—NY Post

—CNBC Financial

Let me ask you a question: who exactly do you think is going to be fired first? Exactly.

Goldman Sachs is about to embark on a project referred to by my Chinese friends as “kill the chicken to scare the monkey”, which means setting a strong example to get everyone else in line. Executives at the bank are well aware that entitled young bankers prefer working from home (WFH) doing sort of half-days while being paid full time wages and bonuses. Now they are going to take advantage of temporary market weakness to cull their ranks of WFM dissenters. And let’s not forget all the newly-minted MBAs chomping at the bit to work in the office. Believe me, this strategy will work just fine. After all (and I quote from the NY Post),

“In the ’80s, we had a saying on Wall Street: They can’t take your desk away from you if you’re sitting at it. Junior bankers would be wise to remember that,” the source adds.

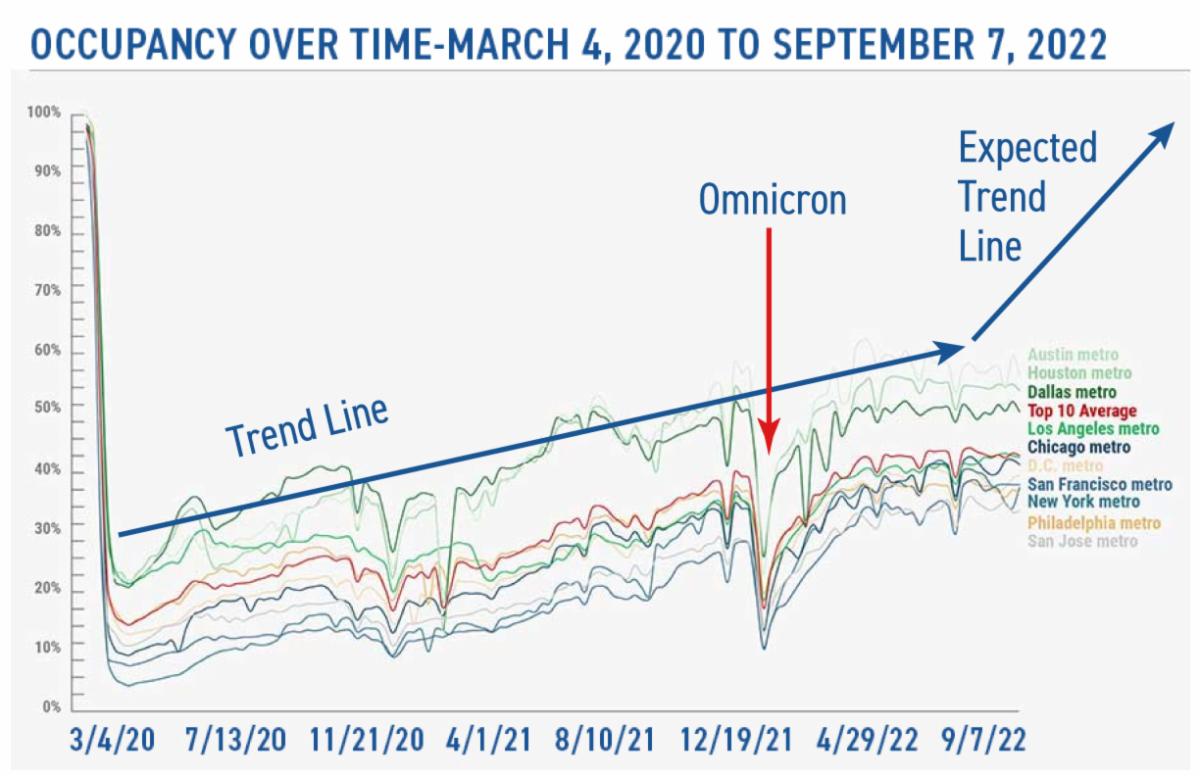

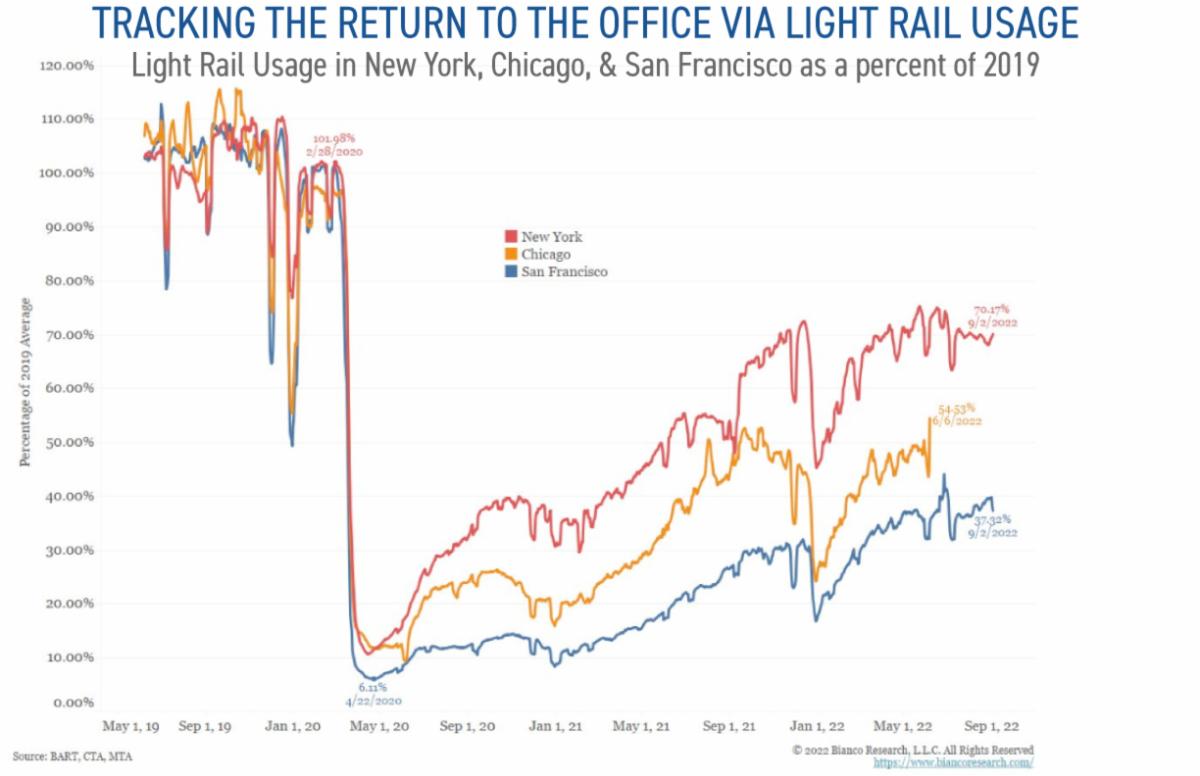

Source: Kastle

Same message, different view:

Fine, so Wall Street will inexorably force its front line workers back to the office. Why does the Insider care? Because this trend is the current bellwether for New York City real estate.

- JP Morgan, Goldman and Citibank are major owners of NYC office space. The more that space is full, the more those assets are worth. So they are going to fill them. Period.

- The big banks set the tone in NY. Once their offices are full and the standard is set, the rest of the city will follow (where in-office work is necessary)

- As the pandemic ends and high interest rates threaten a recession, the power to force workers back into the office is back in management’s hands. Perfect timing (after a few false starts).

Full offices mean demand for apartments. And for retail space. And for office space. This is the trifecta.

Have a great weekend, everyone!