Click to view our seminar with top real estate and mortgage bank professionals to help determine whether to rent or buy in today’s market.

Instead of a Hot Listing of the Week, in this week’s Insider, we’re going to consider whether we should rent or buy. To make this example concrete, I am going to look in a building that has a similar apartment for purchase and rent. I found two such apartments in Zeckendorf Towers, a large apartment building on Union Square, which are the two listings below.

Here’s the rental, which is a one bedroom, one bath rental for $5,000 on the 20th floor:

And here’s the sale, which is a one bedroom, one bath apartment for sale for $1,495,000 on the 18th floor:

As you can see, these apartments are quite similar, even if the one for sale is in slightly better condition.

With rents skyrocketing and the sales market settling down to a more balanced market between buyers and sellers, it is a good time to think about whether staying in a rental is a good idea, or whether it’s time to buy an apartment.

In one way, this is a surprisingly difficult thing to model financially. This is because it requires estimates of home price growth, rental price growth, interest rates, and equity price growth. Rent vs buy calculators are highly sensitive to these inputs, so you can get a very skewed answer unless you have accurate data. And picking a number out of the air because it “feels about right” leads to ridiculous outputs, as we shall see.

We are going to use the Rent vs Buy Calculator provided by the New York Times, the best one I have found. If you want to play around with it, which I suggest, you can see it here (you can access this link with a free account):

CLICK HERE FOR NYT RENT VS BUY CALCULATOR

Let’s enter the calculator parameters and see what’s what:

- Home Price: $1,495,000 (from listing)

- How long do you plan to stay: 7 years

- Mortgage rate: Jumbo 30 year fixed is 4.206% as of the first week of August

- Down Payment: 20%

- Length of Mortgage: 30 years

- Home Price Growth Rate: 5.51% *see addendum below for data and calculation

- Rent Growth Rate: 6.3% *see addendum below for data and calculation

- Equity growth rate (S&P 500): 7.68% *see addendum below for data and calculation

- Inflation Rate: 2.5%

- Real Estate Taxes: 1.14% (taken from listing)

- Marginal tax rate: 30% (Effective tax rate, including federal, state and local)

- Closing costs of buying a home: 3.9% (my estimate for buying a condo, financed)

- Closing costs of selling a home: 8% (my estimate for selling a condo)

- Maintenance/renovation: 1%, which would be $15,000 per year in this example. This seems conservative, as spending $15k every year is a lot.

- Monthly utilities: $100 (this is only what you wouldn’t pay if you were renting, typically heat and hot water)

- Monthly common fees: $1,183, taken from listing

- Common fees deduction: 0%

- Renting security deposit: 1 month

- Broker’s fee for rental: 15% of annual rent

- Renter’s insurance: 0.75% (about right)

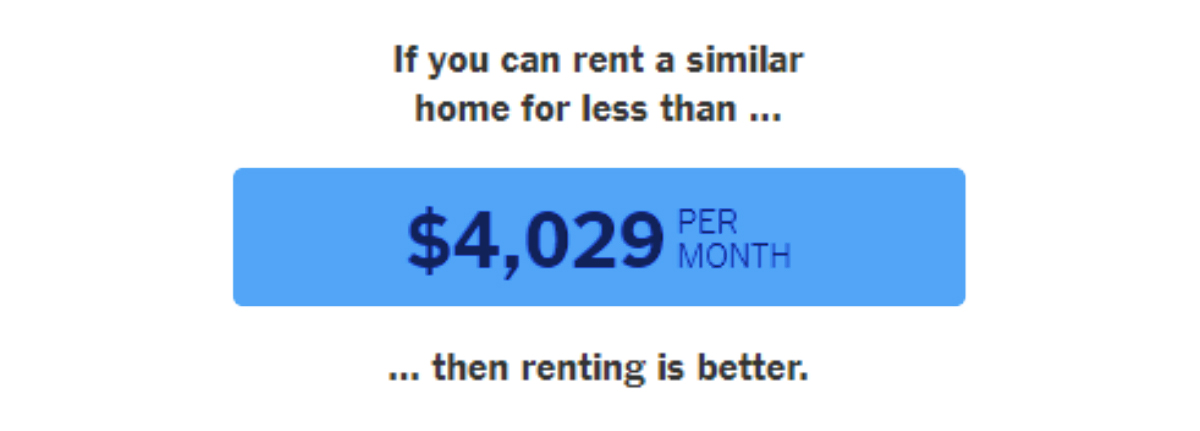

These inputs result in the following:

You can’t remotely rent this apartment for $4,000 in this market. The best comp is $5,000, a full 25% more than what our target rent rate would be if renting were a better idea. Sure, you can rent an apartment for $4,000. But it is not like-for-like and will require sacrificing the doorman, size, amenities and possibly the bedroom to get it done. So the overwhelming conclusion is that you should buy an apartment if you can afford it. I might add that I have run this scenario with several paired apartments to see if renting ever was a better idea according to the model and it never was.

Here is another way to think about it, as an extreme short cut: when you buy an apartment, it’s kind of like rent stabilization. Assuming you have a fixed rate mortgage, you know what you’ll be paying now and what you’ll be paying in 20 years. Sure, your taxes and common charges will go up over time, but marginally – and most likely not as much as your asset value (by a long shot). In New York City, rents can rocket upwards, and so long term assumptions about stable rental growth are suspect.

If you would like to join a Rubin Team free webinar to learn about purchasing in New York, tailored to people who are currently renting, click here:

CLICK HERE TO SIGN UP FOR EVENT

Have a great weekend, everyone!

Addendum Calculations

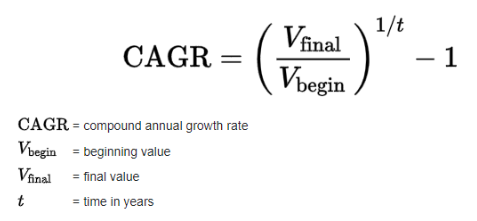

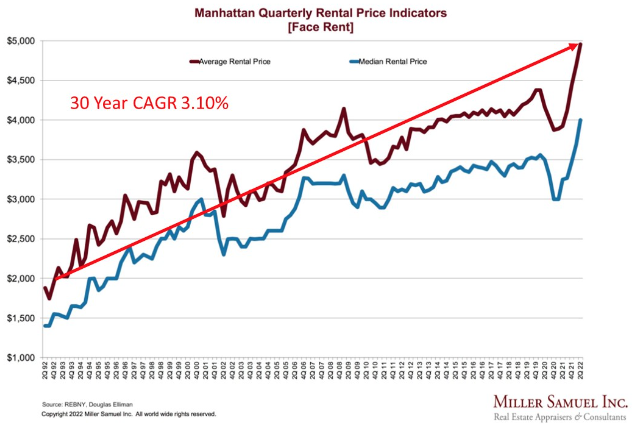

The following three calculations are based on calculating actual 30 year data from Manhattan for the compound annual growth rate (CAGR)

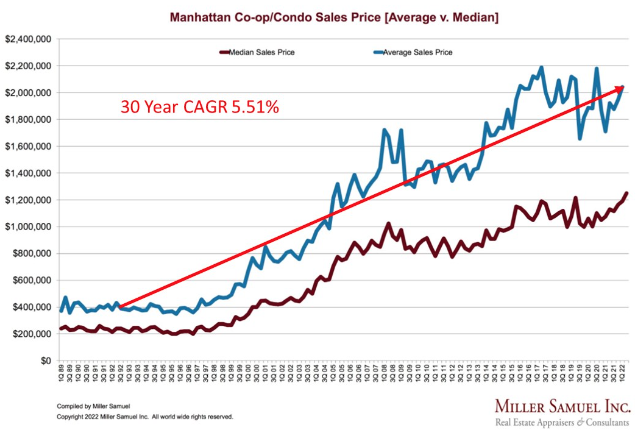

Home Price Growth Rate: 5.51%

V(begin) = 400,000

V(final) = 2,000,000

t=30

Rent Growth Rate: 6.3%

V(begin)=$2,000

V(final)=5,000

t=30

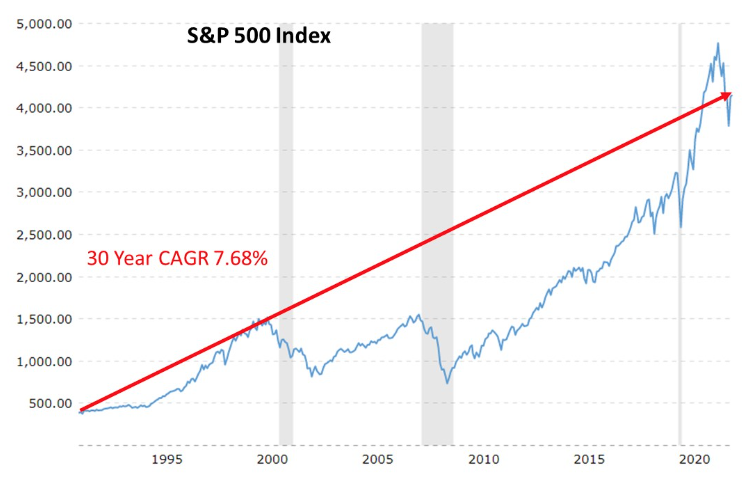

Equity growth rate (S&P 500): 7.68% CAGR

V(begin) = $416.08 (S&P in 1992)

V(final) = $3,831.39 (S&P as of early Aug 2022)