SUBSCRIBE

If you have been tangling with real estate and the stock market as long as I have (since late ‘80s professionally), then market cycles start to look remarkably similar. Yes, they each have their specific flavors, such as distinct periodicity or amplitude, but the broad strokes are always the same. That is because human psychology and market dynamics do not change.

With that in mind, in today’s Insider, I want to delve into how the sales cycle works in real estate and elucidate how to use this understanding to your advantage, either as a buyer or seller.

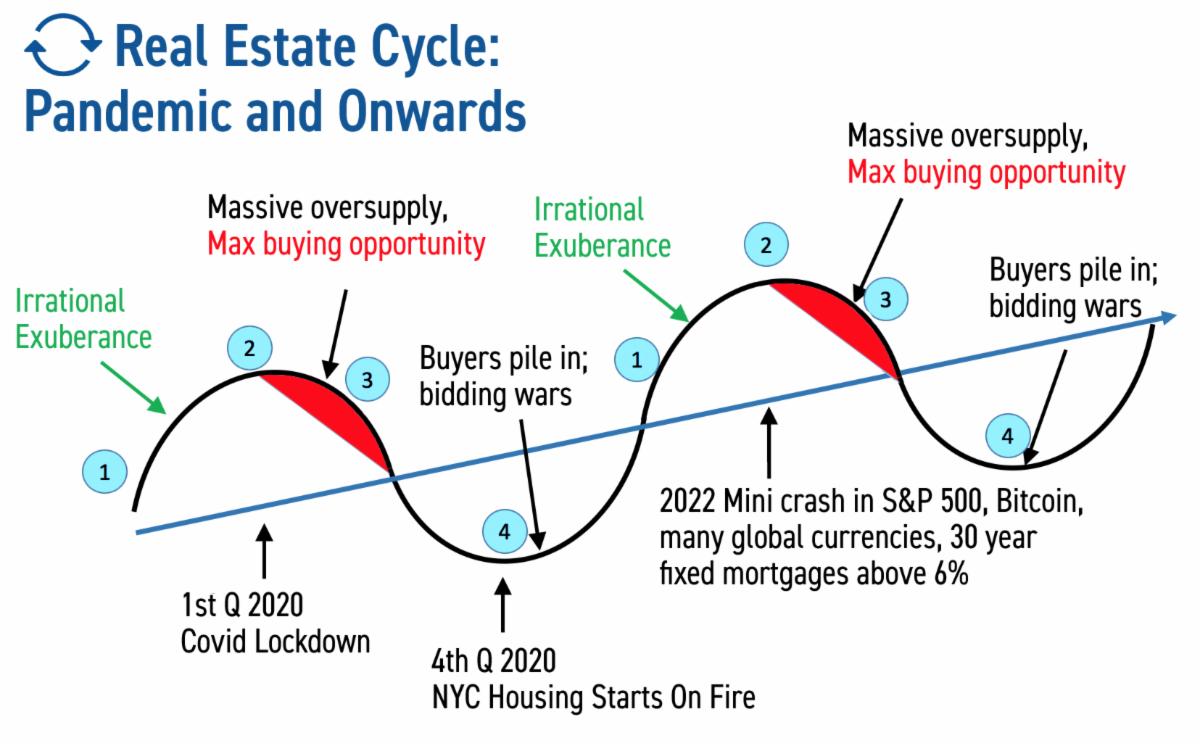

Here is the model of a sales cycle. I have overlaid the 2008 housing crisis and the Covid pandemic timelines on it so you can see what I mean when I say the structure of these things is always the same.

So let’s walk through this.

The end of the bull market. Every seller wants to sell at at the top. But actually before the top is the best place to sell. Why? Because there is still a volume of buyers in the market and bids are still competitive.

The end of the bull market. Every seller wants to sell at at the top. But actually before the top is the best place to sell. Why? Because there is still a volume of buyers in the market and bids are still competitive.

This is the top of the market but by the time you think you are at 2, it’s too late to sell. Why? Because very little volume trades there. Buyers stampede out of the market faster than you think. So supply starts to pile up. Sellers who wait too long have missed their opportunity to sell in a seller’s market.

This is the top of the market but by the time you think you are at 2, it’s too late to sell. Why? Because very little volume trades there. Buyers stampede out of the market faster than you think. So supply starts to pile up. Sellers who wait too long have missed their opportunity to sell in a seller’s market.

This is the most interesting part of the market for buyers, and the hardest for them to understand. Why do I say this? Well in our market, it is very common for buyers to pay all cash. In a competitive bidding situation, financed purchasers get boxed out by cash buyers. So they bid and bid and don’t get any accepted offers much less signed contracts. However! As the market is dropping as it is in sector 3 of the sales cycle, buyers can take their time. Sellers are more likely to accept financing contingencies. Chance of being in a bidding war is dramatically lower. So financed buyers actually can buy things here, unlike in sector 1.

This is the most interesting part of the market for buyers, and the hardest for them to understand. Why do I say this? Well in our market, it is very common for buyers to pay all cash. In a competitive bidding situation, financed purchasers get boxed out by cash buyers. So they bid and bid and don’t get any accepted offers much less signed contracts. However! As the market is dropping as it is in sector 3 of the sales cycle, buyers can take their time. Sellers are more likely to accept financing contingencies. Chance of being in a bidding war is dramatically lower. So financed buyers actually can buy things here, unlike in sector 1.

Buyers think that they only want to buy at the bottom, but the bottom is a chimera. Why? Because it lasts a nanosecond and very very few trades actually happen there. By the time buyer’s realize the market has shifted there are already bidding wars on everything of quality in the market. Buyers have missed their opportunity to buy in a buyer’s market. Financed buyers find they are once again being boxed out by cash buyers.

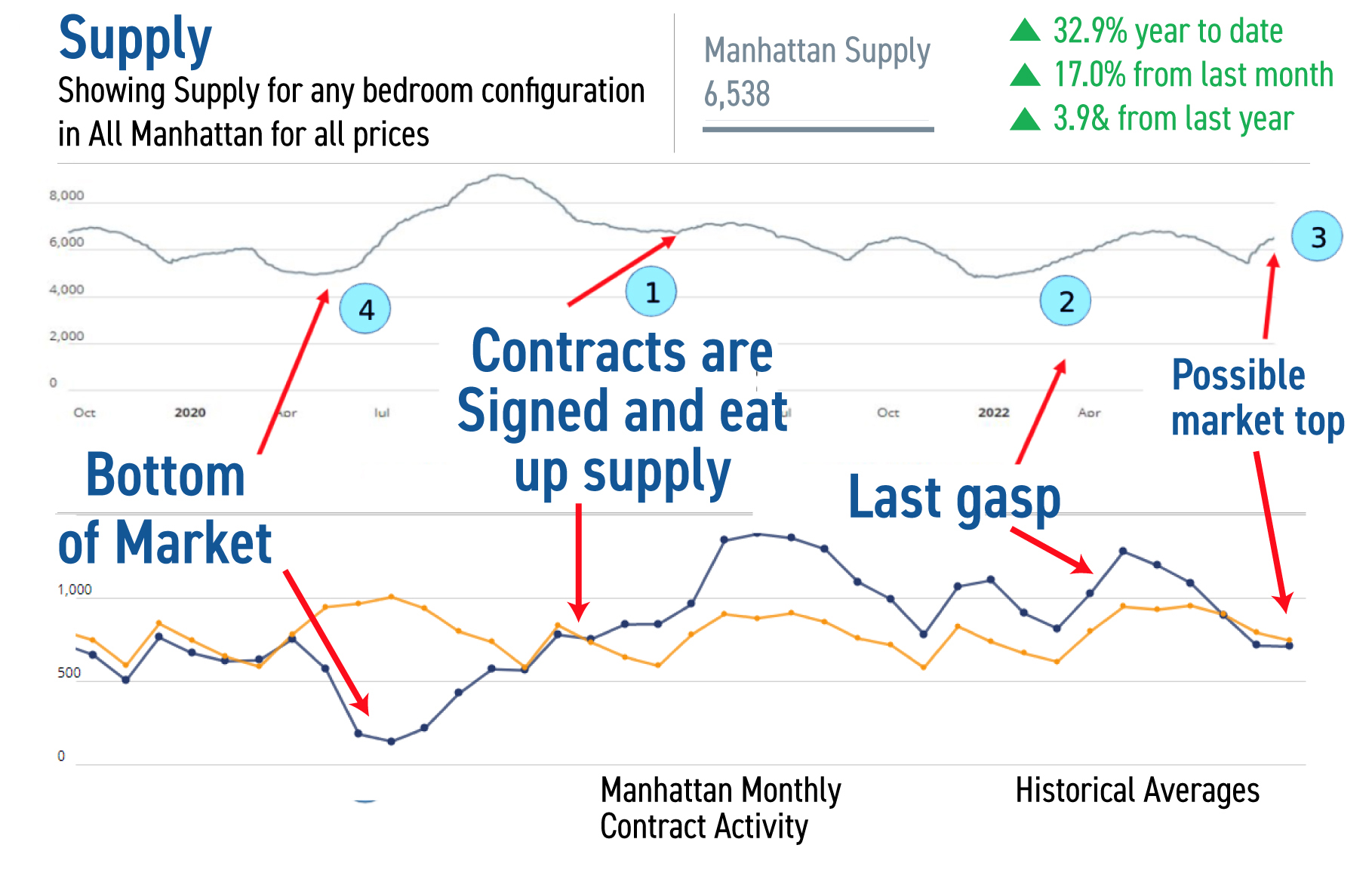

Let’s look at actual data in the following chart:

This is a compound chart, where the top half is supply and the bottom half is contract activity. In the bottom half, the yellow line is the historical average, while the blue line is actual data for that time period. These data span from 4th quarter 2019 to present.

You will notice at the bottom of the market (4), contract activity drops to a local nadir. That’s what I mean by thinking that you’re going to buy at the bottom is a chimera. Almost nobody actually pulls that off. The historical average for this time period is 1,000 units, whereas in july of 2020 it was between 100 and 200 units.

From there (1) both contract activity and supply swell, but contract activity is greater than new supply so over supply starts to drop.

You can see in (2) strong contract activity. As this stage gets long in the tooth, total supply starts to swell.

Finally, in (3), contract activity drops below historical averages and supply starts aggressively accumulating. We won’t know until ex post facto whether this data picture is actually the sign of a market bottom, but given interest rates, a shaky S&P 500, inflation data and talks of an impending recession, it wouldn’t be surprising if it were.

Here are the takeaways, which are the same as last week:

If you are a seller, do it now, do it quickly, and price aggressively.

If you are a buyer, even though it seems like it’s early, now is the time to act. Waiting for the bottom will in all likelihood mean you miss your opportunity.

Have a great weekend, everyone!

SUBSCRIBE

Watch the live recap of today’s Insider with Mark Chin and Josh Rubin here: