Can you sell in today’s market? The answer may surprise you.

Many sellers have paused their plans given uncertainty as a result of Covid-19 and Governor Cuomo’s mandate that non-essential businesses cease operation as of Sunday, March 22. While this is absolutely the best course of action, are transactions still able to be completed? Yes! Read on for the challenges and solutions to how we can continue to the finish line.

There are three steps to selling in New York City once you have an offer. These are as follow:

- Contract Signing

- Board Approval

- Closing

If you’re lucky enough to have an offer in today’s market, congratulations! Selling a cooperative or condominium? Your buyer’s attorney will need to review the offering plan and last two year’s financials for the building. The attorney will also need to review building meeting minutes and have a building questionnaire completed by the managing agent.

Many property management offices are closed resulting in delays in completing these steps. How do we overcome the delays? Similar to selling a house in the suburbs, where buyers and sellers can be under agreement with a certain number of days providing for home inspection, and addressing related issues, the same can be done for due diligence review in New York City. What could appear in a questionnaire or meeting minute review? Building-wide projects being considered or budget shortfalls that result in maintenance or common charge increases or assessments aren’t uncommon.

If you’re selling a townhouse, your buyers will likely need a home inspection done. Can an inspector come during these times of non-essential business? Not legally, but what people do in the dark of night is up to them. We have seen a handful of townhouses in the city successfully go to contract in the last couple of weeks.

For qualified buyers, applying for a loan is as simple as providing a completed application and supporting paperwork. So where’s the challenge? Banks need to confirm the value of the property that’s serving as collateral to the loan. Many appraisers aren’t scheduling visits though some are. Again, theses delays can be overcome by providing for time to complete the appraisal if your buyer is obtaining a loan.

With more buildings in New York City using online application platforms like boardpackager.com, completing board applications is much easier. Managing agents log into the system and confirm that all requirements are met, then forward to the board for review. Once the board reviews the application, condominiums issue their approval through issuing a waiver of its right of its first refusal — simple enough. Here’s where it gets challenging: co-op boards traditionally meet with the applicants to get a better sense of their background. With social distancing being top of mind, boards are turning to video conferencing solutions like Zoom to meet with buyers. In fact, we just had our first board meeting scheduled via Zoom this past Monday, March 23, resulting in an approval.

Once both parties are ready to close, it’s more important than ever to have hardworking attorneys who are able to think outside of the box representing you. Traditionally, closings are scheduled with the managing agent, lending bank, payoff bank, buyer, seller and their attorneys. The closing is held in a conference room, where buyer and seller sign documents, exchange checks and the buyer gets their keys. In today’s age of social distancing, we are innovating using powers of attorney, bank wires and closing remotely.

While County Clerks and Town Halls across the country are closing, man real estate professionals are finding ways to innovate in order to record closings using new technology and creativity. Hopefully these methods will be here to stay and help New York be stronger than ever!

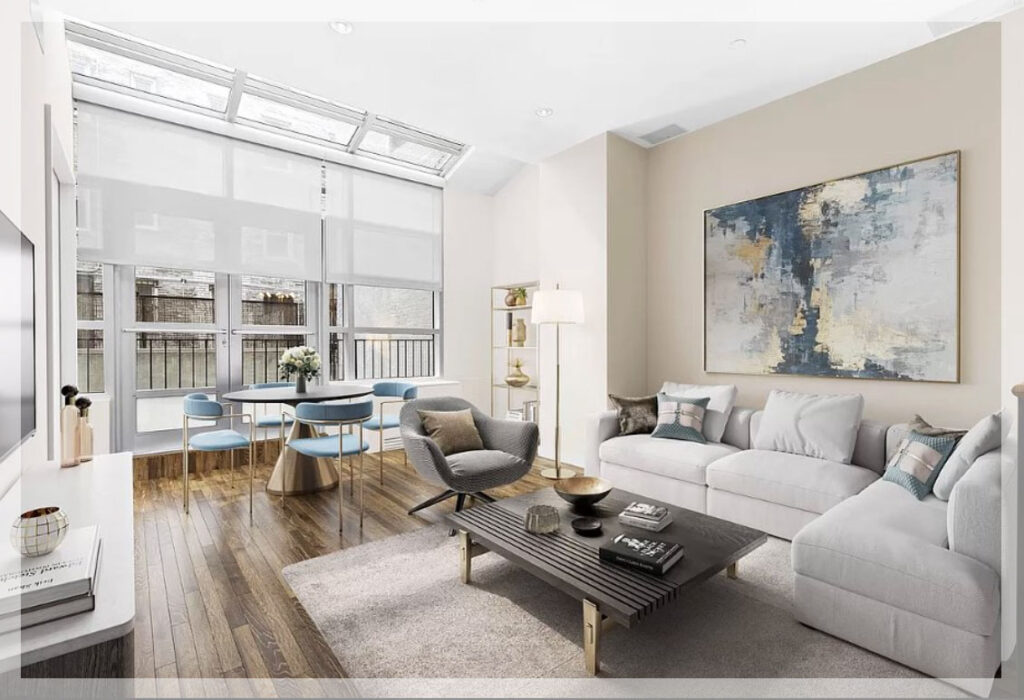

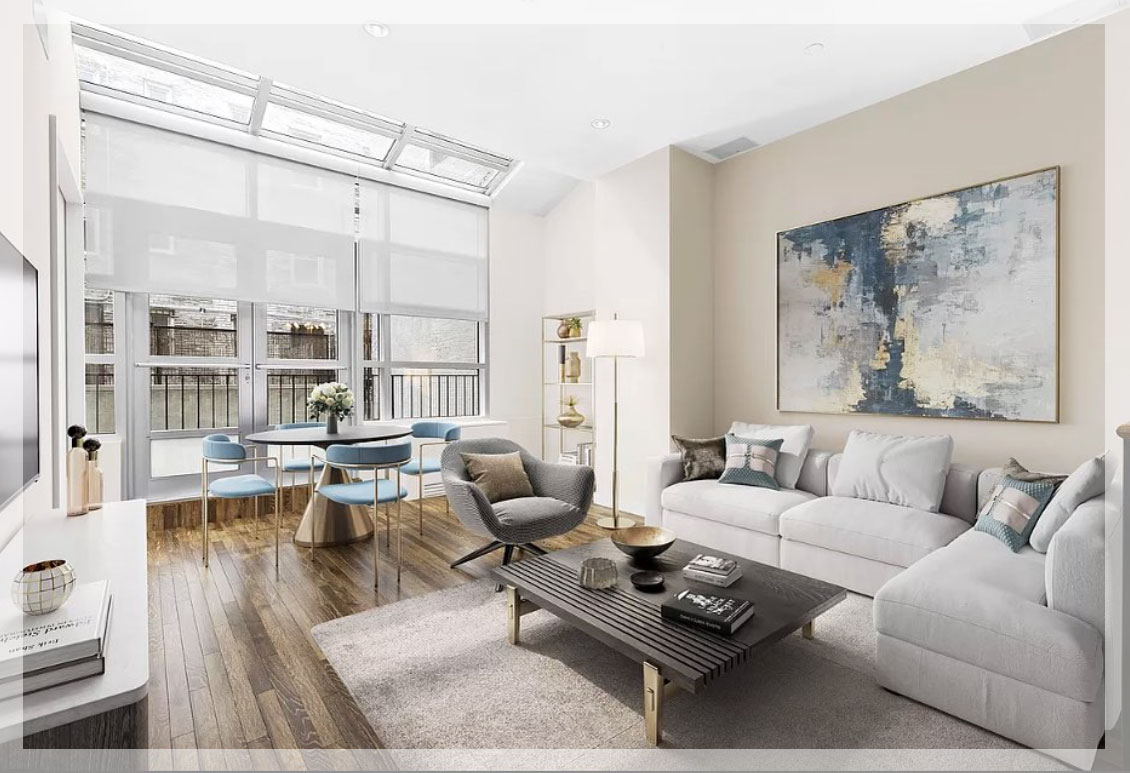

🏀 Wins come in many forms in the wonderful world of real estate. In fact a wiseman once said “sometimes the best listings are the ones you don’t get.” Well this is one that we did get and turned into not one but two deals. A bigger win is our client who is a top tech exec had this to say

🏀 Wins come in many forms in the wonderful world of real estate. In fact a wiseman once said “sometimes the best listings are the ones you don’t get.” Well this is one that we did get and turned into not one but two deals. A bigger win is our client who is a top tech exec had this to say

The

The  British actor Kunal Nayyar, best known for his role in the hit TV show “The Big Bang Theory,” has recently listed

British actor Kunal Nayyar, best known for his role in the hit TV show “The Big Bang Theory,” has recently listed  New York City is

New York City is  The luxury real estate market has shown signs of improvement, with an increase in contracts being signed. The

The luxury real estate market has shown signs of improvement, with an increase in contracts being signed. The

Fresh off Beyonce’s critically acclaimed album, Renaissance, featuring collaborations with Grace Jones and Nile Rogers, the Queen broke another record with her purchase of a $200 million seaside Malibu estate. Earlier this year Beyonce’s husband, Shawn ‘Jay-Z’ Carter, sold his stake in cognac brand D’Usse to Bacardi for a reported $750 million. Not to worry, Jigga Man still has his partnership with Moet-Hennesy in champagne brand Ace of Spades so the Carters will be just fine.

Fresh off Beyonce’s critically acclaimed album, Renaissance, featuring collaborations with Grace Jones and Nile Rogers, the Queen broke another record with her purchase of a $200 million seaside Malibu estate. Earlier this year Beyonce’s husband, Shawn ‘Jay-Z’ Carter, sold his stake in cognac brand D’Usse to Bacardi for a reported $750 million. Not to worry, Jigga Man still has his partnership with Moet-Hennesy in champagne brand Ace of Spades so the Carters will be just fine.  Drake, the Canadian rapper and former child TV star, is also known for his business acumen, and now he’s testing his skills in the Los Angeles real estate market. After last year’s purchase of UK pop sensation Robbie Williams’ estate for $75 million, Drake has decided to flip the property for $88 million. Williams originally bought the property for $32 million in 2015. Higher mortgage rates be damned!

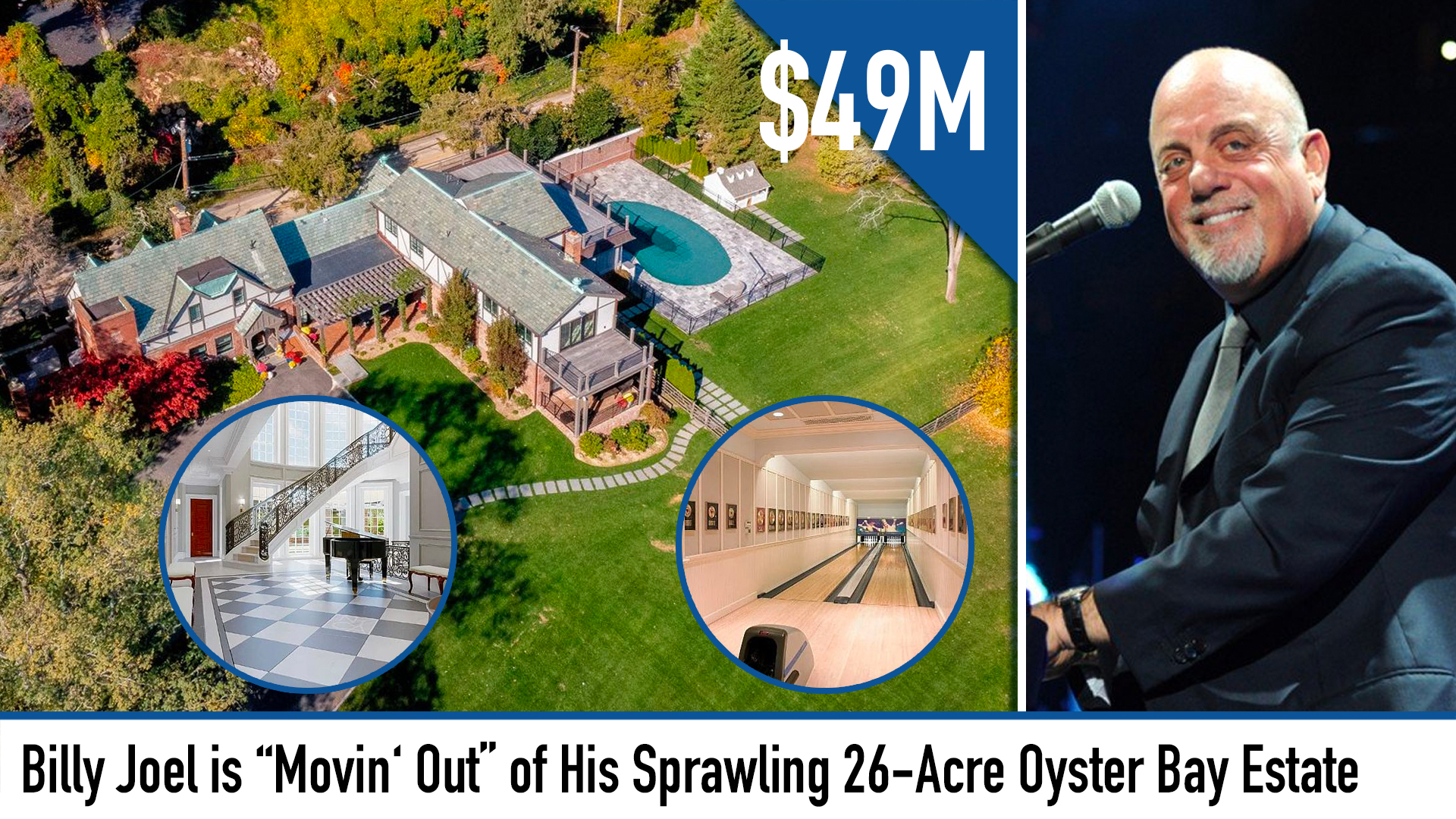

Drake, the Canadian rapper and former child TV star, is also known for his business acumen, and now he’s testing his skills in the Los Angeles real estate market. After last year’s purchase of UK pop sensation Robbie Williams’ estate for $75 million, Drake has decided to flip the property for $88 million. Williams originally bought the property for $32 million in 2015. Higher mortgage rates be damned!  Closer to home, legendary musician and Long Island’s own, Billy Joel, has listed his sprawling 26-acre Oyster Bay estate for a staggering $49 million. This magnificent property, complete with a 20,000’ main house, offers potential buyers a tranquil retreat away from the bustling city. Now THAT’s what you get for your money! Joel’s decision to sell his beloved home, with multiple pools and private dock, after decades of ownership is the result of his spending more time in Florida. We look forward to seeing what happens in the estate’s next

Closer to home, legendary musician and Long Island’s own, Billy Joel, has listed his sprawling 26-acre Oyster Bay estate for a staggering $49 million. This magnificent property, complete with a 20,000’ main house, offers potential buyers a tranquil retreat away from the bustling city. Now THAT’s what you get for your money! Joel’s decision to sell his beloved home, with multiple pools and private dock, after decades of ownership is the result of his spending more time in Florida. We look forward to seeing what happens in the estate’s next Rosie O’Donnell, the beloved comedian and television personality, has put her exquisite Turtle Bay penthouse on the market for $8.3 million. This after her purchase in 2017 for $8 million. The luxurious residence boasts panoramic city views, elegant interiors, and a prime location. As Rosie bids farewell to her lavish abode, potential buyers have the opportunity to acquire a piece of New York City’s elite real estate.

Rosie O’Donnell, the beloved comedian and television personality, has put her exquisite Turtle Bay penthouse on the market for $8.3 million. This after her purchase in 2017 for $8 million. The luxurious residence boasts panoramic city views, elegant interiors, and a prime location. As Rosie bids farewell to her lavish abode, potential buyers have the opportunity to acquire a piece of New York City’s elite real estate. New Yorkers, meanwhile, are bracing themselves for an increase in subway and bus fares, proverbially known as the cost of a token, by the end of the summer, according to a proposed plan by the Metropolitan Transportation Authority (MTA). The fare hike, which would raise the cost to $2.90, has sparked concerns among commuters. In addition to buses and subways, fares on the Long Island Rail Road and Metro-North would also go up by about 4%, while keeping the $500 cap on any monthly pass.

New Yorkers, meanwhile, are bracing themselves for an increase in subway and bus fares, proverbially known as the cost of a token, by the end of the summer, according to a proposed plan by the Metropolitan Transportation Authority (MTA). The fare hike, which would raise the cost to $2.90, has sparked concerns among commuters. In addition to buses and subways, fares on the Long Island Rail Road and Metro-North would also go up by about 4%, while keeping the $500 cap on any monthly pass.

However, not all real estate sales are what they seem. The Real Deal

However, not all real estate sales are what they seem. The Real Deal