of the staggeringly high prices in the rental market.

If you are a foreign investor looking for a blue chip asset that will provide modest income and a stable home for some portion of your real estate portfolio, the same strategy applies.

If you are looking to take advantage of cheap prices in Europe or the UK due to the US currency being strong, buying property there might be a good idea. Take this caveat, however: during winter the Russian-created energy crisis will disproportionately hit western Europe. With more interest rate hikes on the near term horizon here suggesting an even stronger US dollar, you may want to wait until early 2023 to make that investment.

Have a great weekend, everyone!